Bovine Artificial Insemination Industry Overview

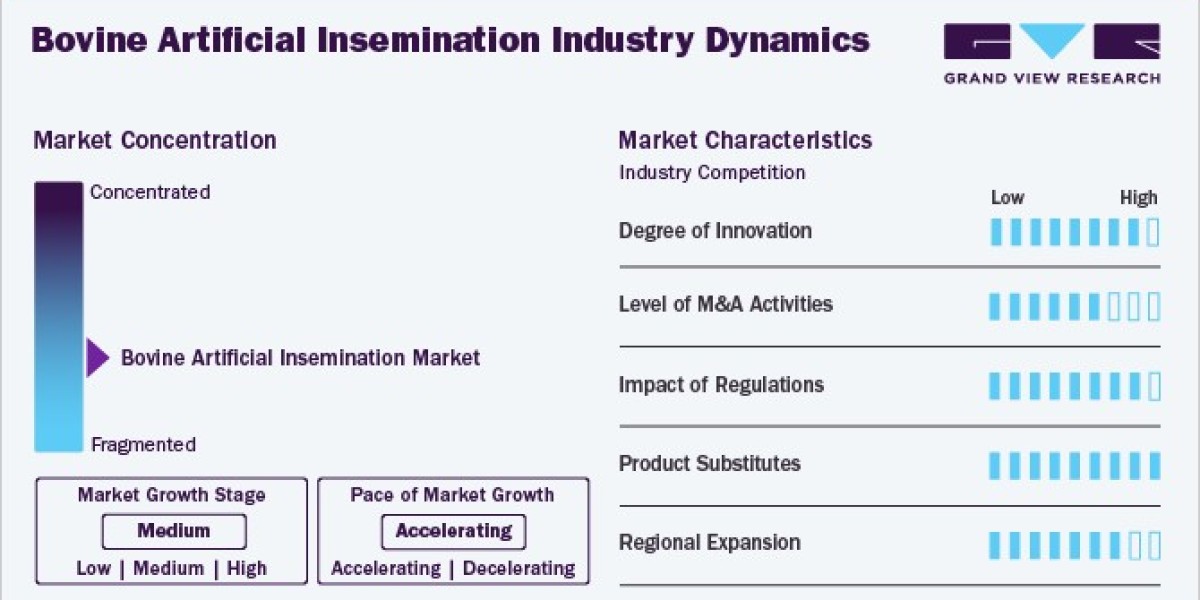

The global bovine artificial insemination market size was estimated at USD 2.99 billion in 2023 and is projected to grow at a CAGR of 6.32% from 2024 to 2030. The market is primarily driven by the rising demand for meat, dairy, and dairy products, advancements in veterinary reproductive technologies, the need for sustainable food production, and supportive actions taken by governments and market participants.

Gather more insights about the market drivers, restrains and growth of the Bovine Artificial Insemination Market

In September 2023, the Chief Minister of Rajasthan, India, approved a scheme granting up to 50% or INR 500 (USD 5.99) to farmers for every bovine artificial insemination (AI) they undertake. The scheme targeted 2,500,000 cattle farmers, with a budget of INR 36.65 crore (USD 44 million) for 500,000 procedures from 2023 to 2024. Such incentives are likely to boost the implementation of bovine artificial insemination, boosting the market growth.

AI enables farmers to access high-quality genetic material from superior bulls. By using semen from genetically superior sires, farmers can improve the traits and productivity of their cattle herds. This genetic improvement leads to higher milk & meat yields, better disease resistance, and enhanced overall herd quality. This allows farmers to produce more food with fewer inputs, such as land, water, and feed. By increasing productivity per animal, AI supports more efficient resource utilization and helps meet the growing global demand for food while minimizing environmental impacts.

For instance, a July 2023 study by The Royal Agricultural Society of England (RASE) identified five key areas for dairy production to focus on to improve sustainability. These key areas are enhancing breeding, controlling nitrogen on farms, promoting health & welfare, increasing yield per rumen, and developing innovative technologies.

Sustainable food production practices prioritize minimizing environmental impact. AI contributes to environmental sustainability by reducing the need for extensive grazing lands. It allows farmers to breed selectively, producing high-quality offspring with desirable traits without maintaining large herds. This, in turn, helps reduce greenhouse gas emissions, land degradation, and water usage associated with extensive livestock production systems. The growing need for sustainable food production is thus anticipated to fuel market growth in the coming years.

The industry is also witnessing increased initiatives from various industry participants like animal health organizations, government bodies, and animal research institutions. In December 2020, VikingGenetics, Evolution, and Masterrind formed Arcowin-a dairy and beef genetic cooperative-to ensure the sector's highest possible and most sustainable genetic progress. These three stakeholders represented key cooperatives in cattle breeding with robust bases in France, Germany, Finland, Denmark, and Sweden. Arcowin’s creation enabled the three stakeholders to use their genetic resources and investments better. Similar undertakings to facilitate the highest possible genetic progress in cattle and buffaloes are estimated to propel the market growth shortly.

Supportive initiatives by governments, animal health organizations, and private players are key factors driving the market. For example, in August 2022, the Indian Ministry of Fisheries, Animal Husbandry and Dairying initiated phase IV of its Nationwide Artificial Insemination Programme (NAIP). During this phase, around 33 million cows in the 604 districts in the country received insemination coverage i.e., less than 50% receiving AI coverage. They further reported the production of 2.78 million doses of sex-sorted semen in 2022 under the Rashtriya Gokul Mission.

AI is also being used in bovine to help produce other products useful for human health. For instance, according to a March 2024 report by Technology Networks, an animal farm in Brazil, in collaboration with researchers from the University of Illinois and the University of São Paolo, successfully bred the world’s first cow using AI, which capable of producing human insulin in the milk. Such discoveries are expected to lead to the emergence of a novel era of medicine production, like insulin, to eliminate the need for synthetic drug production and administer required drugs through natural products such as milk.

Browse through Grand View Research's Animal Health Industry Research Reports.

• The global foot and mouth disease vaccine market size was valued at USD 2.27 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. The increasing population of livestock and demand for animal products are the significant factors contributing to the market growth.

• The global veterinary stents market size is estimated to be USD 36.21 million in 2023 and is anticipated to grow at a CAGR of 6.74% from 2024 to 2030. The market is driven by quick R&D initiatives, an increase in pipeline products, increased adoption due to proven advantages over other minimally invasive treatments, and increased research into the application of existing technologies in veterinary use.

Bovine Artificial Insemination Market Segmentation

Grand View Research has segmented the global bovine artificial insemination market report based on solutions, distribution channel, sector, and region:

Bovine Artificial Insemination Solutions Outlook (Revenue, USD Million, 2018 - 2030)

• Equipment & Consumables

• Semen

o Normal (Conventional)

o Sexed

• Services

Bovine Artificial Insemination Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

• Private

• Public

Bovine Artificial Insemination Sector Outlook (Revenue, USD Million, 2018 - 2030)

• Meat

• Dairy

Bovine Artificial Insemination Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Poland

o Netherlands

• Asia Pacific

o Japan

o India

o China

o South Korea

o Australia

o New Zealand

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East and Africa (MEA)

o South Africa

o Egypt

o Iran

Order a free sample PDF of the Bovine Artificial Insemination Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• Genus Plc

• IMV Technologies

• SEMEX

• Jorgensen Laboratories

• URUS Group

• STgenetics

• National Dairy Development Board

• Munster Bovine

• World Wide Sires, Ltd

• CRV

Recent Developments

• In February 2024, Cogent Breeding and Sainsbury’s beef supply chain entered into a partnership. This partnership increases the access of farmers involved in Sainsbury’s Gamechanger program to Cogent’s genetics

• In October 2023, Munster Bovine introduced a website tailored to farmers, featuring comprehensive information on bull panels, AI Technician Services, DIY AI Training, and other farm management tools. It also includes enhanced features like custom shortlists and detailed bull catalogs to aid farmers in making informed decisions

• In April 2023, Showbox Sires LLC, a new genetic venture led by Tim and Sharyn Abbott as well as Mike and Julie Duckett, launched a high-type sire development program in collaboration with Select Sires and Semex. This program aimed to offer elite Holstein and Red & White genetics to dairy breeders

• In April 2023, URUS Group and Genetics Australia entered into a joint venture to increase their offering of global genetics and technology for Australian dairy and beef providers