The Ghana insurance market has experienced significant growth and transformation over the past decade, driven by a combination of economic development, regulatory reforms, and an increasing awareness of the importance of insurance coverage among individuals and businesses. As the countrys economy continues to expand, the demand for insurance services in sectors such as health, motor, life, and property insurance is on the rise. This article explores the key aspects of the Ghana insurance market, including its structure, challenges, opportunities, and future prospects.

Overview of the Ghana Insurance Market

Ghanas insurance industry is regulated by the National Insurance Commission (NIC), which ensures that insurance companies adhere to regulatory standards, maintain solvency, and offer products that meet consumer needs. The market comprises both life and non-life insurance sectors, with non-life (general) insurance holding the largest market share. In recent years, the sector has seen the introduction of innovative products and digital insurance solutions aimed at improving access to insurance for a wider portion of the population.

As of 2023, there were over 50 licensed insurance companies in Ghana, including both local and international players. These companies are providing a range of products such as life insurance, health insurance, motor insurance, and property insurance. Additionally, the microinsurance segment has been expanding, targeting low-income earners who previously had limited access to insurance products.

Key Drivers of Growth

Economic Growth: Ghanas economy has been growing steadily, driven by sectors like oil, mining, agriculture, and services. This economic development has led to a rising middle class, creating more demand for insurance products, especially in urban areas.

Regulatory Reforms: The NIC has implemented several reforms aimed at strengthening the insurance industry. One of the significant reforms was the increase in the minimum capital requirement for insurance companies, which has helped improve the financial stability of insurers.

Digital Transformation: The adoption of technology in the insurance sector is rapidly changing the landscape. Insurtech solutions, such as mobile-based insurance and online premium payment platforms, are making it easier for individuals and businesses to access insurance products.

Increased Awareness: Awareness of the benefits of insurance is growing, thanks to educational campaigns by both the government and private sector players. More people are now aware of the need for life insurance, health coverage, and the importance of insuring valuable assets.

Challenges Facing the Industry

Despite the growth and potential, the Ghana insurance market faces several challenges:

Low Insurance Penetration: Ghanas insurance penetration rate remains low compared to other African countries, with an estimated penetration of around 1% of GDP. Many Ghanaians, especially in rural areas, remain uninsured due to lack of awareness or affordability.

High Competition: The presence of many insurance companies in the market has led to intense competition. While this benefits consumers by driving down premiums, it also puts pressure on profit margins for insurers, especially smaller companies.

Fraud and Claims Management: Insurance fraud, particularly in motor insurance, remains a significant issue in the market. The NIC has been working on measures to curb fraudulent activities, but it remains a challenge for insurers.

Economic Instability: Ghanas economy, while growing, has been subject to fluctuations in inflation and currency depreciation, which can affect the profitability of insurance companies and the affordability of premiums for consumers.

Opportunities in the Ghana Insurance Market

Microinsurance Expansion: Microinsurance offers a huge opportunity for growth in Ghana, particularly among the informal sector and low-income populations. These products provide affordable coverage and have the potential to significantly increase insurance penetration.

Health Insurance Growth: With rising healthcare costs, there is an increasing demand for health insurance in Ghana. Private health insurance providers have a key opportunity to complement the governments National Health Insurance Scheme (NHIS) and offer more comprehensive coverage options.

Agricultural Insurance: Agriculture remains a major part of Ghanas economy, and the introduction of more comprehensive agricultural insurance products could protect farmers against risks such as droughts, floods, and pest infestations. The government has already partnered with some insurers to offer crop and livestock insurance schemes.

Technological Innovations: The adoption of digital tools such as mobile applications, artificial intelligence, and big data analytics presents opportunities for insurers to improve customer service, streamline operations, and offer personalized insurance products.

The Future of Insurance in Ghana

Looking ahead, the Ghana insurance market is poised for further growth. The increasing adoption of technology, regulatory reforms, and rising consumer awareness are expected to drive the industry forward. Insurers that can adapt to the changing landscape by offering innovative products and improving customer engagement will be well-positioned to capitalize on the markets potential.

To achieve sustained growth, insurers in Ghana must focus on improving customer education, addressing affordability challenges, and expanding insurance access to underserved communities, especially in rural areas. As the countrys economy continues to grow, the insurance industry is set to play a crucial role in providing financial protection and stability for individuals and businesses alike.

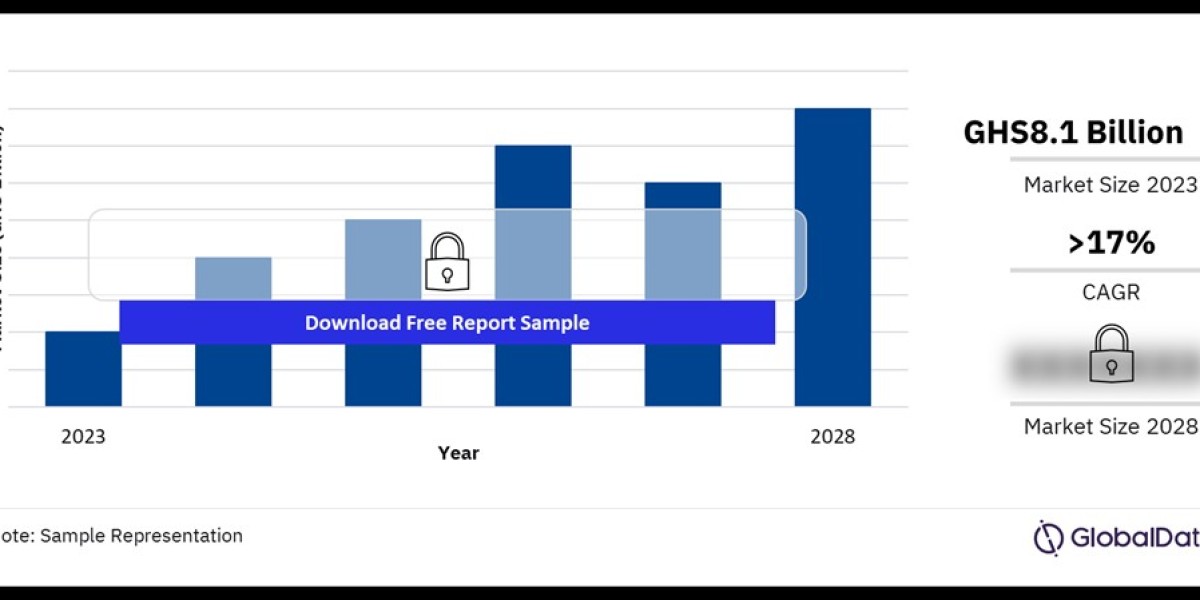

Buy the Full Report for More Insights into the Ghana Insurance Market Forecast

Download a Free Report Sample