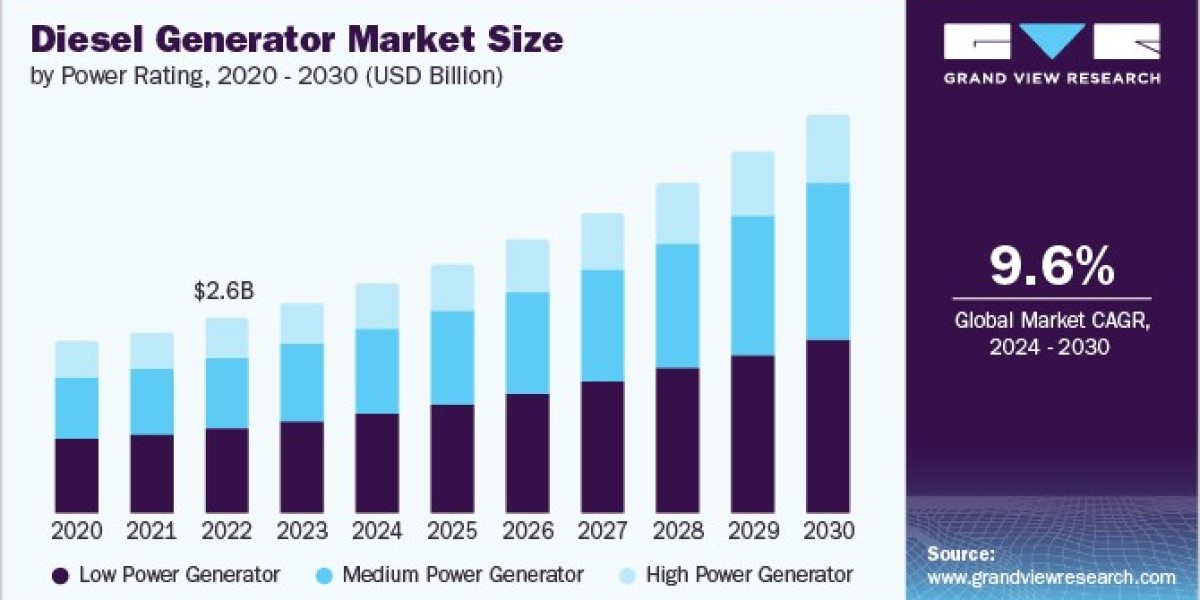

The global diesel generator market size was estimated at USD 16.36 billion in 2023 and is expected to grow at a CAGR of 9.6% from 2024 to 2030. Increasing energy demand globally far outstrips the supply. Factors, such as continuous population growth, infrastructure development, and rapid industrialization in emerging economies drive power demand. Diesel generators are favoured for their numerous benefits, including low operating costs and superior fuel efficiency, making them particularly popular in developing areas, notably the Asia Pacific region. Despite these advantages, they also have several disadvantages, such as noise pollution and the emission of harmful gases. The World Nuclear Association has predicted that the electricity demand is likely to double from current levels. In addition, the U.S. Department of Energy forecasts that solar energy will become the most plentiful energy source available.

Significant growth in the economies of major developing nations, such as India and Brazil, is expected by 2050. India is expected to grow from being the third largest to the second largest economy in the world, only after China in terms of GDP at PPP (purchase power parity). Countries, such as Brazil, India, and South Africa, are already suffering due to a low power supply. Emerging economies are expected to account for 65% of the global economy. The U.S. market is anticipated to witness substantial growth owing to rising costs of power outages across several IT-enabled service firms and data centers and growing consumer awareness of the need for a reliable emergency power supply. In addition, the market is also driven by the rising vulnerability of grid power stations to disasters caused by changing weather conditions across the region.

Gather more insights about the market drivers, restrains and growth of the Diesel Generator Market

Detailed Segmentation:

Power Rating Insights

The power generator segment accounted for a significant market revenue share of 44.0% in 2023, owing to a broad application base in the commercial and residential sectors. Generators with a capacity below 80 kW are used as power backup solutions in residential homes to power devices such as water pumps, water purifiers, AC units, geysers, and others. Furthermore, the low cost of these generators is expected to play a crucial role in boosting product demand over the forecast years.

Application Insights

The commercial application segment occupied the largest revenue share in 2023 and is projected to grow substantially over the forecast period. The high growth rate can be attributed to the broad application scope, including several industries, such as data centers, government centers, educational institutions, healthcare, hospitality, telecom, and agriculture. Diesel generators are used as backups across commercial establishments in case of sudden power interruptions, such as electrical outages and voltage fluctuations, which add to financial losses if not tackled.

Regional Insights

The diesel generator market in North America accounted for a share of 20.2% in 2023. The presence of prominent diesel generator OEMs and the growing demand for backup power are the primary factors driving the regional market growth.

Key Diesel Generator Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

• In May 2023, Cummins, a power generation equipment and engine manufacturer, launched a novel diesel generator set powered by their B45 engine, a 4.5-liter, four-cylinder diesel engine designed for power generation applications. This new generator set is expected to provide reliable power for a variety of industries, including construction, rental, and prime power

• In August 2022, Caterpillar launched three standby diesel generators ranging from 20 to 30 kilowatts (KW) for the North American market. These diesel generator sets, powered by the Cat C2.2 engine, are designed for small industrial, telecommunications, and commercial applications. They meet U.S. EPA emergency emission standards and industry safety certifications and offer features like exceptional performance, compact size, readily available parts, and optional enclosures

Key Companies profiled:

• AKSA Power Generation Company

• Atlas Copco AB

• Caterpillar

• Cummins Inc.

• Doosan Portable Power

• Generac Power System Inc.

• Honda India Power Products Ltd.

• Kohler Co.

• Rolls-Royce Plc

• Wartsila Corporation

Browse through Grand View Research's Category Power Generation & Storage Industry Research Reports.

• The global offshore pipeline market size was estimated at USD 13.97 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. The rising global demand for energy, particularly oil and natural gas, is poised to highlight the necessity for offshore pipelines, as they are vital in transporting such resources from offshore fields to onshore processing facilities, ensuring a stable supply of energy.

• The global battery recycling market size was estimated at USD 1.83 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 37.6% from 2024 to 2030. The industry is expected to grow rapidly during the forecast period owing to increasing popularity of electric vehicles (EVs) and renewable energy storage systems leading to a higher demand for batteries, and, in turn, driving the need for recycling.

Diesel Generator Market Segmentation

Grand View Research has segmented the global diesel generator market based on power rating, application, region:

Diesel Generator Power Rating Outlook (Revenue, USD Million, 2018 - 2030)

• Low Power Generator

• Medium Power Generator

• High Power Generator

Diesel Generator Application Outlook (Revenue, USD Million, 2018 - 2030)

• Industrial

• Commercial

• Residential

Diesel Generator Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o Russia

o France

• Asia Pacific

o China

o Japan

o India

o South Korea

• Central & South America

o Brazil

o Argentina

• Middle East & Africa

o Saudi Arabia

o UAE

Order a free sample PDF of the Diesel Generator Market Intelligence Study, published by Grand View Research.