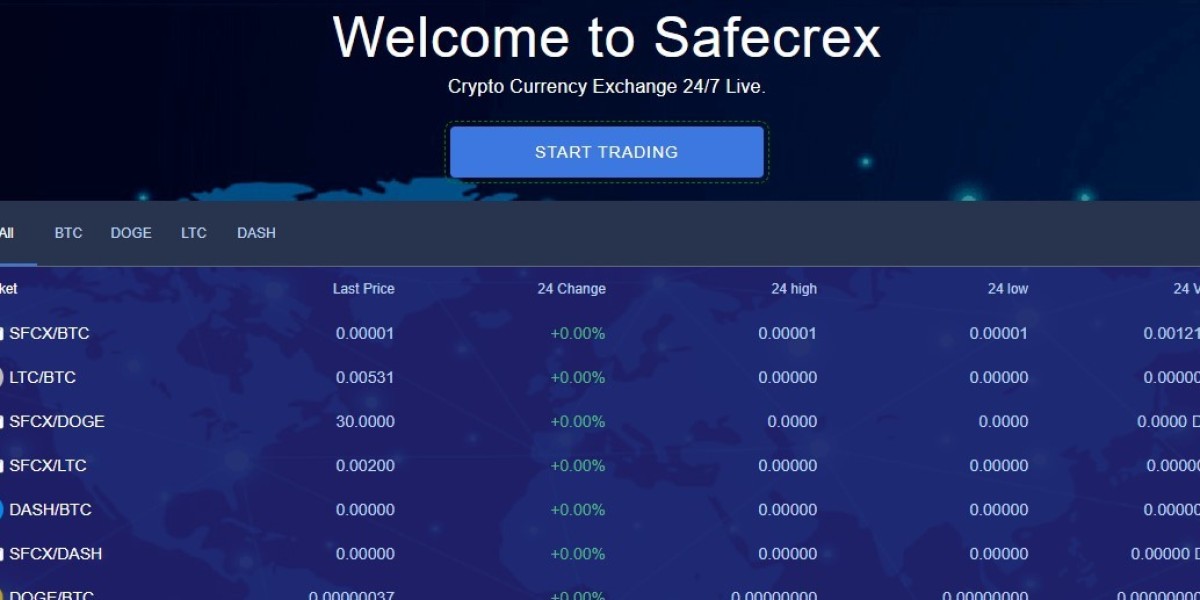

In the dynamic world of digital finance, cryptocurrency exchanges serve as the crucial gateway for buying, selling, and trading digital assets. These platforms enable users to convert traditional currencies into cryptocurrencies like Bitcoin, Ethereum, and countless altcoins. With the surge in cryptocurrency popularity, understanding how cryptocurrency exchanges work and choosing the right one has never been more critical. This article provides an in-depth look into cryptocurrency exchanges, helping you make informed decisions in your digital asset journey.

What is a Cryptocurrency Exchange?

A cryptocurrency exchange is a digital marketplace where users can trade cryptocurrencies for other digital currency or traditional fiat money, such as US dollars or euros. These exchanges operate similarly to traditional stock exchanges but are designed specifically for cryptocurrency trading. They facilitate transactions by matching buyers with sellers and often offer various features and tools to enhance trading efficiency.

Types of Cryptocurrency Exchanges

- Centralized Exchanges (CEX): Centralized exchanges are the most common type of cryptocurrency exchange. They are operated by a centralized organization that manages the platform, holds users' funds, and facilitates trades. Examples include Coinbase, Binance, and Kraken. Centralized exchanges offer high liquidity and a user-friendly experience but require users to trust the platform with their assets.

- Decentralized Exchanges (DEX): Unlike their centralized counterparts, decentralized exchanges operate without a central authority. They use blockchain technology to facilitate peer-to-peer trading, allowing users to retain control of their assets. Prominent examples include Uniswap and SushiSwap. DEXs provide increased privacy and security but may lack the liquidity and ease of use found in centralized exchanges.

- Hybrid Exchanges: Hybrid exchanges combine elements of both centralized and decentralized exchanges. They aim to provide the liquidity and user experience of centralized exchanges while maintaining some level of decentralization to enhance security and privacy.

Key Features to Consider When Choosing a Cryptocurrency Exchange

- Security: Security is paramount when selecting a cryptocurrency exchange. Ensure that the platform employs robust security measures, such as two-factor authentication (2FA), encryption, and cold storage for funds. Research the exchange’s security history and reputation to gauge its reliability.

- Fees: Cryptocurrency exchanges typically charge fees for transactions, including trading fees, withdrawal fees, and deposit fees. These fees can vary significantly between platforms. Carefully review the fee structure to determine which exchange offers the best value for your trading needs.

- Liquidity: Liquidity refers to the ability to buy or sell an asset without causing significant price fluctuations. Higher liquidity usually results in tighter spreads and more favorable trading conditions. Look for exchanges with high trading volumes and liquidity to ensure efficient transactions.

- User Experience: A user-friendly interface can significantly impact your trading experience. Choose an exchange with a well-designed platform that offers easy navigation, comprehensive tools, and responsive customer support.

- Regulation and Compliance: Ensure that the cryptocurrency exchange complies with relevant regulations and operates legally in your jurisdiction. Regulatory compliance helps protect users and ensures that the exchange adheres to industry standards.

- Range of Supported Cryptocurrencies: If you plan to trade a diverse range of cryptocurrencies, select an exchange that supports a wide array of digital assets. Some exchanges focus on major cryptocurrencies, while others offer a broader selection of altcoins.

How to Get Started with a Cryptocurrency Exchange

- Choose Your Exchange: Based on your requirements and preferences, select a cryptocurrency exchange that aligns with your needs. Consider factors such as security, fees, and supported cryptocurrencies.

- Create an Account: Sign up for an account on the chosen exchange. This process typically involves providing personal information and completing identity verification to comply with Know Your Customer (KYC) regulations.

- Deposit Funds: Once your account is set up, deposit funds into your exchange account. This can usually be done via bank transfer, credit card, or cryptocurrency transfer.

- Start Trading: With funds in your account, you can begin trading. Explore the exchange’s trading features, such as market orders, limit orders, and stop-loss orders, to optimize your trading strategy.

- Withdraw Funds: When you’re ready to cash out or move your assets, use the exchange’s withdrawal function to transfer funds to your bank account or external wallet.

Conclusion

Cryptocurrency exchanges play a pivotal role in the world of digital finance, enabling users to buy, sell, and trade cryptocurrencies efficiently. By understanding the different types of exchanges, evaluating key features, and selecting a reliable platform, you can navigate the complex landscape of cryptocurrency trading with confidence. As the cryptocurrency market continues to evolve, staying informed and making strategic decisions will help you maximize your trading potential and safeguard your investments.