South Africa, a dynamic economy with a growing middle class, has witnessed a significant transformation in its South Africa cards and payments market. The country has embraced digital payments, driven by technological advancements, increased financial inclusion, and changing consumer preferences.

Key Trends in South Africa's Cards and Payments Market

- Mobile Payments Surge: Smartphones have become ubiquitous in South Africa, fueling the adoption of mobile payment solutions. QR code payments, contactless cards, and mobile wallets have gained significant popularity among consumers and businesses.

- E-commerce Growth: The rise of e-commerce in South Africa has created a demand for convenient and secure payment options. Online payment gateways and digital wallets have become essential tools for businesses operating in the digital marketplace.

- Contactless Payments: Contactless payment technology has gained widespread acceptance, offering a quick and convenient way to make payments. This trend has been further accelerated by the COVID-19 pandemic.

- Financial Inclusion: The South African government has made significant efforts to promote financial inclusion, leading to increased access to banking services and payment options for previously underserved populations.

- Open Banking: South Africa has embraced open banking initiatives, allowing consumers to share their financial data with authorized third-party providers. This has led to the development of innovative financial services and payment solutions.

Challenges and Opportunities

Despite the significant growth in South Africa's cards and payments market, there are still challenges to be addressed:

- Infrastructure Development: Expanding the country's payment infrastructure, including POS terminals and internet connectivity, is essential to support the growth of digital payments.

- Security Concerns: As the market continues to evolve, ensuring the security of digital transactions remains a top priority.

- Financial Literacy: Promoting financial literacy among the population is crucial to drive the adoption of digital payments and prevent fraud.

However, these challenges also present opportunities for innovation and growth. The South African government and private sector are actively working to address these issues and create a conducive environment for the development of the cards and payments market.

Future Outlook

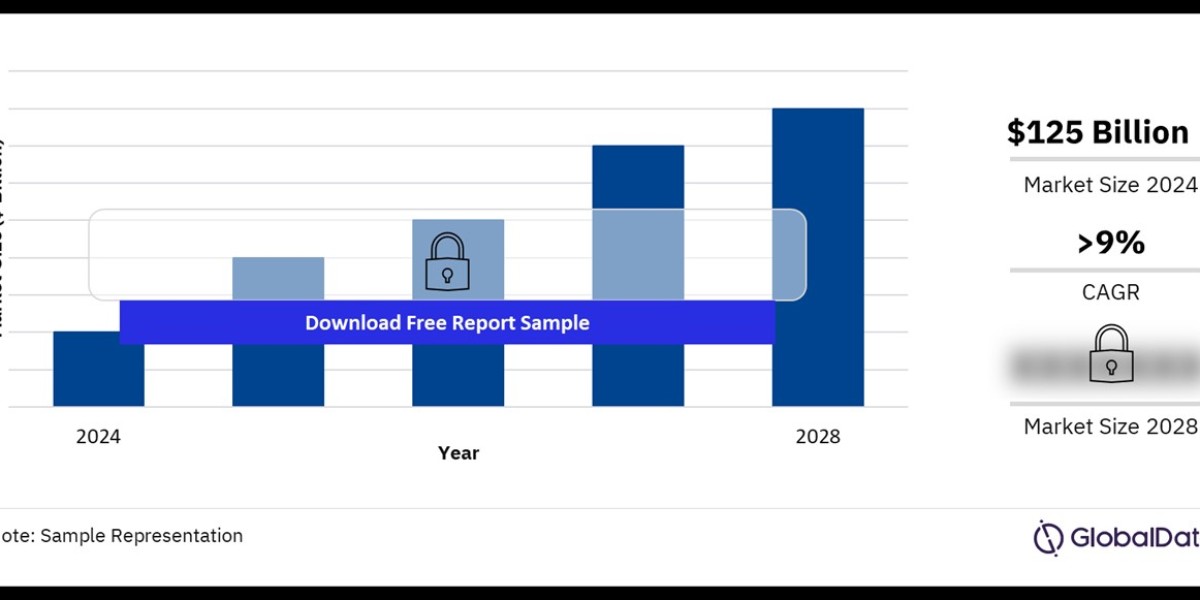

South Africa's cards and payments market is poised for continued growth, driven by technological advancements, changing consumer behavior, and government initiatives. As the country continues to embrace digital transformation, innovative payment solutions and services will emerge, further enhancing the convenience and efficiency of transactions.

Buy the Full Report for More Information on the South Africa Cards and Payments Market Forecast