The global smart lighting market size was valued at USD 15.05 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 22.1% from 2023 to 2030. The ability of lights to connect with IoT devices and create a variety of ambient lighting using just smartphones or tablets has increased its popularity and demand across commercial and residential spaces. Smart lights are dimmable with various color tones as per requirement, can be scheduled to turn on/off, monitor lighting’s energy usage, and be connected via Wi-Fi, Bluetooth, SmartThings, Z-Wave, or ZigBee. Additionally, smart lights can be voice-controlled by integration with the platform, such as Google Assistant, Amazon’s Alexa, Apple’s Siri, or Microsoft’s Cortana. These wide ranges of features apart from illumination coupled with the growing adoption of IoT devices and smart assistant platforms have created market growth avenues for smart lighting.

Smart lighting is also termed connected lighting as it can be seamlessly integrated into the IT network in a building or city infrastructure to share information regarding the status of the operation. For instance, smart street lights in city parking or roads ensure safety by offering wide coverage, environmental monitoring, parking and traffic management information, and city surveillance by connecting with IoT devices. Smart lights are often integrated with sensors, which turn them into a point of intelligence device to gather information on activity patterns, daylight levels, occupancy, changes in temperature, or humidity. This information proves to be vital for government departments to take appropriate actions and monitor the city for unwarranted activity.

Gather more insights about the market drivers, restrains and growth of the Smart Lighting Market

Detailed Segmenation:

Component Insights

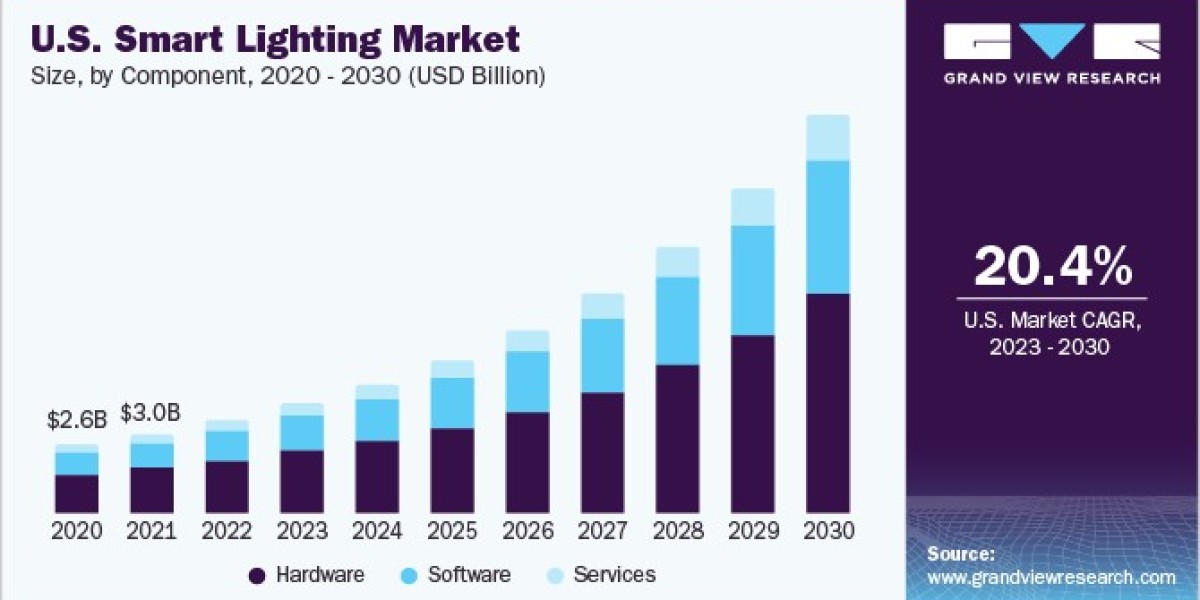

The smart lighting market is segmented into three components, namely hardware, software, and services. The hardware segment led the market with a revenue share of 56.9% in 2020. Smart lighting hardware has been further categorized into lamps and luminaires, wherein the lamp segment is exhibiting high growth potential during the period 2023 to 2030. The hardware segment demand is attributed to the popularity of connected lighting bulbs and fixtures that can change hues, dim lights, and switch on/off using a controlling device such as a smartphone or tablet.

Connectivity Insights

The wired segment accounted for the largest revenue share of 64.2% in 2022 and is expected to grow at the fastest CAGR of 21.8% during the forecast period. The wired connections are required for the range above 30 feet. Ethernet as an exception can facilitate wired connection within 100 meters, while DALI, DSI, and DLVP provide connectivity above the range of 1000 feet. The increasing adoption of smart lighting in commercial and industrial spaces is driving the demand for wired connectivity in the smart lighting space.

Application Insights

The indoor segment accounted for the largest revenue share of 65.5% in 2022. The indoor application is further sub-segmented into residential, commercial, and industrial. The residential segment is expected to attain a high growth rate over the forecast period due to the rising popularity of smart lighting bulbs and fixtures that can be controlled by the user for setting different lighting moods. Additionally, demand within commercial and industrial space is propelled by the need to control lighting consumption as the office spaces or warehouses are functional 24x7 and need regular power supply throughout the day and night. Installing smart lighting with inbuilt sensors ensures lights are used only in the required area based on the movement of people, which is captured by the sensors. Also, the light setting can automatically dim based on outside lighting inside the premises.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 37.0% in 2022. Europe is leading the way in drafting safety and uniform performance standards for certain indoor commercial smart lighting for garages, roadways, and parking. Dedicated LED luminaires and LED replacement smart lamps are emerging as the key growth areas in the lighting industry in line with the continued advancements in LED designs and technology. While incumbent smart lighting manufacturers continuously update their product offerings, existing manufacturers are expanding their product portfolio to foray into the market. A looming surplus of dedicated smart luminaires vendors can be particularly noted for applications, such as downlighting, task lighting, landscape lighting, general ambient illumination, and outdoor general area lighting.

Browse through Grand View Research's Semiconductors Industry Research Reports.

• The global next generation non-volatile memory market size was valued at USD 6.15 billion in 2023 and is projected to grow at a CAGR of 17.8% from 2024 to 2030. Next-generation non-volatile memory (NVM) technologies are emerging storage solutions that enable high-speed data access and maintain data integrity during power loss.

• The global embedded non-volatile memory market size was valued at USD 3.88 billion in 2023 and is projected to grow at a CAGR of 11.5% from 2024 to 2030. The increasing use of embedded non-volatile memory (eNVM) in consumer electronics, such as smartphones, wearables, and IoT devices, drives the market growth.

Key Companies profiled:

• Acuity Brands Lighting, Inc.

• Signify Holding

• Honeywell International Inc.

• Itron Inc.

• IDEAL INDUSTRIES, INC.

• Häfele America Co.

• Wipro Lighting

• YEELIGHT.

• Sengled Optoelectronics Co., Ltd.

• Verizon

• Schneider Electric

Smart Lighting Market Segmentation

Grand View Research has segmented the global smart lighting market based on component, connectivity, application, region:

Smart Lighting Component Outlook (Revenue, USD Million, 2018 - 2030)

• Hardware

o Lamp

o Luminaire

• Software

• Services

Smart Lighting Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

• Wired

• Wireless

Smart Lighting Application Outlook (Revenue, USD Million, 2018 - 2030)

• Indoor

o Residential

o Commercial

• Outdoor

o Highways and Roadways

o Architectural

o Others

Smart Lighting Regional Outlook (Revenue in USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

• Asia Pacific

o China

o Japan

o India

o Australia

o South Korea

• Latin America

o Brazil

o Mexico

• Middle East and Africa

o Saudi Arabia

o South Africa

o UAE

Order a free sample PDF of the Smart Lighting Market Intelligence Study, published by Grand View Research.

Recent Developments

• In March 2023, Itron, Inc. signed a contract with Duquesne Light Company (DLC) to improve operational efficiency, update infrastructure, and enable smart city applications. Itron plans to supply DLC with its smart street lighting solution, which includes LED lights, sensors, and software for dimming, collecting data, and controlling traffic. The solution is expected to assist DLC in conserving energy, improving safety, and better understanding how its consumers use its services.

• In January 2023, YEELIGHT, a smart lighting manufacturer unveiled a new range of products including the Cube Smart Lamp, an Automatic Curtain Opener, and a Smart Scene Panel. These products work with the new smart home standard, Matter, which is expected to be released later this year.

• In October 2022,IDEAL INDUSTRIES, INC. announced the sale of Casella, its occupational and environmental monitoring equipment business, to TSI Instruments Ltd., a subsidiary of TSI Incorporated. This strategic divestiture allows IDEAL to focus on its core business and growth ambitions in the professional electrician products, high power density connections, and superior charging solutions markets.

• In September 2022, Alcorcón, a city in Spain, launched a smart city pilot project with Itron's intelligent street lighting solution. The project includes upgrading existing streetlights to LEDs and adding Networked Lighting Controllers (NLCs) from Itron. The NLCs provide the ability to dim and control lights, as well as collect health status data and provide advanced configuration options.

• In August 2022, Häfele America Co. launched the Loox Illuminated Wireless Adjustable Shelf System, a new LED lighting innovation. This system is meant for frameless cabinets such as closets, entertainment centers, kitchens, and pantries. It comes with wireless controllers, adjustable shelves, and a variety of lighting options to suit the user’s needs.

• In July 2022, Signify Holdings. introduced a new line of smart WiZ lighting solutions designed to improve daily comfort and convenience. The new collection adds to the existing line-up with table and floor lamps, a portable light switch, and new ceiling lights and lamps.