The global biochar market size was estimated at USD 541.8 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2024 to 2030. Increasing product consumption in producing organic food and its ability to enhance soil fertility & plant growth are expected to be key factors driving market growth. The European Biochar Certificate has passed regulations on its direct utilization in soil across several European countries including Austria and Switzerland. Biochar is a charcoal derived by controlled heating of waste materials, such as agricultural waste, wood waste, forest waste, and animal manure. Among all end-uses, it is widely used in a soil amendment to reduce pollutants and toxic elements and to prevent reducing moisture level, soil leaching, and fertilizer runoff.

Environmental awareness, cheaper cost of raw materials, and cohesive government policies for waste management are key factors anticipated to create greater avenues for market expansion. The industry comprises the organized and unorganized sectors owing to a strong presence of a few large-scale manufacturers and a growing number of small- and medium-scale manufacturers, especially in North America and Europe. Counties in Asia Pacific and Middle East are expected to grow at a sluggish rate with a lack of product awareness and its long-term advantages. Manufacturing of high-quality biochar requires heavy capital investment. As a result, several companies have exited the market place in the past few years.

Gather more insights about the market drivers, restrains and growth of the Biochar Market

Detailed Segmenatation

Technology Insights

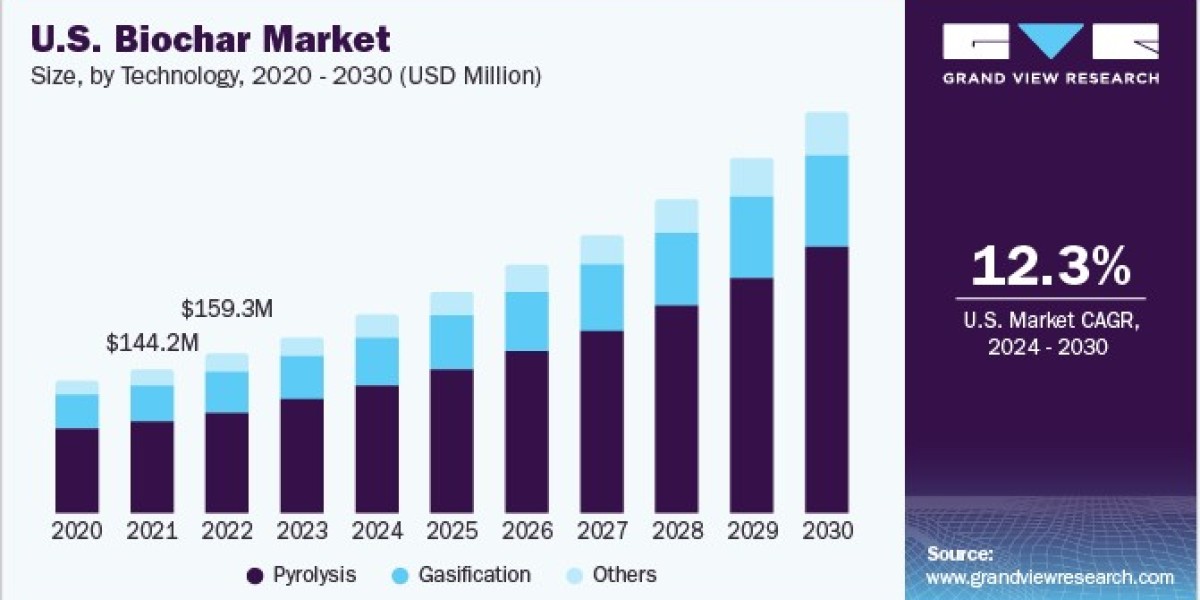

On the basis of technology, the market has been further categorized into pyrolysis, gasification, and others. Pyrolysis was the dominating technology segment in 2023 and accounted for the highest revenue share of over 65.1% owing to high end-product yield of high carbon content and stability of a process. The growing need for electricity generation has displayed a moderate rise in the use of gasification technology.

Application Insights

Agriculture was the dominating application segment in 2023 accounting for a revenue share of over 77.0%. Biochar helps enhance water and fertilizer holding capacity and improve soil’s biological productivity, which helps in providing crop nutrition and accelerating growth. However, a large number of farmers still lack knowledge about the product and its benefits. In agricultural applications, general farming is a major segment that is expected to rise substantially and augment the demand of the overall market owing to increasing efforts by research groups & institutes to spread awareness among farmers. Livestock farming contributes to a large proportion of the overall consumption in agricultural applications.

Regional Insights

North America dominated the market and held a revenue share of over 58.5% in 2023 owing to the increasing demand for organic food and high consumption of meat. Moreover, increasing awareness about the product and its benefits, especially among the farming community, support region’s growth. Low feed costs for livestock are also expected to boost product consumption in this sector. The U.S. has been generating the highest revenue in the world as a result of high awareness about the product in the country. Numerous small- and large-scale manufacturers have contributed to the growth of this sector. Despite several companies exiting from the industry, owing to lack of capital and expected growth, the overall growth prospects will be highly positive in the coming years.

Browse through Grand View Research's Agrochemicals & Fertilizers Industry Research Reports.

• The global agricultural biologicals market size was estimated at USD 9.9 billion in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030.

• The global biostimulants market size was valued at USD 2.6 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030.

Key Biochar Company Insights

• In July 2023, a consortium of Canadian and French companies, including Airex Energy, Groupe Rémabec, and SUEZ, invested C$80 million to construct North America’s largest biochar production facility.

• In July 2023, Eco Allies, a Stereovision subsidiary, announced that Eco Allies, Inc. and Biochar Now, LLC have expanded their J/V's terms. A second plant in Mexico is added, and an increase in the number of kilns for each plant to be built goes from 120 to 180, or 360 kilns in total.

Key Companies profiled:

• Biochar Products, Inc.

• Biochar Supreme, LLC

• ArSta Eco

• Carbon Gold Ltd

• Airex Energy Inc.

• Pacific Biochar Benefit Corporation

Biochar Market Segmentation

Grand View Research has segmented the global biochar market based on technology, application, and region:

Biochar Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Pyrolysis

• Gasification

• Others

Biochar Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Agriculture

• Animal Farming

• Industrial Uses

• Other Applications

Biochar Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Sweden

o Denmark

• Asia Pacific

o China

o India

o Japan

o Australia

o Malaysia

• Central & South America

• Middle East & Africa

Order a free sample PDF of the Biochar Market Intelligence Study, published by Grand View Research.