Introduction

The Egyptian general insurance market has been experiencing significant transformation over the past decade. As one of the most populous countries in Africa and the Middle East, Egypt presents a diverse and growing landscape for the insurance industry. Factors such as economic reform, increasing awareness of insurance products, and regulatory changes have contributed to the market's development. This article provides an in-depth analysis of the current state of the Egyptian general insurance market, exploring key trends, challenges, opportunities, and future outlook.

Overview of the Egyptian General Insurance Market

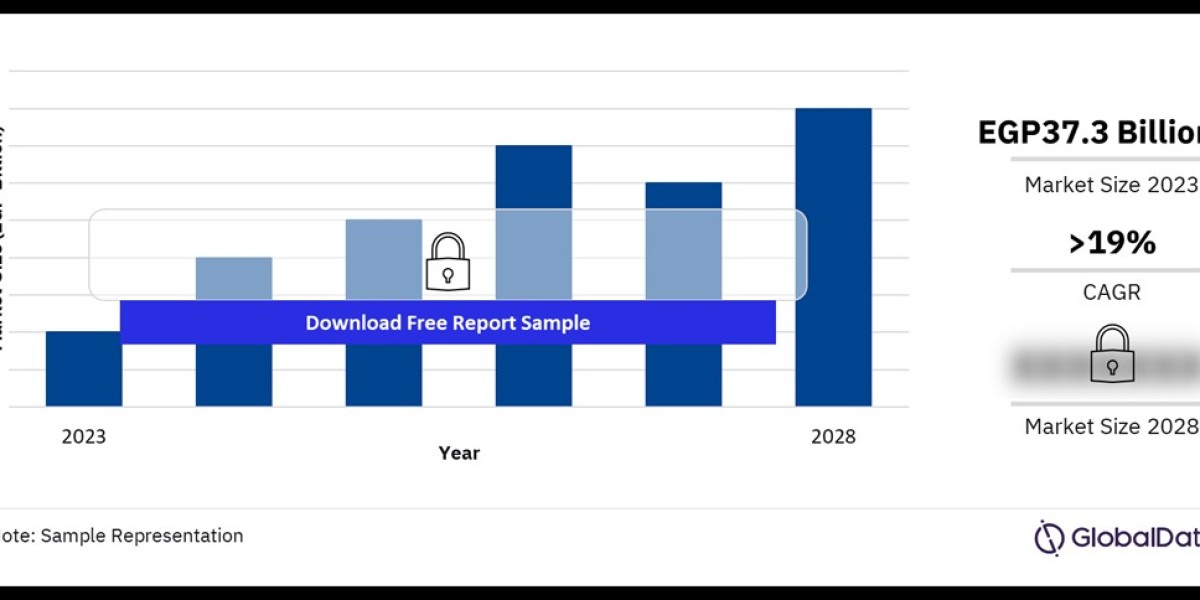

1. Market Size and Growth

The Egyptian general insurance market has seen steady growth, with total premiums reaching approximately EGP 50 billion (about $3 billion) in 2023. The market is projected to grow at a compound annual growth rate (CAGR) of around 10-12% over the next few years, driven by increasing consumer awareness, economic development, and a growing middle class.

2. Key Segments

The general insurance market in Egypt can be segmented into several key categories:

Property Insurance: This segment covers risks associated with physical assets, including buildings, machinery, and inventory. The growth of the real estate sector in Egypt has boosted demand for property insurance.

Motor Insurance: Motor insurance is one of the largest segments, driven by the increasing number of vehicles on the roads. The Egyptian government has implemented regulations mandating third-party liability insurance, further enhancing market growth.

Liability Insurance: Liability insurance covers businesses against claims for negligence or harm caused to third parties. As businesses expand and regulations become more stringent, the demand for liability insurance is on the rise.

Marine and Aviation Insurance: This segment is crucial for Egypt due to its strategic location and significant maritime and air traffic. The growth in trade and tourism has contributed to increased demand for marine and aviation insurance.

Health Insurance: Although primarily classified under life insurance, health insurance is a growing segment in the general insurance market, driven by rising healthcare costs and increasing awareness of health-related risks.

Key Trends in the Egyptian General Insurance Market

1. Digital Transformation

Digital transformation is reshaping the insurance landscape in Egypt. Insurers are increasingly adopting digital technologies to enhance customer engagement, streamline processes, and improve service delivery. The rise of InsurTech companies has introduced innovative solutions, such as online policy purchases, digital claims processing, and mobile applications for customer service.

2. Regulatory Reforms

The Egyptian insurance sector is undergoing significant regulatory reforms aimed at enhancing transparency, consumer protection, and market competitiveness. The Financial Regulatory Authority (FRA) has introduced new regulations that promote fair practices, improve governance, and ensure compliance with international standards. These reforms are expected to foster investor confidence and drive market growth.

3. Increasing Awareness and Education

There is a growing awareness of the importance of insurance among Egyptian consumers. Initiatives by insurers and regulatory bodies to educate the public about insurance products and their benefits have contributed to increased uptake. Campaigns highlighting the risks associated with not having insurance coverage are encouraging individuals and businesses to consider various insurance options.

4. Emphasis on Customer Experience

As competition intensifies, insurers are focusing on enhancing customer experience. Providing personalized services, quick claims processing, and excellent customer support are becoming essential for retaining customers. Insurers are leveraging data analytics to better understand customer preferences and tailor their offerings accordingly.

5. Microinsurance Growth

Microinsurance is gaining traction in Egypt, catering to low-income individuals and small businesses that may not afford traditional insurance products. These products offer affordable coverage for specific risks, making insurance more accessible to underserved populations. Insurers are exploring partnerships with microfinance institutions to reach these markets.

Challenges Facing the Egyptian General Insurance Market

1. Low Penetration Rates

Despite the growth in the general insurance market, penetration rates in Egypt remain low compared to global averages. Many individuals and businesses still lack insurance coverage due to factors such as limited awareness, cultural perceptions, and economic constraints. Addressing these barriers is essential for expanding the market.

2. Economic Volatility

Egypt's economy has faced challenges, including inflation and currency fluctuations, which can impact the disposable income of consumers and businesses. Economic volatility may lead to reduced spending on insurance products, affecting market growth.

3. Regulatory Compliance

While regulatory reforms are necessary for market development, navigating the complex regulatory landscape can be challenging for insurers. Compliance with new regulations requires significant investments in systems and processes, which may be a burden for smaller insurers.

4. Cybersecurity Risks

As the insurance sector becomes more digitalized, the risk of cyberattacks and data breaches increases. Insurers must invest in robust cybersecurity measures to protect sensitive customer data and maintain trust. A significant data breach could have severe reputational and financial consequences.

Opportunities in the Egyptian General Insurance Market

1. Rising Middle Class

The growing middle class in Egypt presents significant opportunities for the insurance market. As disposable incomes rise, more individuals are likely to seek insurance coverage for health, property, and personal assets. Insurers can capitalize on this trend by offering tailored products that meet the needs of this demographic.

2. Health Insurance Demand

The demand for health insurance is expected to grow as healthcare costs continue to rise and awareness of health-related risks increases. Insurers can develop comprehensive health insurance products that offer coverage for a wide range of medical services, including preventive care, hospitalization, and chronic disease management.

3. Technology Adoption

The adoption of advanced technologies, such as artificial intelligence, big data analytics, and blockchain, presents opportunities for insurers to enhance their operations. These technologies can improve risk assessment, streamline claims processing, and enhance customer engagement through personalized services.

4. Public-Private Partnerships

The Egyptian government is increasingly recognizing the importance of insurance in promoting economic stability and growth. Public-private partnerships can facilitate the development of innovative insurance products and services, particularly in areas such as agriculture, infrastructure, and social insurance.

Future Outlook

1. Sustained Growth

The Egyptian general insurance market is expected to continue its growth trajectory, driven by economic reforms, increasing awareness, and digital transformation. Insurers that embrace innovation and adapt to changing consumer preferences will be well-positioned for success.

2. Enhanced Regulation

Ongoing regulatory reforms will likely focus on enhancing consumer protection, promoting fair practices, and ensuring market stability. Insurers must remain proactive in adapting to these changes to maintain compliance and capitalize on new opportunities.

3. Increased Competition

As the market grows, competition among insurers is expected to intensify. Insurers will need to differentiate themselves through innovative products, superior customer service, and effective marketing strategies. Collaboration with InsurTech firms can also provide a competitive edge.

4. Focus on Sustainability

Sustainability will become increasingly important in the insurance sector. Insurers that prioritize sustainable practices, such as offering coverage for renewable energy projects or promoting eco-friendly initiatives, will appeal to environmentally conscious consumers.

Conclusion

The Egyptian general insurance market is poised for significant growth, driven by economic development, increasing awareness, and technological advancements. While challenges such as low penetration rates and economic volatility remain, opportunities abound for insurers to innovate and expand their offerings. By focusing on customer experience, embracing digital transformation, and adapting to regulatory changes, insurers can thrive in this dynamic market. The future of the Egyptian general insurance market promises to be exciting, with ongoing developments set to reshape the industry for years to come.