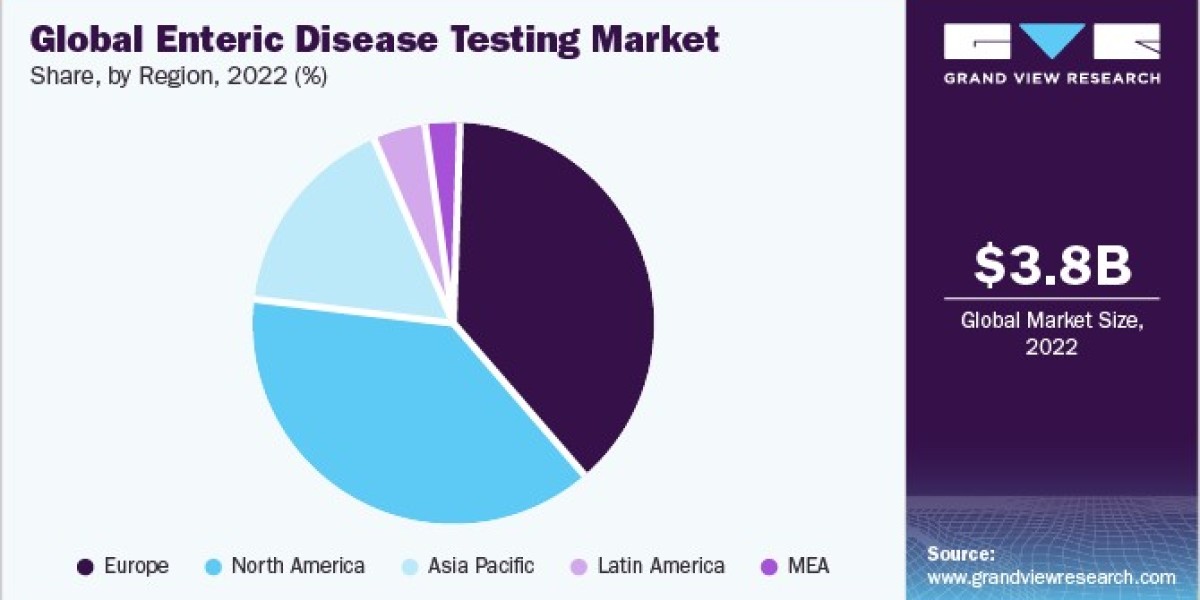

The global enteric disease testing market size was valued at USD 3.81 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.7% from 2023 to 2030. Vital drivers of this market include technological advancements and supportive government funding in emerging economies. Furthermore, growing global demand for early diagnostics is expected to enhance the applicability of the market, fueling its growth.

Gather more insights about the market drivers, restrains and growth of the Enteric Disease Testing Market

Throughout the COVID-19 pandemic, there was an increasing focus on viral and bacterial infections, leading individuals to prioritize the consumption of home-cooked and hygienic food to minimize the risk of infection. Therefore, there was a decrease in the incidence of enteric diseases and a subsequent decline in the demand for enteric disease testing in 2020 and 2021. Additionally, COVID-19 testing had top priority during the pandemic, surpassing testing for other infectious diseases, due to which the demand for enteric disease testing products experienced a negative impact, thereby impeding market growth.

In regions such as Asia, Africa, and Latin America, the prevalence of enteric infections, including salmonella, campylobacter, escherichia coli, and norovirus, remains significantly high. According to the National Library of Medicine, as of 2018, a case fatality rate of 1% is observed in enteric fever cases in the Asia and Africa regions. Consequently, there is an increasing demand for enteric disease testing to enable accurate and timely diagnoses. Moreover, there is increasing awareness among individuals, healthcare providers, and government entities regarding the importance of early detection and effective management of enteric diseases. As a result, various organizations and government bodies are undertaking initiatives to enhance awareness, implement screening programs, and advocate for the utilization of diagnostic tests, thereby stimulating market growth.

The traditional diagnostic process of enteric diseases was based on the culture method which demanded skilled staff and was a time-consuming procedure. The development of molecular diagnostics and other diagnostic technologies revolutionized the enteric disease testing market over the last decade. The increasing mortality rate due to these conditions and the cost efficiency of technologically advanced diagnostic systems are expected to drive the demand for early diagnosis of these conditions.

Initial symptoms associated with enteric diseases include abdominal cramps, vomiting, nausea, and anorexia, which can progress to severe conditions characterized by substantial fluid and nutrient loss from the body. The vulnerability of pediatric and geriatric age groups to these diseases is sensitive due to their weakened immune systems. According to the Bill and Melinda Gates Foundation, annually, approximately 500,000 young children under the age of 5 succumb to enteric and diarrheal diseases, predominantly in developing nations. Furthermore, an estimated 25,000 children annually lose their lives to enteric fever, primarily affecting regions lacking access to safe water and adequate sanitation facilities.

The mild initial symptoms of enteric diseases are sometimes overlooked, which poses a significant constraint to the market. These diseases have emerged as a leading cause of morbidity and mortality globally, particularly in developing countries with inadequate drainage and sanitation infrastructure. In terms of incidence and epidemiology, it is estimated that developing nations contribute to more than 85% of the total enteric infection cases.

Rising incidence of enteric diseases and the cost-efficiency of technologically advanced diagnostic systems are expected to drive demand for the early diagnosis of enteric disease. For instance, according to the Centers for Disease Control and Prevention, salmonella bacteria cause approximately 1.35 million infections, around 26,500 hospitalizations, and about 420 deaths every year in the U.S. Increasing incidence of enteric conditions in developing economies along with a lack of adequate laboratory settings and limited awareness is expected to provide a largely untapped market. According to the Foundation Merieux, enteric diseases are the second leading cause of death among children under 5 years in Asian and African countries. In addition, 90% of deaths caused by diarrhea are due to a lack of access to safe drinking water and basic sanitation facilities. Furthermore, 90% of deaths due to typhoid occur in Asia. As of 2021, there are an estimated 11 to 21 million typhoid fever cases and 128,000 to 161,000 deaths in south Asian countries every year. Thus, the increasing prevalence of enteric disease and poor sanitation facilities in developing countries provides a largely untapped market.

Molecular diagnostics are used in various areas of microbiology, which include strain identification and isolation of enteric pathogens. Disease-causing microorganisms are also studied using different molecular diagnostics techniques. The application of molecular diagnostics in microbiology is expected to increase due to the introduction of technologically advanced instruments with improved accuracy levels. Clinical laboratories are adopting molecular diagnostics as a part of laboratory automation. Currently, polymerase chain reaction (PCR), implicit association test (IAT), and gene chip are the most widely used molecular diagnostic tests for infectious diseases. Thus, the rising adoption of molecular diagnostics in the detection of enteric diseases is expected to drive the enteric diseases market over the forecast period.

Technological advancement is another key factor accelerating market growth. Technological advancements such as gastrointestinal panel tests are used for the identification and qualitative detection of multiple parasitic, bacterial, and viral nucleic acids in individuals with signs and symptoms of gastroenteritis or infectious colitis. The tests are performed on saliva and stool samples to generate rapid results for 15 pathogens in 6 hours. It is also used for testing the inherited food sensitivities/allergies to organisms such as Toxoplasma gondii and Entamoeba histolytica. This test has been approved by the U.S. FDA. Market players undergoing clinical studies to develop a new diagnostic test with high accuracy and high-performance delivery is anticipated to drive the market. For instance,in November 2019, the XTAG Gastrointestinal (GPP) test was approved by the Food and Drug Administration (FDA). XTAG is a multiplexed nucleic acid test designed to detect multiple viral, parasitic, and bacterial nuclei in stool samples simultaneously.

Browse through Grand View Research's Medical Devices Industry Research Reports.

• The global alginate dressing market size was valued at USD 938.3 million in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030. The rising incidence of chronic and acute wounds is the major factor driving the industry.

• The Asia Pacific disposable endoscopes market size was valued at USD 705.6 million in 2023 and is projected to grow at a CAGR of 18.3% from 2024 to 2030. Disposable endoscopes are vital for reducing cross-contamination and improving patient safety during medical procedures.

Enteric Disease Testing Market Segmentation

Grand View Research has segmented the global enteric disease testing market on the basis of disease type, and region:

Enteric Disease Testing Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

• Bacterial Enteric Disease

• Viral Enteric Disease

o Rotavirus

o Norovirus

• Parasitic Enteric Disease

Enteric Disease Testing Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Sweden

o Norway

o Denmark

• Asia Pacific

o Japan

o China

o India

o Australia

o Thailand

o South Korea

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East and Africa

o Saudi Arabia

o South Africa

o UAE

o Kuwait

Order a free sample PDF of the Enteric Disease Testing Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• Abbott

• BD

• Biomerica

• BIOMÉRIEUX

• Bio-Rad Laboratories, Inc.

• Cepheid

• Coris BioConcept

• DiaSorin S.p.A.

• Meridian Bioscience

• Quest Diagnostics Incorporated