The Europe gas and LNG market is undergoing significant transformations, driven by the increasing demand for cleaner energy sources, geopolitical dynamics, and advancements in technology. As Europe aims to achieve its climate goals and reduce dependency on traditional fossil fuels, the role of natural gas and liquefied natural gas (LNG) is becoming increasingly vital. This article provides an in-depth analysis of the current landscape of the Europe gas and LNG market, exploring key trends, challenges, and future prospects.

Market Overview

As of 2023, the European gas market is valued at approximately €150 billion and is projected to grow at a compound annual growth rate (CAGR) of 4-5% over the next five years. The market encompasses both pipeline gas and LNG, with LNG playing an increasingly crucial role in ensuring energy security and diversifying supply sources.

Key Market Drivers

1. Energy Transition and Decarbonization Goals

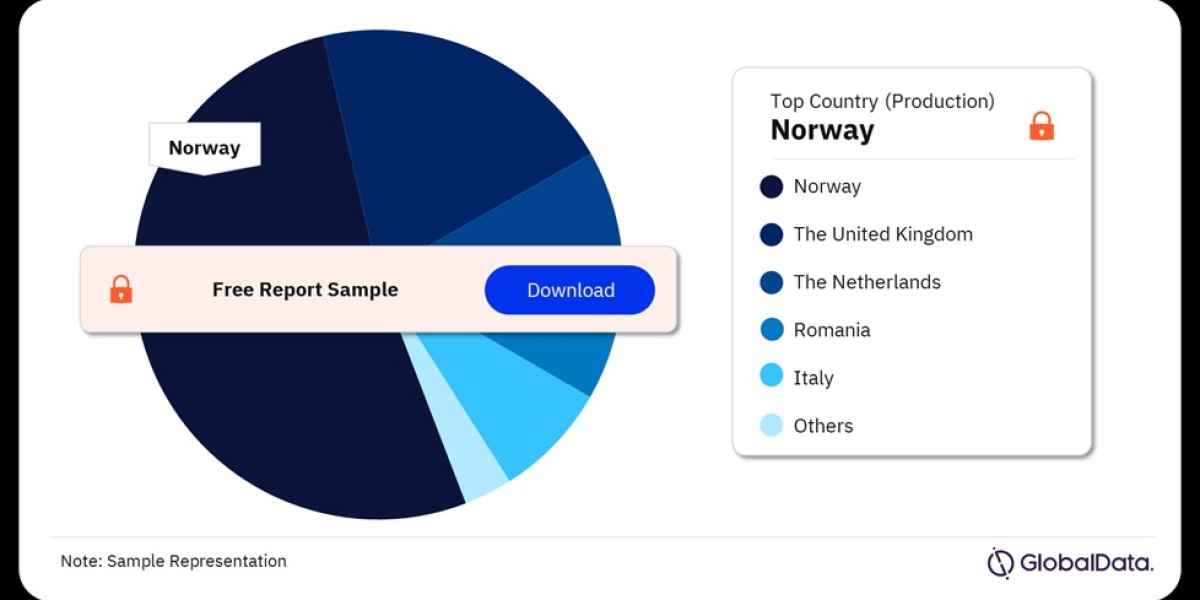

The European Union (EU) has set ambitious climate targets, including a commitment to become climate-neutral by 2050. This transition involves a significant shift away from coal and oil toward cleaner energy sources, where natural gas and LNG are seen as transitional fuels that can help bridge the gap. Gas emits less carbon dioxide than coal and oil, making it a critical component in reducing greenhouse gas emissions. Buy the Full Report for More Country-Wise Insights into the Europe Natural Gas Market,

Download a Free Sample Report

2. Geopolitical Factors

Geopolitical tensions, particularly related to the Ukraine crisis and the EU's dependency on Russian gas, have prompted European countries to diversify their energy sources. The need for energy security has accelerated investments in LNG infrastructure and alternative supply routes, reducing reliance on single sources.

3. Technological Advancements

Advancements in extraction, transportation, and storage technologies are driving the growth of the gas and LNG market. Innovations in liquefaction and regasification processes are making LNG more accessible and cost-effective, facilitating its integration into the European energy mix.

4. Rising Demand for Natural Gas

Natural gas demand is projected to increase in the coming years, particularly in the power generation and industrial sectors. As countries transition to cleaner energy, natural gas is expected to play a pivotal role in meeting energy needs while reducing emissions.

Market Segmentation

The Europe gas and LNG market can be segmented based on type, end-use application, distribution channel, and region.

By Type:

Natural Gas

- This includes both conventional and unconventional gas sources, such as shale gas. The primary modes of transportation for natural gas in Europe are pipelines, which connect major gas-producing regions to consumption centers.

Liquefied Natural Gas (LNG)

- LNG is natural gas that has been cooled to a liquid state for ease of storage and transport. The demand for LNG is rising due to its flexibility, allowing for the transportation of gas over long distances without the need for extensive pipeline infrastructure.

By End-Use Application:

Power Generation

- Natural gas is increasingly being used in power generation as countries phase out coal and nuclear power. Gas-fired power plants are more efficient and emit fewer pollutants compared to their coal counterparts.

Industrial Applications

- Various industries, including chemicals, manufacturing, and refining, are major consumers of natural gas. The flexibility and reliability of gas make it an attractive option for industrial processes.

Residential and Commercial Heating

- Natural gas is widely used for heating residential and commercial buildings. Its availability and lower emissions compared to oil make it a preferred choice for heating.

Transportation

- LNG is gaining traction in the transportation sector, particularly for heavy-duty vehicles and maritime shipping. The transition to LNG as a cleaner fuel option helps reduce emissions and improve air quality.

By Distribution Channel:

Pipeline Distribution

- A significant portion of natural gas is transported through an extensive network of pipelines. Major pipeline networks, such as Nord Stream and Trans Adriatic Pipeline, facilitate the transportation of gas from producing regions to consumers.

LNG Terminals

- LNG terminals are critical for the import, storage, and regasification of LNG. The establishment of new terminals across Europe is enhancing the region’s capacity to handle LNG imports.

Key Trends Shaping the Europe Gas and LNG Market

1. Increased Investment in LNG Infrastructure

The growing demand for LNG is prompting increased investment in LNG infrastructure across Europe. New terminals and regasification facilities are being developed to enhance the capacity to receive and process LNG. Countries like France, Spain, and the Netherlands are expanding their LNG facilities to improve energy security.

2. Decarbonization Initiatives

Many European countries are investing in technologies to reduce the carbon footprint of natural gas. This includes carbon capture and storage (CCS) technologies and the development of hydrogen as a cleaner alternative. The integration of renewable gases, such as biogas and synthetic natural gas, is also gaining momentum.

3. Emergence of LNG as a Transportation Fuel

The adoption of LNG as a fuel for maritime shipping and heavy-duty vehicles is becoming increasingly popular. As environmental regulations tighten, LNG is seen as a cleaner alternative to traditional marine fuels and diesel, leading to the establishment of more bunkering facilities across Europe.

4. Strengthening of Supply Chains

To mitigate risks associated with geopolitical tensions and supply disruptions, European countries are strengthening their supply chains. This includes diversifying sources of natural gas, establishing strategic partnerships with non-EU gas suppliers, and increasing domestic production.

5. Focus on Sustainability

Sustainability is becoming a key focus for gas companies operating in Europe. Consumers and regulators are demanding greater transparency and accountability regarding the environmental impact of gas production and consumption. As a result, companies are adopting sustainable practices and promoting low-carbon technologies.

Challenges Facing the Europe Gas and LNG Market

1. Regulatory and Policy Uncertainty

The gas and LNG market in Europe is subject to evolving regulations and policies aimed at addressing climate change. Uncertainty regarding future regulations can create challenges for investors and companies operating in the market. Adapting to changing policies while maintaining profitability is a significant concern for stakeholders.

2. Competition from Renewable Energy

The rise of renewable energy sources, such as wind and solar, poses a challenge to the natural gas market. As countries invest more in renewable energy infrastructure, the demand for natural gas may face competition, particularly in the power generation sector.

3. Price Volatility

Gas prices can be highly volatile due to factors such as geopolitical tensions, changes in supply and demand, and fluctuations in global energy markets. Price volatility poses risks for producers, consumers, and investors, complicating long-term planning and investment strategies.

4. Environmental Concerns

Despite being a cleaner alternative to coal and oil, natural gas is still a fossil fuel. Concerns regarding methane emissions, fracking practices, and the environmental impact of gas extraction continue to raise questions about the sustainability of natural gas in the long term.

Future Outlook

The future of the Europe gas and LNG market is likely to be shaped by several key factors:

Increased Role of LNG in Energy Security: LNG will continue to play a crucial role in enhancing Europe’s energy security, particularly in light of geopolitical tensions and the need to diversify supply sources. The establishment of new LNG terminals and the expansion of existing facilities will be critical in this regard.

Integration of Renewable Energy: The integration of renewable energy into the gas and LNG market will be essential for achieving decarbonization goals. The development of renewable gases, such as hydrogen and biogas, will complement natural gas in the energy mix.

Technological Innovation: Ongoing advancements in technology will continue to improve the efficiency and sustainability of gas extraction, transportation, and consumption. Innovations in carbon capture and storage, as well as hydrogen production technologies, will be pivotal in reducing the environmental impact of natural gas.

Collaboration and Partnerships: Collaboration among stakeholders, including governments, energy companies, and research institutions, will be essential in driving the transition to a low-carbon energy system. Strategic partnerships will facilitate knowledge sharing and resource allocation to support the development of sustainable gas solutions.

Adaptation to Changing Consumer Preferences: As consumers become more environmentally conscious, the gas and LNG market will need to adapt to changing preferences. Companies that prioritize sustainability, transparency, and social responsibility will be better positioned to succeed in this evolving market.

In conclusion, the Europe gas and LNG market is at a pivotal juncture, facing both challenges and opportunities in the context of the energy transition. By understanding the key trends and dynamics shaping this market, stakeholders can navigate the complexities and position themselves for success in the future. The focus on sustainability, technological innovation, and energy security will be essential as Europe strives to meet its climate goals and create a sustainable energy landscape.