Indonesia, with its dynamic and rapidly expanding economy, has become a focal point in Southeast Asia's financial landscape. The nation's cards and payments market is a critical component of this growth, reflecting the broader economic trends and consumer behaviors. This article provides an in-depth analysis of Indonesia's cards and payments market, exploring the key trends, challenges, opportunities, and future outlook.

Market Overview

Indonesia's cards and payments market has experienced significant growth over the past decade, driven by the rising middle class, increased internet penetration, and the government’s push towards financial inclusion. As of 2024, the market includes a variety of payment methods, from traditional bank cards to innovative digital wallets and mobile payment solutions.

Key Trends Shaping the Market

Shift from Cash to Digital Payments: Traditionally a cash-driven economy, Indonesia is witnessing a gradual but steady shift towards digital payments. This change is largely attributed to the growing adoption of smartphones, which has facilitated the use of mobile payment platforms such as GoPay, OVO, and DANA.

Rise of E-commerce: The booming e-commerce sector in Indonesia has been a major catalyst for the growth of card payments. With platforms like Tokopedia, Shopee, and Bukalapak gaining popularity, consumers are increasingly using credit and debit cards, as well as digital wallets, for online purchases.

Government Initiatives: The Indonesian government has been actively promoting financial inclusion and cashless transactions through initiatives such as the National Non-Cash Movement (GNNT). These efforts aim to reduce the country's reliance on cash, thereby improving efficiency and transparency in financial transactions.

Growth of Contactless Payments: The COVID-19 pandemic accelerated the adoption of contactless payments in Indonesia. Consumers are now more inclined to use contactless cards and QR code-based payments, which offer a safer and more convenient way to transact.

Expanding Credit Card Market: Although credit card penetration in Indonesia is relatively low compared to neighboring countries, there is significant growth potential. Banks and financial institutions are increasingly targeting the middle-class segment with attractive credit card offers and rewards programs.

Challenges in the Market

Low Financial Literacy: Despite the growing adoption of digital payments, a large portion of the Indonesian population remains unbanked or underbanked. Low financial literacy levels pose a challenge to the widespread adoption of cards and digital payment solutions.

Infrastructure Limitations: In rural and remote areas, the lack of infrastructure, such as point-of-sale (POS) terminals and internet connectivity, hampers the adoption of card payments. This limitation restricts the market's growth potential in these regions.

Security Concerns: With the rise in digital payments, there is an increasing risk of cyber fraud and data breaches. Ensuring the security of online transactions remains a key challenge for financial institutions and payment service providers in Indonesia.

Opportunities in the Market

Untapped Market Potential: The low penetration of cards and digital payments in Indonesia presents a significant opportunity for growth. Financial institutions can focus on expanding their reach in rural areas and among the unbanked population.

Innovative Payment Solutions: There is a growing demand for innovative payment solutions that cater to the unique needs of Indonesian consumers. Companies that can offer secure, convenient, and user-friendly payment methods are likely to gain a competitive edge in the market.

Partnerships and Collaborations: Collaborations between banks, fintech companies, and telecommunication providers can help drive the adoption of digital payments. Such partnerships can facilitate the development of integrated payment solutions that offer greater convenience to consumers.

Regulatory Support: The Indonesian government's continued support for financial inclusion and digital payments provides a favorable environment for market growth. Regulatory frameworks that promote innovation while ensuring consumer protection will be crucial for the market's future development.

Future Outlook

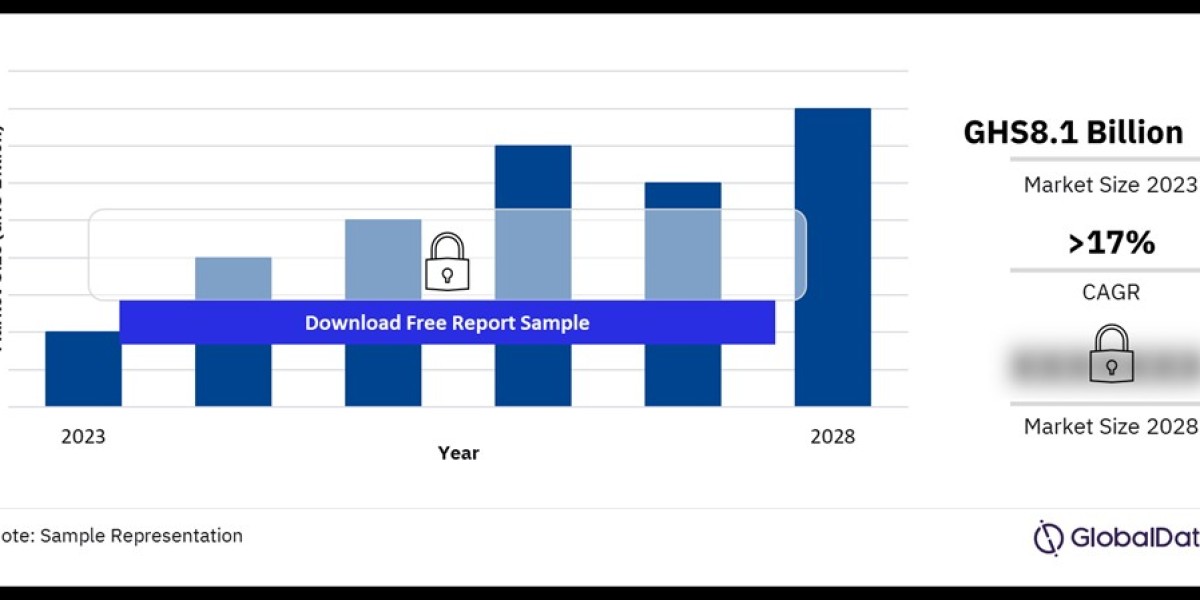

The future of Indonesia's cards and payments market looks promising, with continued growth expected over the coming years. The market is likely to see increased competition as both local and international players vie for a share of the growing consumer base. The expansion of digital payment solutions, coupled with the government's push for financial inclusion, will be key drivers of this growth.

Moreover, the integration of new technologies such as artificial intelligence (AI) and blockchain could revolutionize the payments landscape in Indonesia, offering faster, more secure, and efficient transaction processes.

Buy the Full Report for More Information on the Indonesia Cards and Payments Market Forecast Download a Free Sample Report