Agricultural Tractors Industry Overview

The global agricultural tractors market size was valued at 3,098.2 thousand units in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. The increase in demand for compact tractors on small farms and technical developments such as the integration of telematics with agricultural tractors are expected to drive growth. Furthermore, the quick adoption of mechanization is expected to be favorable for the market's expansion during the following eight years. Additionally, it is anticipated that the market will witness growth due to the migration of farm workers to cities, which would result in a labor shortage. Due to the brief production halt and supply chain disruption caused by the COVID-19 outbreak, product demand was impeded.

Gather more insights about the market drivers, restrains and growth of the Agricultural Tractors Market

However, in H1 2022, the demand for tractors bounced back significantly with double-digit growth in major economies, such as the U.S., Canada, the U.K., Germany, China, and India. Also, strong crop production in these markets, along with the need to replace aging equipment, increased product sales in H1 2022. However, a sudden increase in demand led to lower inventory levels of tractors in H2 2022, a trend expected to continue over the next few quarters of 2022. In 2022, OEMs are presumed to increase agricultural tractor prices from 4% to 22%, which is anticipated to slow down the market growth. It is attributed to low inventory levels of tractors experienced by dealers.

Also, OEMs are currently experiencing a shortage of semiconductors coupled with supply chain disruptions and market uncertainty due to the growing COVID-19 cases, which may delay production. Furthermore, a hike in steel and aluminum prices is expected to increase tractor prices, which is further anticipated to hinder market growth over the next few quarters. Favorable government policies are likely to boost market growth over the forecast period. For instance, on September 15, 2022, the U.S. Department of Agriculture (USDA) introduced a Precision Agriculture Loan (PAL) Act to allow farmers and ranchers to avail of loans to purchase precision agriculture equipment.

Similarly, the implementation of the Canadian Agricultural Loans Act (CALA) and the U.K. Agriculture Act 2020 is expected to increase product demand over the forecast period. Over the course of the projected period, such initiatives are anticipated to fuel market expansion. Agricultural tractors' technological developments are also anticipated to be favorable for the market's expansion throughout the forecast period. For instance, the growing use of electric and driverless tractors will boost farming production.

Recent Developments

• In November 2022, CNH Industrial N.V. signed a long-term agreement with Monarch Tractor, an AgTech company, to develop fully electrified autonomous tractors. The initiative would enable the former company to increase its product portfolio.

• In August 2022, AGCO Corporation launched the latest New 700 Vario Series tractors in North America which have a more efficient powertrain with FendtiD low engine speed, hydraulic capacity, VarioDrive transmission, and a larger frame. This launch is expected to strengthen the company’s position in the North America region.

• In March 2021, CLAAS KGaAmbH launched CLASS ARION 400 tractors equipped with turbochargers and 4-valve technology. These tractors have low AdBlue and low diesel consumption. This launch was expected to strengthen the company’s position in the market.

• In September 2022, Kubota Corporation launched an electric compact tractor in Europe in 2023. This initiative is aimed at carbon neutrality. LXe-261 is the model’s name, which will be available by April 2023 for long-term rental service.

• In Jully 2022, Mahindra & Mahindra Ltd. launched the Yuvo Tech+ range supported by ELS 4-cylinder engines and mZIP3 cylinders for better mileage, torque, and power. The range has three options of speed(H-M-L) for optimal performance based on different agriculture and soil types of applications. This launch was expected to strengthen its position of it in the market.

• In May 2022, Tractors and Farm Equipment Limited launched EICHER PRIMA G3 Series, which utilizes high-intensity 3D cooling technology and Digi NXT Dashboard for more extended and continuous operations. This launch was expected to strengthen its position in the market.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global service robotics market size was valued at USD 46.99 billion in the year 2023 and is projected to grow at a CAGR of 12.4% from 2024 to 2030. The service robotics has witnessed growing penetration in various sectors owing to factors including precise services, low-cost solutions, flexibility and reduction of human efforts.

• The global disaster recovery solutions market was size valued at USD 9.59 billion in 2023 and is projected to grow at a CAGR of 36.3 % from 2024 to 2030. Growing awareness about the precautionary measures to avoid loss of data and increasing number of cloud computing solutions are driving the market primarily.

Agricultural Tractors Market Segmentation

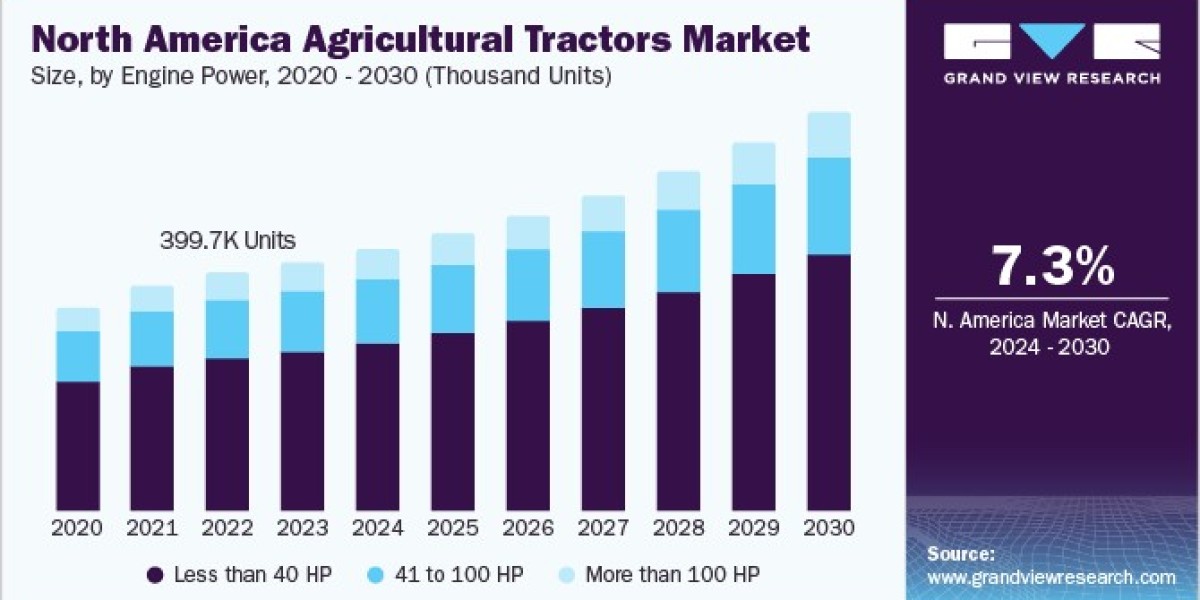

Grand View Research has segmented the global agricultural tractors market report based on engine power, driveline, propulsion, and region:

Agricultural Tractors Engine Power Outlook (Volume, Thousand Units, Revenue, USD million 2017 - 2030)

• Less than 40 HP

• 41 to 100 HP

• More than 100 HP

Agricultural Tractors Driveline Outlook (Volume, Thousand Units, Revenue, USD million 2017 - 2030)

• 2WD

• 4WD

Agricultural Tractors Propulsion Outlook (Volume, Thousand Units, Revenue, USD million 2017 - 2030)

• Electric

• ICE

Agricultural Tractors Regional Outlook (Volume, Thousand Units, Revenue, USD million 2017 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o U.K.

o Germany

o France

o Italy

o Spain

o Ukraine

o Romania

o Poland

o Benelux

o Turkey

• Asia Pacific

o China

o India

o Japan

o Australia

o South Korea

• Latin America

o Brazil

o Mexico

• Middle East and Africa (MEA)

Key Companies profiled:

• AGCO Corp.

• CNH Industrial N.V.

• Deere & Company

• CLAAS KGaAmbH

• Escorts Ltd.

• International Tractors Ltd.

• YanmarCo., Ltd.

• KubotaCorp.

• Mahindra & Mahindra Ltd.

• Tractors and Farm Equipment Ltd.

Order a free sample PDF of the Agricultural Tractors Market Intelligence Study, published by Grand View Research.

Key Agricultural Tractors Company Insights

• Deere & Company is engaged in the manufacturing & construction of agricultural and forestry machinery; drivetrains and diesel engines for heavy equipment; and lawn care machinery. Additionally, the company also manufactures and provides other heavy manufacturing equipment. The company serves diverse industries such as agriculture, forestry, construction, landscaping & grounds care, engines & drivetrain, government and military, and sports turf.

• AGCO Corporation is a U.S.-based agriculture equipment manufacturer. The company develops and sells products and solutions such as tractors, combines, foragers, hay tools, self-propelled sprayers, smart farming technologies, seeding equipment, and tillage equipment.

• Iron Ox is a global service provider of agriculture technology. The company provides automated robotic arms for tasks such as planting, harvesting, and packaging.

• Rowbot Systems is a agriculture solution provider. The company develops and provides a robotic machine that allows farmers to practice in-season nitrogen management.