Copper is a key metal in the global economy, and Chile stands at the forefront of its production. As the world's largest copper producer, Chile accounts for approximately 28% of global copper output, making the Chilean copper mining market an essential pillar in both the national and global economies. This article explores the key aspects of Chile's copper mining market, including its importance, production trends, challenges, and future outlook.

The Importance of Chilean Copper

Copper is an essential metal for various industries, ranging from electronics and renewable energy to construction and telecommunications. It is known for its superior conductivity and corrosion resistance, making it indispensable for electrical applications. Chiles dominance in copper production ensures its position as a vital player in global markets, attracting investments from international mining corporations and bolstering the countrys economy.

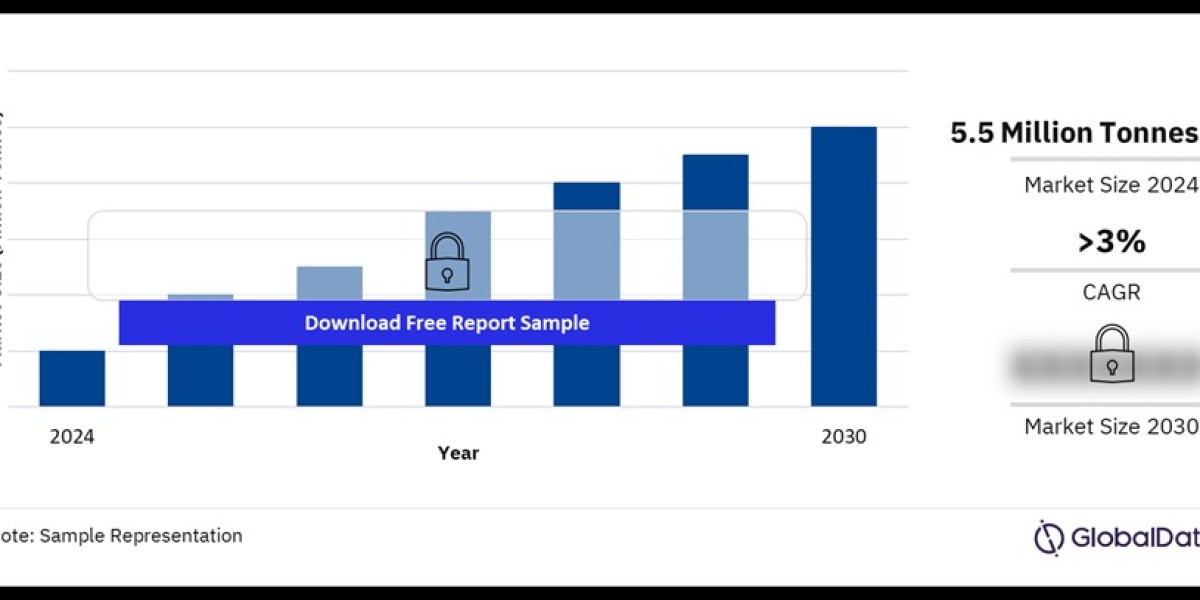

In 2023 alone, Chile produced approximately 5.8 million metric tons of copper, contributing significantly to the nations GDP. The mining sector represents about 10% of Chiles GDP and around 50% of its total exports, showcasing coppers importance to the Chilean economy.

Major Copper Mining Companies in Chile

Chile is home to several major mining companies, including state-owned Codelco, the largest copper producer in the world. Codelco controls numerous key mining operations, including Chuquicamata, one of the world's largest open-pit mines, and El Teniente, the largest underground copper mine globally.

Apart from Codelco, international players like BHP, Anglo American, and Antofagasta Minerals operate in Chile, contributing significantly to the nations copper production. These multinational companies bring in advanced mining technologies and investments, making Chile an attractive mining destination.

Production Trends

In recent years, the Chilean copper mining industry has experienced both growth and challenges. Chiles copper production has remained strong despite fluctuating copper prices. Several new mining projects, such as the Quebrada Blanca Phase 2 and Spence Growth Option, have come online, boosting production capacities.

The demand for copper, driven by global efforts to transition to clean energy and electric vehicles (EVs), has fueled interest in the Chilean copper sector. Copper is a crucial component in EV batteries, wind turbines, and solar panels, placing Chile at the heart of the global shift towards sustainable energy.

However, mining costs in Chile have risen in recent years due to stricter environmental regulations, declining ore grades, and higher labor expenses. Many mining companies are investing in technology and automation to mitigate these costs and improve efficiency.

Challenges in Chilean Copper Mining

While Chile is a leader in copper production, the industry faces several challenges. Key issues include:

Declining Ore Grades: Many of Chiles major copper deposits are aging, resulting in lower-grade ore, which makes extraction more costly and less efficient.

Water Scarcity: Copper mining is water-intensive, and Chile, particularly in the northern desert regions where most mining occurs, faces severe water shortages. This has led to tensions between mining companies and local communities over water use.

Environmental and Social Concerns: Mining activities have a significant environmental impact, including land degradation, water contamination, and carbon emissions. Growing awareness and advocacy for sustainable mining practices have resulted in stricter environmental regulations, which have increased operational costs for mining companies.

Political and Taxation Changes: The Chilean government has proposed tax reforms that would increase royalties on copper production. While this aims to boost national revenue, it could deter foreign investments if taxes become too burdensome.

Future Outlook

Despite the challenges, the future of the Chilean copper mining market appears promising, largely driven by the global demand for copper in the renewable energy and electric vehicle sectors. To maintain its leadership position, Chilean mining companies are investing in innovation, with technologies such as autonomous trucks, artificial intelligence (AI), and sustainable mining practices aimed at reducing environmental impact and improving efficiency.

Furthermore, exploration efforts are ongoing to discover new copper deposits, particularly in the untapped regions of northern Chile. The government is also working towards policies that balance economic growth with environmental sustainability, ensuring the longevity of the industry.

Buy the Report for More Insights on the Chile Copper Mining Market Forecast