The telecommunications industry in Nigeria has experienced remarkable growth over the past two decades, becoming one of the largest and most dynamic sectors in the country’s economy. As of 2024, Nigeria is Africa’s largest telecom market, driven by increasing mobile penetration, data consumption, and investments in network infrastructure. In this article, we explore the growth of the Nigeria telecom services market, the key drivers behind this expansion, and the opportunities available for businesses and investors.

Market Overview

Nigeria’s telecom industry is dominated by mobile operators, with the country’s fixed-line market remaining relatively underdeveloped. As of the latest data, Nigeria has over 220 million mobile subscriptions, translating into a tele-density of more than 115%. This growth has been primarily fueled by an increasing population, urbanization, and widespread use of affordable mobile phones.

Top Telecom Operators in Nigeria:

- MTN Nigeria – The largest operator with over 80 million subscribers.

- Airtel Nigeria – A major competitor with a strong market share.

- Globacom (Glo) – A homegrown brand that has maintained a solid position.

- 9mobile – A relatively smaller but significant player in the Nigerian market.

These operators provide a variety of services, including mobile voice, data, and digital financial services.

Key Drivers of Growth

Rising Data Consumption

Nigeria has witnessed a shift from voice services to data-centric services, largely driven by increasing smartphone penetration and the demand for internet access. As of 2024, the country’s internet penetration rate stands at over 70%, with more than 150 million internet users. The rise of social media platforms, streaming services, and online businesses has significantly boosted data usage, making it a crucial growth driver for telecom operators.Infrastructure Investments

Telecom operators in Nigeria are investing heavily in infrastructure to improve network coverage and quality. The rollout of 4G LTE services is expanding rapidly, while preparations for 5G deployment are also underway. This infrastructure investment is aimed at enhancing broadband access, which is essential for economic growth and the digital transformation of Nigeria’s economy.Regulatory Support

The Nigerian Communications Commission (NCC) has played a pivotal role in fostering a competitive and enabling environment for telecom operators. Through its regulatory framework, the NCC has promoted fair competition, improved service quality, and encouraged innovation in the telecom sector. In addition, government initiatives aimed at expanding digital inclusion have helped increase access to telecom services in rural and underserved areas.Growing Population and Urbanization

Nigeria is home to over 220 million people, making it the most populous country in Africa. With an annual population growth rate of 2.6%, the demand for telecom services is expected to continue rising. Urbanization is also playing a significant role, as more people move to cities where access to telecom infrastructure is better developed.

Opportunities in the Nigerian Telecom Market

Expansion of Digital Financial Services

Telecom operators are increasingly offering mobile money and digital financial services as part of their portfolio. With a large unbanked population, estimated at over 40 million people, Nigeria presents a massive opportunity for growth in mobile financial services. Operators like MTN and Airtel have already launched mobile money platforms, offering secure and convenient banking services to millions of Nigerians.5G Technology Adoption

Nigeria is on the verge of adopting 5G technology, which promises faster internet speeds, lower latency, and improved network reliability. The rollout of 5G will revolutionize industries such as healthcare, education, and agriculture, offering new revenue streams for telecom operators and opportunities for tech-savvy entrepreneurs and businesses to innovate.Internet of Things (IoT)

As Nigeria's telecom infrastructure improves, the adoption of IoT solutions is expected to increase. The IoT ecosystem offers opportunities in sectors such as agriculture, smart cities, transportation, and energy management, all of which require robust telecom networks for effective data collection and transmission.Broadband Expansion in Rural Areas

While urban areas enjoy relatively good telecom coverage, rural areas are still underserved. Expanding telecom services to these regions represents a significant growth opportunity. Government initiatives like the National Broadband Plan aim to improve broadband penetration to 90% by 2025, which will create new business opportunities in these rural communities.

Challenges Facing the Nigeria Telecom Market

Infrastructure Deficiencies

Despite substantial investments, there are still gaps in network infrastructure, particularly in rural areas. Power supply challenges, vandalism of telecom equipment, and high operational costs continue to impede the expansion of services.High Competition and Price Wars

The competitive landscape in Nigeria’s telecom market is intense. Operators often engage in price wars, which can lead to reduced profit margins. Maintaining profitability while expanding services and improving network quality remains a significant challenge.Regulatory Hurdles

While the regulatory environment is generally supportive, telecom operators sometimes face challenges related to multiple taxation, right-of-way issues, and the slow issuance of permits for infrastructure development. Addressing these regulatory bottlenecks will be crucial for sustained growth.

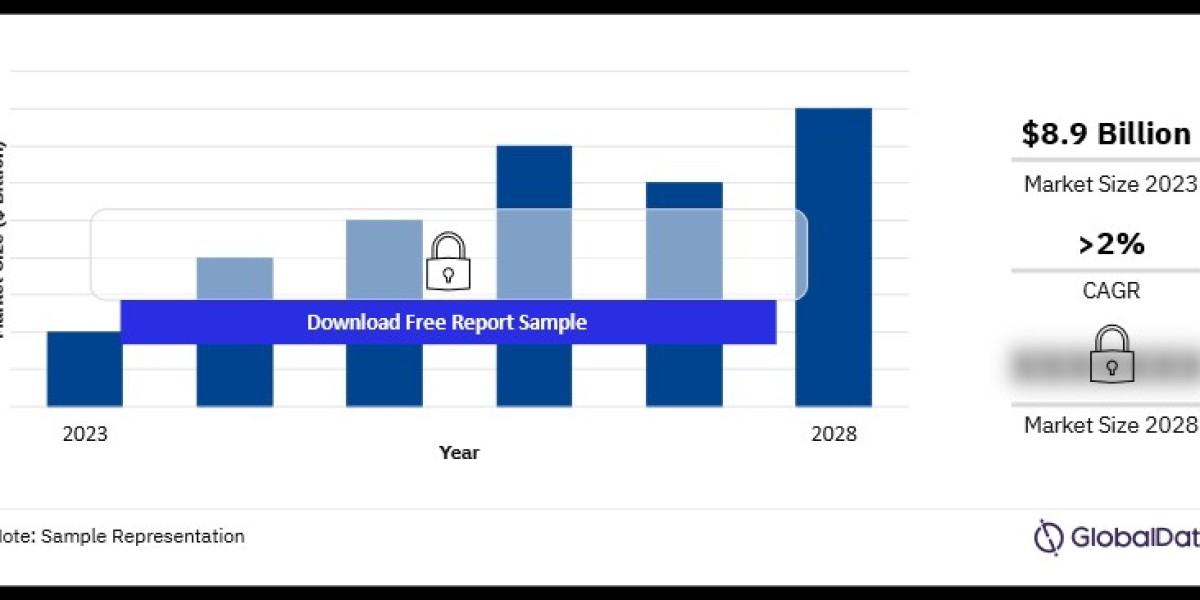

Buy the Full Report to Gain More Information on the Nigeria Telecom Services Market Forecast