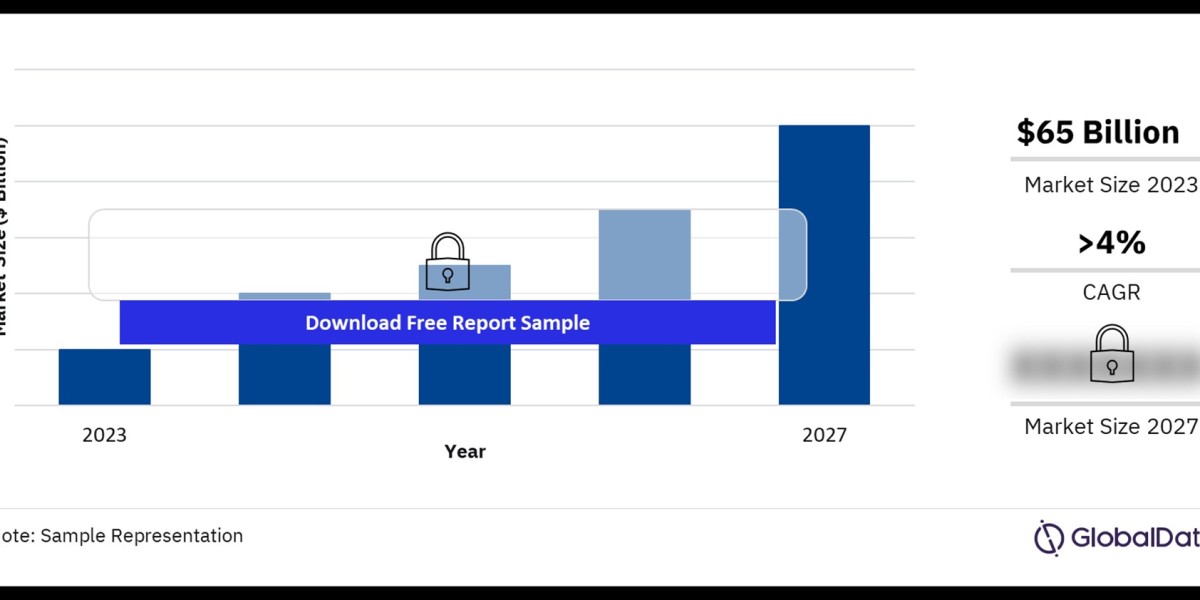

The New Zealand cards and payments market has undergone significant transformation in recent years, driven by technological advancements, changing consumer behaviors, and evolving regulatory landscapes. As the digital payments ecosystem continues to evolve, understanding the current trends, challenges, and opportunities is essential for businesses looking to thrive in this dynamic environment. This article explores the key aspects of the New Zealand cards and payments market, offering insights into its growth trajectory and future prospects.

Market Overview

New Zealand's payments landscape is marked by a strong adoption of digital payment solutions. The rise of contactless payments, mobile wallets, and e-commerce has reshaped how consumers and businesses interact with financial transactions. According to recent reports, card payments account for a substantial share of the country's transaction volume, with debit and credit cards being the most commonly used payment methods.

Key Trends in the New Zealand Cards and Payments Market

Contactless Payments Surge

Contactless payments have seen a significant surge in popularity in New Zealand. The convenience and speed of tapping a card or mobile device for transactions have resonated with consumers. Retailers and businesses are increasingly adopting contactless payment terminals to meet customer expectations and enhance the overall payment experience.

Rise of Mobile Wallets

Mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, have become a prominent feature in the New Zealand payments landscape. These digital solutions offer a secure and convenient way for consumers to make purchases using their smartphones. The integration of loyalty programs and rewards into mobile wallets further drives their adoption.

E-Commerce Growth

The growth of e-commerce has had a profound impact on the payments market. Online shopping has become a preferred method for consumers, leading to increased demand for secure and seamless online payment solutions. Businesses are investing in robust payment gateways and fraud prevention measures to ensure a smooth online shopping experience.

Emergence of Buy Now, Pay Later (BNPL) Solutions

Buy Now, Pay Later services have gained traction in New Zealand, providing consumers with flexible payment options. These solutions allow shoppers to split their purchases into manageable installments, making high-ticket items more accessible. BNPL providers are partnering with retailers to offer integrated payment options at checkout.

Challenges Facing the Market

Fraud and Security Concerns

As the payments landscape becomes more digital, the risk of fraud and security breaches increases. Ensuring the security of payment transactions and protecting consumer data is a top priority for businesses and financial institutions. Investments in advanced fraud detection technologies and compliance with security standards are crucial for mitigating risks.

Regulatory Compliance

The payments industry in New Zealand is subject to regulatory oversight aimed at ensuring fair practices and protecting consumers. Adhering to regulatory requirements, such as the Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Act, is essential for businesses operating in the payments sector.

Technological Integration

Keeping up with rapidly evolving payment technologies and integrating them into existing systems can be challenging for businesses. Seamless integration of new payment solutions while maintaining compatibility with legacy systems requires careful planning and investment.

Opportunities for Growth

Innovation and Technology Adoption

Embracing innovative payment technologies presents significant opportunities for growth. Companies that invest in emerging technologies, such as blockchain and artificial intelligence, can enhance payment security, streamline processes, and offer personalized experiences to customers.

Expansion of Digital Payment Solutions

As digital payment adoption continues to rise, there are opportunities for businesses to expand their digital payment offerings. Developing and integrating new payment solutions that cater to evolving consumer preferences can drive customer engagement and loyalty.

Collaboration and Partnerships

Collaboration between financial institutions, technology providers, and retailers can foster innovation and drive growth in the payments market. Strategic partnerships can lead to the development of new payment solutions and improved customer experiences.

Buy the Full Report for More Information on the New Zealand Cards and Payments Market Forecast