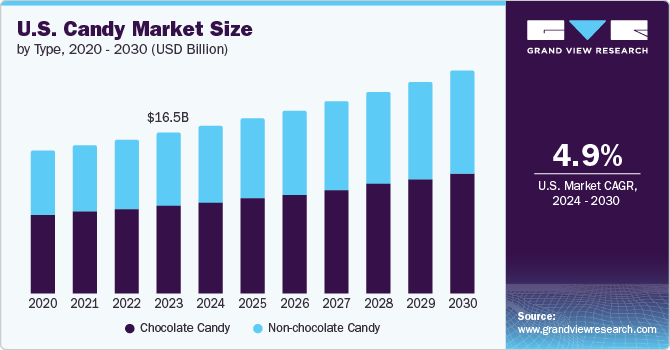

The U.S. candy market size is expected to reach USD 22.9 billion by 2030, registering a CAGR of 4.9% from 2024 to 2030, according to a new report by Grand View Research, Inc. Growing consumer expenditure and disposable income and increasing urbanization are driving the growth of the candy market in the U.S. Candies and chocolates are generating a huge amount of sales in the U.S. targeting the sweet tooth among the people. Huge revenue generation of candies is primarily due to their consumption during holidays like Halloween and Easter accounting for around USD 3.5 billion sales.

Currently, around 82% of the population in North America are living in urban areas with a high concentration in mid and large-sized cities. Rising urbanization has led to a growing awareness of new products and their easy availability. This is due to the fact that giant players have a significant hold of the candy market in urban areas.

Gather more insights about the market drivers, restrains and growth of the U.S. Candy Market

Children with an inclination towards a sweet tooth is a major factor driving the demand of the products. Hence, this group of population is a huge contributor towards revenue generation of the market. Moreover, key players are creating appealing advertisements targeting the children and young population, thus, attracting them towards impulse purchase. Teenagers are also a significant target population for candies, especially chocolate candies due to the high preference for the chocolate flavor.

An increase in product innovation and new product development has led to the high growth of the market. Sugar-free candies manufactured by the key players is further expected to boost the market demand for the diabetic population. Companies are also engaged in new product launch, which is further boosting the demand for candies. For instance, in March 2017, Hershey’s Reese’s brand launched Reese’s Crunchy Cookie Cup. In May 2016, DeMet’s Candy Company launched a new product, TURTLES Double Chocolate.

U.S. Candy Market Report Highlights

- Chocolate candies held the dominant share in this segment, with a revenue share of 54.7% in 2023.

- Non-chocolate candies are expected to grow substantially during the forecast period due to their diverse types. Non-chocolate candies include a variety of flavors in the form of hard candies, chewing gums, lollipops, gummies, caramel, jelly candies, and more.

- Based on the distribution channel segment, Supermarkets and hypermarkets held a significant market share of 35.8% owing to their expansive storage capacity and diverse product offerings

- Online distribution channels offer many candy options, enhancing consumer awareness of new products.

Browse more reports published by Grand View Research.

- Seasoning & Spices Market Size, Share & Trends Analysis Report By Product (Spice, Salt & Salts Substitutes), By Brand (National Brand, Private Label Brand), By End-use (Retail, Foodservice), By Region, And Segment Forecasts, 2024 - 2030

- Cranberries Market Size, Share & Trends Analysis Report By Type (Fresh Cranberries, Dried Cranberries, Frozen Cranberries), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts, 2024 - 2030

List of Key Players in the U.S. Candy Market

- The Hershey Company

- Ferrara Candy Co.

- Mars Incorporated

- Mondeléz International

- DeMet's Candy Co.

- Nestlé S.A.

- Compartés

- Vosges Haut-Chocolat

- Fortnum & Mason

- John Kelly Chocolates

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database