The Mexico power market is undergoing a significant transformation, driven by a mix of policy reforms, technological advancements, and shifts in energy demand. This article explores the current state of the Mexico power market, its recent developments, and future trends, providing valuable insights for investors, policymakers, and industry stakeholders.

Overview of the Mexico Power Market

Mexico's power market has traditionally been dominated by state-owned enterprises, primarily Comisión Federal de Electricidad (CFE). However, recent reforms have opened the market to private investments, promoting competition and efficiency. These changes aim to modernize the sector and support the country’s energy needs sustainably.

Key Recent Developments

Energy Reform and Liberalization: The energy reform of 2013-2014 marked a pivotal shift in Mexico's power market. It aimed to break the monopoly held by CFE and encourage private sector participation. The reform introduced the Wholesale Electricity Market (WEM), allowing private companies to generate, sell, and buy electricity.

Renewable Energy Integration: Mexico has set ambitious goals for renewable energy integration, targeting 35% of electricity generation from clean sources by 2024. The country is investing heavily in wind, solar, and hydropower projects. The Energy Transition Law of 2015 supports these goals by providing incentives for renewable energy development and setting out a clear framework for transitioning to a low-carbon economy.

Technological Advancements: Technological innovation is driving changes in Mexico’s power market. Smart grids, energy storage solutions, and advanced metering infrastructure are enhancing grid reliability and efficiency. These technologies also support the integration of intermittent renewable energy sources and improve overall energy management.

Private Sector Participation: The Mexican government has introduced several initiatives to attract private investments in the power sector. The Long-Term Electricity Auctions, which began in 2016, are a key mechanism for sourcing renewable energy. These auctions allow private entities to bid for long-term power purchase agreements (PPAs), providing a stable revenue stream and encouraging further investment.

Challenges Facing the Mexico Power Market

Regulatory Uncertainty: Ongoing changes in energy policies and regulatory frameworks pose challenges for market participants. Frequent shifts in regulations can create uncertainty for investors and hinder long-term planning. Ensuring regulatory stability is crucial for fostering confidence and sustaining investment in the power sector.

Infrastructure Constraints: Mexico’s power infrastructure faces limitations, particularly in rural and underserved areas. Expanding and upgrading transmission and distribution networks are essential to support the growing demand for electricity and facilitate the integration of renewable energy sources.

Market Competition: While the reform has introduced competition, the market is still in a transitional phase. Balancing competition with the need to ensure reliable and affordable electricity supply is a complex task that requires ongoing adjustments and oversight.

Future Outlook

The Mexico power market is poised for continued evolution as it navigates the transition to a more competitive and sustainable energy landscape. Key trends to watch include:

Accelerated Renewable Energy Deployment: Mexico is expected to continue its push toward renewable energy, with increased investment in solar and wind projects. Technological advancements and decreasing costs for renewable technologies will further drive this trend.

Decarbonization Efforts: The Mexican government’s commitment to reducing greenhouse gas emissions will likely lead to more stringent environmental regulations and policies. This will impact both existing and new power projects, driving the adoption of cleaner energy solutions.

Increased Market Participation: As the market matures, greater participation from private entities and international investors is anticipated. This will bring increased competition, innovation, and efficiency to the power sector.

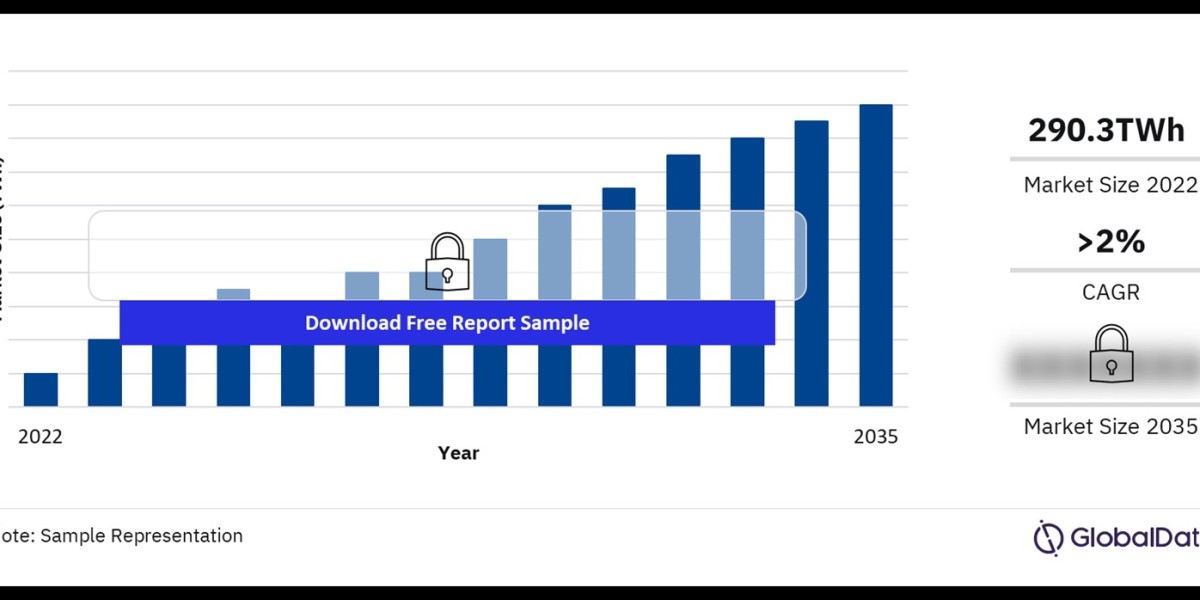

Buy the Full Report for More Insights on the Mexico Power Market Forecast, Download a free Report Sample