The life insurance market in South Korea is one of the most developed and competitive in Asia. With a strong economy, a well-established regulatory framework, and a high level of consumer awareness, the market has grown steadily over the years. This article delves into the key aspects of the South Korean life insurance market, including its history, current trends, and future prospects.

Historical Background

The life insurance market in South Korea has a rich history, dating back to the early 20th century. The first life insurance company was established in 1921, and since then, the industry has evolved significantly. The market witnessed rapid growth during the post-Korean War period, particularly in the 1970s and 1980s, as South Korea's economy expanded. The government played a crucial role in shaping the industry by implementing various regulatory measures and promoting life insurance as a means of social security.

Market Structure and Key Players

South Korea's life insurance market is characterized by a mix of domestic and foreign players. The domestic market is dominated by a few large insurers, such as Samsung Life Insurance, Hanwha Life Insurance, and Kyobo Life Insurance. These companies have a strong presence and account for a significant share of the market. In addition to these domestic giants, several foreign insurers, including Prudential Life Insurance and AIA Korea, have also established a foothold in the market.

The market is highly competitive, with insurers constantly innovating and offering a wide range of products to cater to the diverse needs of consumers. These products include traditional whole life policies, term life insurance, annuities, and more recently, unit-linked insurance plans that combine life coverage with investment opportunities.

Current Trends

Several trends are currently shaping the South Korean life insurance market:

- Aging Population: South Korea has one of the fastest-aging populations in the world. This demographic shift is driving demand for life insurance products, particularly those that offer retirement planning and long-term care benefits. Insurers are increasingly focusing on developing products that cater to the needs of the elderly, such as annuities and long-term care insurance.

- Digital Transformation: The digital revolution is transforming the life insurance industry in South Korea. Insurers are leveraging digital technologies to enhance customer experience, streamline operations, and introduce new products. Online sales channels, mobile apps, and digital platforms are becoming increasingly popular, allowing consumers to compare products, purchase policies, and manage their insurance portfolios with ease.

- Regulatory Changes: The South Korean government has been proactive in implementing regulatory reforms to ensure the stability and transparency of the life insurance market. Recent changes include the introduction of the Risk-Based Capital (RBC) framework, which requires insurers to maintain adequate capital reserves to cover potential risks. Additionally, the government is promoting the adoption of International Financial Reporting Standards (IFRS 17) to enhance financial reporting and disclosure practices.

- Focus on ESG: Environmental, Social, and Governance (ESG) factors are gaining importance in the South Korean life insurance market. Insurers are increasingly integrating ESG considerations into their investment strategies and product offerings. This shift is driven by growing awareness among consumers and regulators about the importance of sustainable and socially responsible practices.

Future Prospects

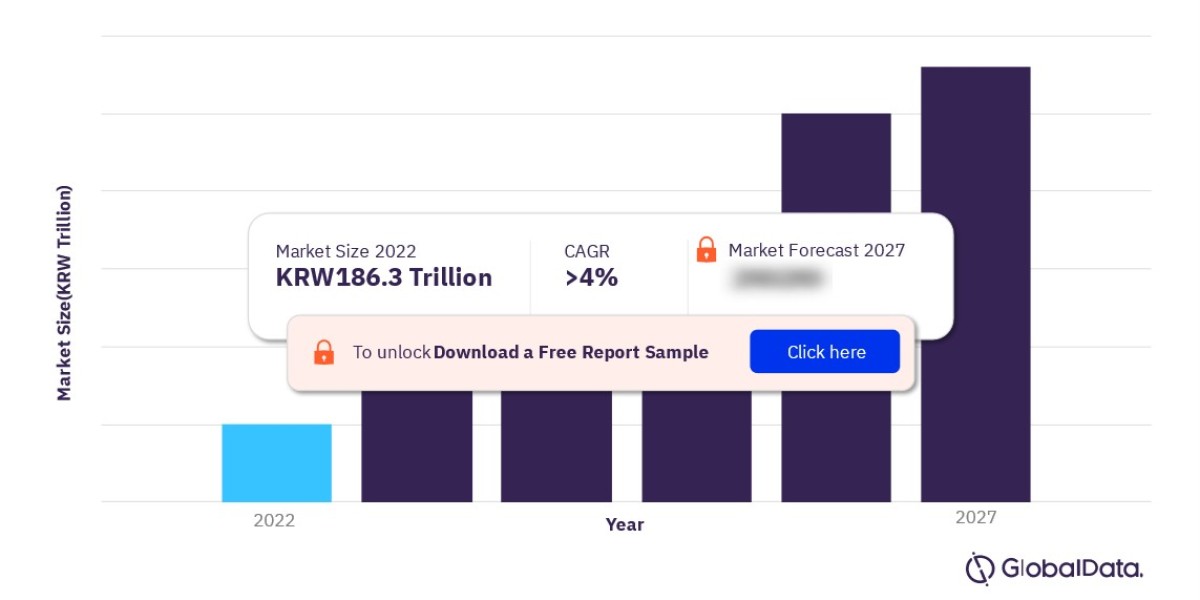

The future of the South Korean life insurance market looks promising, with several growth opportunities on the horizon. The aging population will continue to drive demand for retirement and long-term care products. Additionally, the ongoing digital transformation will open up new avenues for innovation and customer engagement.

However, the market also faces challenges, such as low-interest rates, which can impact the profitability of insurers. To mitigate this, companies may need to explore new investment opportunities and diversify their portfolios. Moreover, the competitive landscape will require insurers to differentiate themselves by offering personalized and value-added services to retain and attract customers.

To gain more information about the South Korea life insurance market forecast, download a free report sample