Sustainable Finance Industry Overview

The global sustainable finance market size was estimated at USD 519.88 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 22.6% from 2023 to 2030. The sustainable finance Asset Under Management (AUM) was valued at USD 37.80 trillion in 2022. The growing awareness and concern about environmental and social issues, such as climate change, resource depletion, and social inequality, is expected to boost the market’s growth. This heightened awareness has increased the demand for sustainable finance solutions as individuals, businesses, and institutions seek to align their investments with their values and contribute to a more sustainable future. Moreover, regulatory frameworks and government initiatives are playing a crucial role in driving the market’s growth.

Gather more insights about the market drivers, restrains and growth of the Sustainable Finance Market

Many countries have implemented policies and regulations encouraging sustainable investment practices, such as tax incentives, disclosure requirements, and sustainability reporting standards. These regulatory measures create a supportive environment for sustainable finance and incentivize market participants to incorporate sustainability factors into their investment decisions. Furthermore, investors are increasingly recognizing the financial benefits of sustainable finance. It is no longer seen as just an ethical choice but also a strategic one.

Sustainable investments have demonstrated competitive financial performance and risk mitigation potential, attracting investors seeking financial returns and positive environmental and social impacts. This shift in investor preferences has resulted in a surge in sustainable investment products and strategies, driving the growth of the sustainable finance industry. In addition, technological advancements and data analytics have played a significant role in driving the market. The availability of data on Environmental, Social, and Governance (ESG) factors has improved, enabling investors and financial institutions to assess the sustainability performance of companies and investment portfolios more accurately.

Technological tools and platforms have also facilitated the integration of ESG considerations into investment processes, making sustainable finance more accessible and efficient. In addition, companies and organizations increasingly recognize the importance of sustainability in their long-term business strategies. The adoption of sustainable practices not only helps mitigate risks but also enhances brand reputation, customer loyalty, and employee engagement. This corporate sustainability trend has increased the demand for sustainable finance solutions to support green projects, sustainable supply chains, and responsible business practices.

However, the market is restrained by the lack of standardized and globally recognized definitions, metrics, and reporting frameworks for sustainability. This creates challenges in comparing and evaluating the sustainability performance of different companies and investment products. To overcome this restraint, efforts are being made to develop common standards and frameworks. For instance, initiatives like the Task Force on Climate-related Financial Disclosures (TCFD) and Global Reporting Initiative (GRI) have provided guidelines for companies to disclose their sustainability-related information. In addition, collaborations among financial institutions, industry associations, and regulatory bodies are working towards harmonizing sustainability reporting requirements and promoting the adoption of globally recognized frameworks.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global voice commerce market size was valued at USD 42.75 billion in 2023 and is expected to grow at a CAGR of 24.6% from 2024 to 2030. The market is expanding rapidly, driven by the growing adoption of smart speakers, smartphones, and IoT devices that enable voice-based interactions.

• The global vision transformers market size was valued at USD 217.5 million in 2023 and is expected to grow at a CAGR of 33.6% from 2024 to 2030. Vision Transformer (ViTs) is an extension of the transformer architecture, originally successful in natural language processing (NLP).

Sustainable Finance Market Segmentation

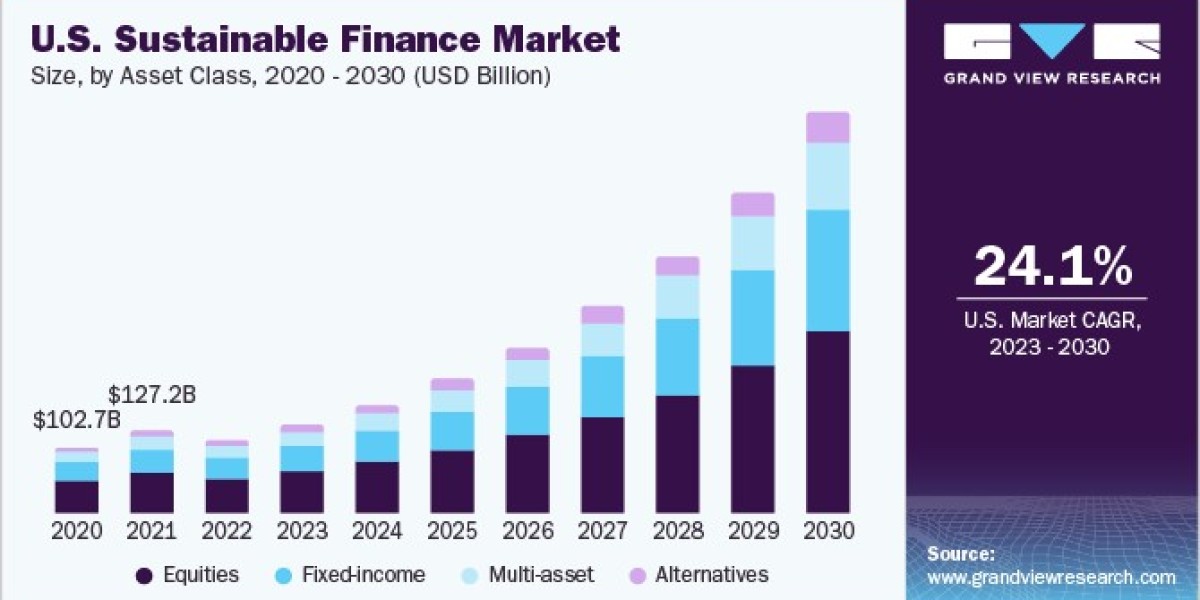

Grand View Research has segmented the global sustainable finance market based on asset class, offerings, investment style, investor type, and region:

Sustainable Finance Asset Class Outlook (Revenue, USD Billion, 2017 - 2030)

• Equities

• Fixed-income

• Multi-asset

• Alternatives

Sustainable Finance Offerings Outlook (Revenue, USD Billion, 2017 - 2030)

• Equity Funds

• Bonds Funds

• ETFs/Index Funds

• Alternatives/Hedged Funds

Sustainable Finance Investment Style Outlook (Revenue, USD Billion, 2017 - 2030)

• Active

• Passive

Sustainable Finance Investor Type Outlook (Revenue, USD Billion, 2017 - 2030)

• Institutional Investor

• Retail Investor

Sustainable Finance Regional Outlook (Revenue, USD Billion, 2017 - 2030)

• North America

o U.S.

o Canada

• Europe

o Luxemburg

o UK

o France

o Germany

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

• Latin America

o Brazil

o Mexico

• Middle East & Africa

o Kingdom of Saudi Arabia (KSA)

o UAE

o South Africa

Order a free sample PDF of the Sustainable Finance Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• BlackRock, Inc.

• State Street Corporation

• Morgan Stanley

• UBS

• JPMorgan Chase & Co.

• Franklin Templeton Investments

• Amundi US

• The Bank of New York Mellon Corporation

• Deutsche Bank AG

• Goldman Sachs