Colorado Legal Cannabis Market Growth & Trends

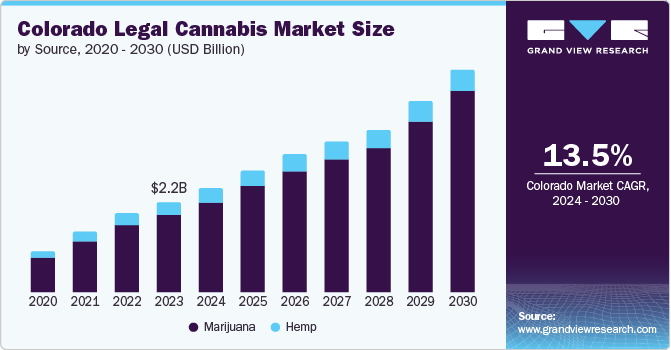

The Colorado legal cannabis market size is projected to reach USD 5.53 billion by 2030, expanding at a CAGR of 13.5% during the forecast period, according to a report by Grand View Research, Inc. The growth is driven by ease of access to cannabis products owing to its legalization coupled with rising technological advancements. Furthermore, increasing government efforts in the form of initiatives and policies is fuelling the market growth in the state. For instance, in April 2023, Cannabis Business Office announced a partnership with NuProject, a mission-based lender, to launch the Cannabis Business Loan Program. The loan program is expected to provide emerging businesses access to funding and create 239 jobs in the state.

Moreover, the increasing prevalence of cancer in the state, coupled with rising awareness regarding the benefits associated with the use of medical marijuana for cancer treatment, is anticipated to drive growth over the forecast period. According to Colorado Environmental Public Health Tracking, around 25,000 adults in the state are diagnosed, and around 7,600 deaths are caused by cancer every year. Additionally, a study conducted by the University of Colorado has shown that patients suffering from cancer reported pain relief, enhanced sleep cycles, and a reduction in brain fog after consumption of cannabis.

Gather more insights about the market drivers, restrains and growth of the Colorado Legal Cannabis Market

The National Commission on Marijuana and Drug Abuse decriminalized marijuana in 1975. Under the law, adults over the age of 21 years are allowed to possess less than one ounce of cannabis products. Furthermore, the Medical Use of Marijuana Act was passed in 2000 by the voters in the states that allow the possession of medical marijuana among patients suffering from debilitating health conditions. The Marijuana Enforcement Division (MED) of the Colorado Department of Revenue is responsible for the regulation and licensing of cannabis businesses in the state.

The presence of key players, such as TREES CORPORATION, Cannasseur Pueblo West, LivWell Dispensary, The Green Solution, Lightshade, Medicine Man, NATIVE ROOTS, and Starbuds, are adopting partnerships, acquisitions, expansions, new product launches, and collaboration as strategies to expand their geographical footprint and strengthen their market position.

For instance, in December 2022, TREES CORPORATION announced the acquisition of the Green Tree cannabis dispensaries along with manufacturing and cultivation assets in Longmont and Berthoud, Colorado. This acquisition is expected to contribute to the company’s expansion plans in the state. Furthermore, in December 2022, Medicine Man Technologies, a multi-state, vertically operating company, announced the acquisition of Lightshade Labs LLC’s assets located in Aurora and Denver for a total of USD 2.75 million. This acquisition strengthens the company’s geographical presence across New Mexico and Colorado.

Colorado Legal Cannabis Market Segmentation

Grand View Research has segmented the Colorado legal cannabis market based on source, product, cultivation and end-use:

Colorado Legal Cannabis Source Outlook (Revenue, USD Million, 2018 - 2030)

- Hemp

- Marijuana

Colorado Legal Cannabis Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

- CBD

- THC

- Others

Colorado Legal Cannabis Cultivation Outlook (Revenue, USD Million, 2018 - 2030)

- Indoor Cultivation

- Greenhouse Cultivation

- Outdoor Cultivation

Colorado Legal Cannabis End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Industrial Use

- Medical Use

- Recreational Use

Order a free sample PDF of the Colorado Legal Cannabis Market Intelligence Study, published by Grand View Research.