The global oleochemicals market size was estimated at USD 24.42 billion in 2023 and is projected to grow at a CAGR of 7.0% in terms of revenue from 2024 to 2030. The market outlook is considered positive due to the increasing demand for biodegradable products and restrictions on petrochemical-based products.

Oleochemicals are the products derived from fats and oils. They can be produced from natural sources such as plant oils and animal fats as well as fossil fuel sources such as petrochemicals. Oleochemicals can be produced using various chemical or enzymatic reactions by the manufacturers. Fluctuating crude oil prices have resulted in a major shift toward the utilization of vegetable oils such as palm and palm kernel oil as a key feedstock for oleochemical production. The global oleochemicals market has an advantageous edge owing to the constantly increasing raw material availability, minor toxicity, and green image of the products.

Detailed Segmenattion:

Product Insights

Glycerol esters dominated the market and accounted for a share of approximately 35.55% in 2023. Glycerol esters, also known as acylglycerols or glycerides, are formed by a reaction between glycerol and fatty acids. Food-grade glycerol is significantly used in the production of ice creams, chewing gums, flavored beverages, and cosmetics. Glycerol has three hydroxyl groups, which can be esterified with one, two, or three fatty acids to form monoglycerides, diglycerides, and triglycerides. These are further used to produce glycerol monostearate (GMS), medium chain triglycerides (MCT), oleates, glycerol di-stearate, and other glycerides.

Application Insights

Personal care & cosmetics application dominated the market and accounted for a share of approximately 22.29% in 2023. In the personal care & cosmetics segment, specialty oleochemical derivatives/formulations find application in creams, skincare, sun care, hair care, and oral care products. The growing demand for organic and anti-aging products to maintain a youthful appearance is driving the demand for personal care products, which, in turn, is expected to trigger the demand for oleochemical derivatives in the personal care & cosmetics application segment. Over the past decade, this industry has shown continuous growth coupled with increasing shelf space in supermarkets, hypermarkets, retail stores, and boutique stores across the world.

Regional Insights

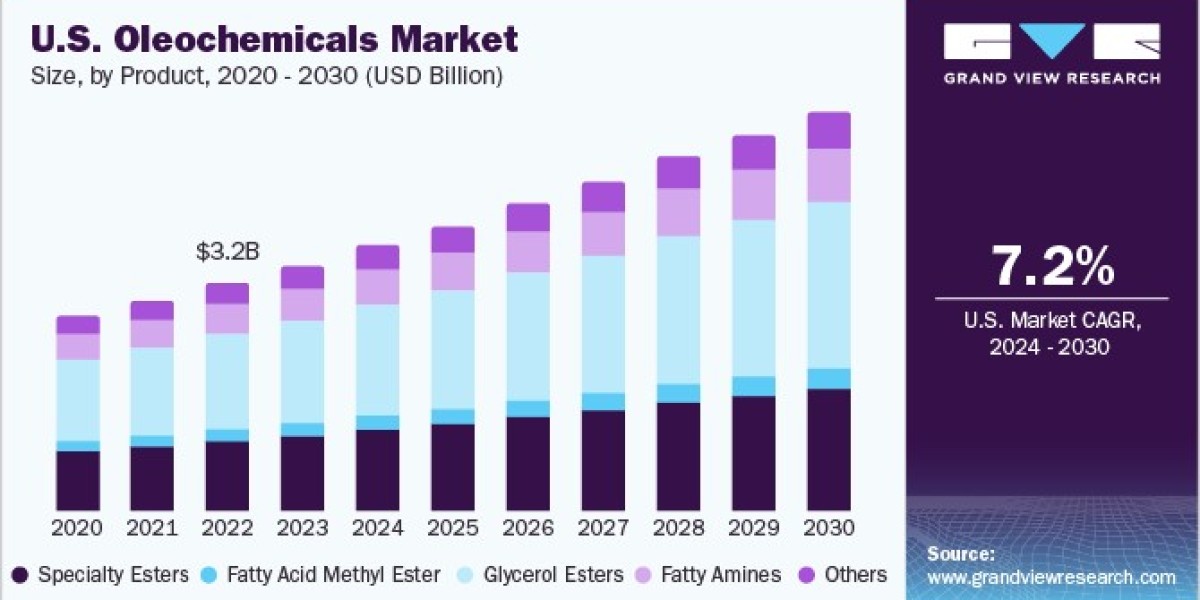

North America oleochemicals marketis driven by stringent government regulations regarding the usage of petroleum-based products owing to their harmful environmental effects. This has fostered the demand for Oleochemicals in the North American region. Rising demand from several end use industries including personal care & cosmetics, healthcare, food processing is expected to augment the product consumption.

Browse through Grand View Research's Renewable Chemicals Industry Research Reports.

• The global oleyl alcohol market size was estimated at USD 1.02 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. The demand is anticipated to be driven by its eco-friendliness, purity, and high effectiveness in terms of performance and quality.

• The global biosurfactants market size was valued at USD 3.13 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. Growing consumer awareness, preference for sustainable and natural products, and increasing demand for cleaning and hygiene products are factors driving the biosurfactants market.

Key Oleochemicals Company Insights

• Vantage Specialty Chemicals, Inc. is a specialty chemicals company that manufactures and distributes specialty derivatives, fatty acids, naturally derived specialty chemicals, and intermediates. The company is a vertically integrated provider and caters to four diverse markets, including personal care and beauty, food, life science and consumer care, and industrial specialties.

• Evonik Industries AG is a key player in the oleochemical sector, and it manufactures and distributes specialty chemicals globally. The company operates through five business units, which include Specialty Additives, Nutrition & Care, Smart Materials, Performance Materials, And Technology & Infrastructure.

• JNJ Oleochemicals, Incorporated. is engaged in the manufacturing and distribution of biodiesel and oleo chemical products worldwide. The products are mainly derived from coconut oil. The company’s product portfolio includes methyl ester derivatives and glycerin, and it is vertically integrated along its value chain. The company has its manufacturing plant in Lucena City, Philippines.

• Stepan Company manufactures and distributes intermediate chemicals including specialty products, surfactants, germicidal & fabric softening quaternaries, phthalic anhydride (P.A.), polyurethane polyols, and special ingredients for supplements, food, and pharmaceutical industries. The company provides a wide range of oleo chemical-based surfactants for the formulation of both home and industrial laundry detergents. It has 18 manufacturing units located in 11 countries in North America, South America, Europe, and Asia.

Key Companies profiled:

• Vantage Specialty Chemicals, Inc.

• Emery Oleochemicals

• Evonik Industries AG

• Wilmar International Ltd.

• Kao Chemicals Global

• Ecogreen Oleochemicals

• Corbion N.V

• Cargill, Incorporated

• Oleon NV

• Godrej Industries

• IOI Corporation Berhad

• KLK OLEO

• Evyap

• JNJ Oleochemicals, Incorporated

• Sakamoto Yakuhin Kogyo Co., Ltd.

• Stepan Company

• Pepmaco Manufacturing Corporation

• Philippine International Dev.

Oleochemicals Market Segmentation

Grand View Research has segmented the global oleochemicals market based on product, application, and region:

Oleochemicals Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Specialty Esters

• Fatty Acid Methyl Ester

• Glycerol Esters

• Alkoxylates

• Fatty Amines

• Other Products

Oleochemicals Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Personal Care & Cosmetics

• Consumer Goods

• Food Processing

• Textiles

• Paints & Inks

• Industrial

• Healthcare & Pharmaceuticals

• Polymer & Plastic Additives

• Other Applications

Oleochemicals Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Italy

o Spain

o The Netherlands

o Russia

o Switzerland

o Poland

o Sweden

o Belgium

• Asia Pacific

o China

o India

o Japan

o South Korea

o Malaysia

o Singapore

o Indonesia

o Taiwan

o Australia

o Thailand

• Central & South America

o Brazil

o Argentina

• Middle East and Africa

o Saudi Arabia

o South Africa

o UAE

Order a free sample PDF of the Oleochemicals Market Intelligence Study, published by Grand View Research.

Recent Developments

• In May 2024, Corbion signed a partnership agreement with IMCD, a key distribution partner and formulating company of specialty chemicals and ingredients, to include hereby Corbion’s various products for the food & beverage sector in Thailand.

• In April 2024, Vantage Specialty Chemicals expands METAUPON* NMT (N-Methyl Taurine) capacity at its Leuna site. This expansion aims to meet consumer demand in the personal care, industrial, and household sectors.

• In January 2024, Godrej Industries signed an MoU with the Gujarat government to invest USD 71.8 million over the coming four years to increase the production capacity of oleochemicals. This expansion is to cater the surging product demand in the personal care, pharmaceuticals, and food industries