The global interactive display market size is expected to reach USD 75.06 billion by 2030, according to a recent analysis from Grand View Research, Inc. Furthermore, the industry is expected to expand at a CAGR of 7.8% over the forecast period. The interactive or touchscreen display is a display unit that accepts user commands with the help of a finger or stylus in place of peripheral devices, such as a mouse or keyboard. Additionally, these display includes screens that project information, such as texts, images, and videos. These display screens are used in various industries, such as retail, healthcare, hospitality, and education. Rapidly increasing adoption of touchscreen tables as well as video walls in the hospitality and corporate sectors is expected to drive the market during the forecast period. The touchscreen table acts as a menu board to indicate the waiting time of the orders taken from the customer, along with prices and ingredients. Furthermore, the use of touchscreen tables in corporate meetings has been observed to provide a better experience for the clients as well as employees. The use of such technology in offices allows better engagement between employees, management, and clients.

The banking, financial services, and insurance (BFSI) industry has seen rapid growth in the adoption of interactive displays in recent years. Interactive displays are becoming more popular in the BFSI industry due to their ability to improve customer engagement, enhance the customer experience, and increase the efficiency of business operations. One of the main reasons for the growth of interactive displays in BFSI is the increasing demand for digital transformation. With the rise of digital banking and online transactions, customers are looking for more convenient and user-friendly ways to interact with their financial institutions. Interactive displays provide an intuitive and engaging interface for customers to navigate through banking services and products, making the customer experience more enjoyable and personalized.

The COVID-19 pandemic has had a significant impact on the interactive display industry, both in the short and long term. With the shift to remote work, remote learning, and virtual meetings, the demand for interactive displays has increased as they offer an immersive and engaging way to communicate and collaborate from a distance. In the short term, the pandemic caused significant disruptions in the supply chain, which in turn led to production delays and increased costs for interactive display manufacturers. With the global spread of the pandemic, many countries implemented lockdowns and restrictions on movement, which had a significant impact on global trade and transportation. This, coupled with the closure of factories and warehouses, led to supply chain disruptions, causing delays in the delivery of raw materials and components necessary for the production of interactive displays. As a result, manufacturers were forced to either delay production or source materials at a higher cost, which ultimately increased the cost of these displays for consumers.

Gather more insights about the market drivers, restrains and growth of the Interactive Display Market

Interactive Display Market Report Highlights

- The retail segment is anticipated to observe the fastest growth, growing at a CAGR of 9.1% throughout the forecast period. Demand for touch-enabled displays is anticipated to increase in the retail sector over the coming years owing to the growing trend of touch-based devices and increased usage of the interactive kiosk and tables. For instance, several big retail store chains, such as Walmart, have started to use kiosks to display products, along with their pricing and specifications, thereby easing the in-store experience of the customers

- In February 2023, SMART Technologies unveiled its latest interactive displays designed for educational purposes at the TCEA Convention & Exposition held in San Antonio, Texas in 2023. The newest release comprises the SMART Board GX (V2) series and the SMART Board MX (V4) series. With this launch, these new displays are part of the SMART Board 6000S as the first interactive displays that enable multiple users to write, erase, and gesture simultaneously, on any platform and application

- The video wall segment is anticipated to observe the fastest growth, growing at a CAGR of 11.2% throughout the forecast period. An interactive video wall typically refers to a large display, consisting of multiple screens or projectors tiled together to form a single large visual display. The display can be used to showcase various types of media, including videos, images, and animations

- Asia Pacific is expected to witness the fastest growth, growing at a CAGR of 10.2% throughout the forecast period. Interactive displays have seen tremendous growth in Asia Pacific in recent years, driven by increasing demand from various sectors such as education, corporate, and healthcare. The Asia Pacific region is home to some of the fastest-growing economies in the world, and the adoption of interactive displays is driven by factors such as technological advancements, increasing investments in education, and growing demand for interactive communication tools

Browse through Grand View Research's Display Technologies Industry Research Reports.

- The global outdoor LED display market sizewas valued at USD 7236.9 million in 2022 and is expanding at a compound annual growth rate (CAGR) of 15.9% from 2023 to 2030. The increasing demand for digital advertising and the rising popularity of large-scale events drive market growth.

- The global smart TV market size was valued at USD 197.82 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.4% from 2023 to 2030. The increased popularity of content on over-the-top (OTT) services has provided a boost to the smart TV market.

Interactive Display Market Segmentation

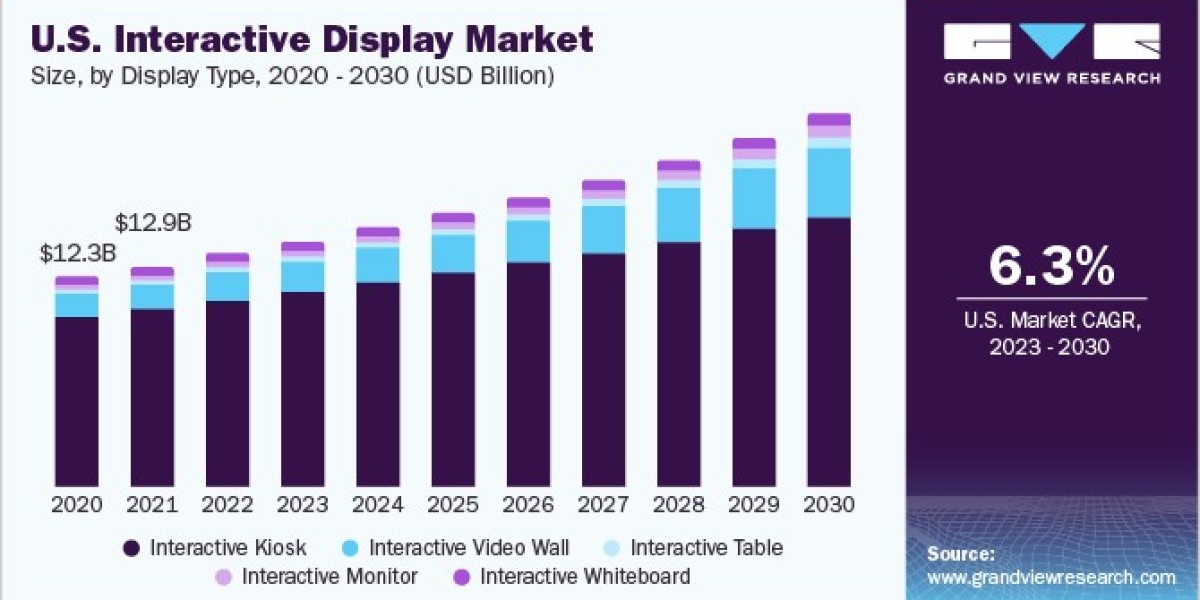

Grand View Research has segmented the global interactive display market on the basis of display type, application, and region.

Interactive Display Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Kiosk

- Video Wall

- Tables

- Monitor

- Whiteboard

Interactive Display Application Outlook (Revenue, USD Billion, 2017 - 2030)

- Retail

- Hospitality

- Healthcare

- Transportation

- BFSI

- Corporate

- Entertainment

- Education

- Others

Interactive Display Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- Latin America

- Brazil

- Mexico

- Middle East & Africa

Order a free sample PDF of the Interactive Display Market Intelligence Study, published by Grand View Research.