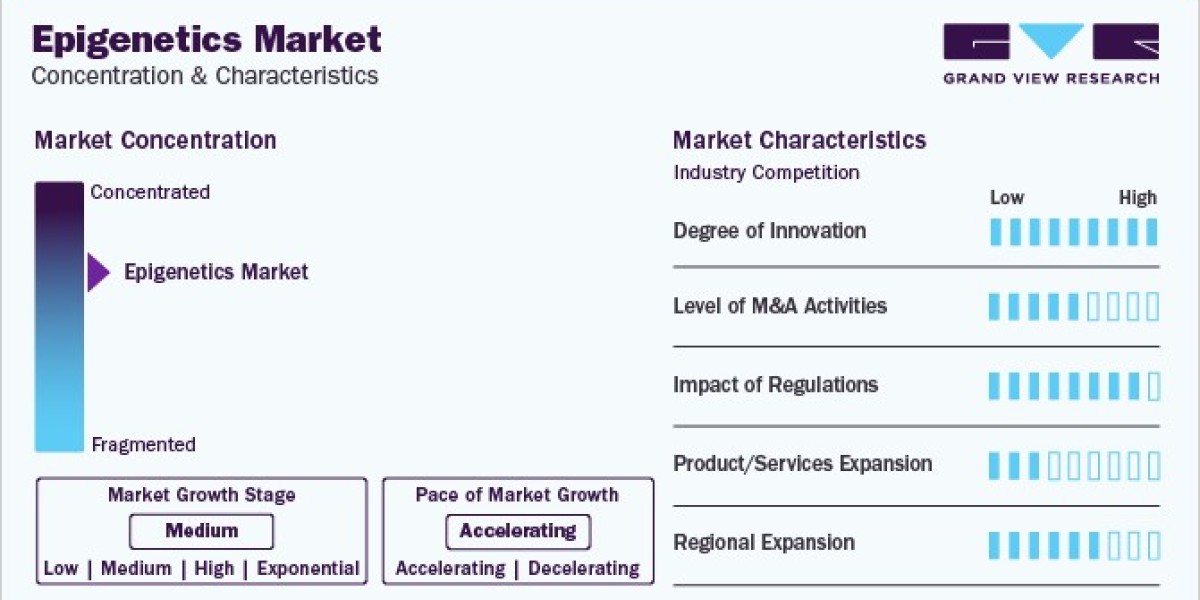

The global epigenetics market size was estimated at USD 14.63 billion in 2023 and is projected to grow at a CAGR of 15.3% from 2024 to 2030. This growth can be attributed to the pivotal role of epigenetics in understanding gene regulation beyond DNA sequencing, aiding disease research, and advancing personalized medicine. The established companies and startups operating in the industry are investing significantly to develop the epigenetics domain. For instance, in January 2024, Moonwalk Biosciences, a biotechnology startup, was launched after the completion of its seed and series A financing rounds with the funding of USD 57 million to advance its epigenetic profiling and engineering technology platform. Thus, the rising investments and funding in this field are anticipated to boost industry growth over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Epigenetics Market

The global rise in the prevalence of cancer is one of the major factors facilitating market growth in the recent past. For instance, according to PAHO, an estimated 20 million new cancer cases and 10 million cancer deaths were estimated in 2023, and the annual reported cases of cancer are expected to reach about 30 million by 2040. The need to develop diagnostic options that can detect cancer at an early stage, which can help improve disease management & reduce mortality, is anticipated to propel the overall market growth.

Several studies focusing on epigenetics drugs and therapeutics for treating various disorders like cancers and brain disorders are being published. For instance, the study published by the MDPI in April 2023 concluded that epigenetic drugs may help treat many disorders by inhibiting DNA methylation. Epigenetic drugs are used to inhibit various enzymes such as HDMs, HMTs, DNMTs, HATs, and HDACs in epigenetic disorders. They can effectively act with other therapies, such as immunotherapy or chemotherapy. In the future, epigenetic therapy can be considered the most efficacious method for treating cancer and brain disorders. Thus, with the rising prevalence of cancer coupled with the increasing focus of industry participants on epigenetics for treating cancer and other diseases, the market is anticipated to witness significant growth over the forecast period.

The COVID-19 pandemic has significantly impacted the epigenetics market, reflecting both opportunities and challenges. The increasing awareness of the complex interplay between SARS-CoV-2 and epigenetic regulation has underscored the potential of epigenetic therapies in combating the virus. Moreover, the absence of clinically accepted antiviral drugs has created an opportunity for market players to explore innovative approaches, such as combining antiviral drugs with DNMT/HDAC inhibitors and other epigenetic remedies. If successful in clinical trials, such novel strategies may alleviate drug resistance and enhance efficacy, presenting a positive outlook for market growth.

Browse through Grand View Research's Biotechnology Industry Research Reports.

• The global immunotoxins market was valued at USD 142.6 million in 2023 and is projected to grow at a CAGR of 8.08% from 2024 to 2030. The rising prevalence of chronic diseases such as cancer and technological advancements are the factors driving the market growth.

• The global tumor profiling market size was valued at USD 11.00 billion in 2023 and is projected to grow at a CAGR of 10.3% from 2024 to 2030. The rising number of cancer cases and precision oncology, tailoring therapies to a tumor's unique genetic makeup, relies heavily on tumor profiling.

Epigenetics Market Segmentation

Grand View Research has segmented the global epigenetics market on the basis of product, technology, application, end-use, and region:

Epigenetics Product Outlook (Revenue, USD Million, 2018 - 2030)

• Reagents

• Kits

o ChIP sequencing kit

o Whole Genomic Amplification kit

o Bisulfite Conversion kit

o RNA sequencing kit

o Others

• Instruments

• Enzymes

• Services

Epigenetics Technology Outlook (Revenue, USD Million, 2018 - 2030)

• DNA Methylation

• Histone Methylation

• Histone Acetylation

• Large non-coding RNA

• MicroRNA modification

• Chromatin structures

Epigenetics Application Outlook (Revenue, USD Million, 2018 - 2030)

• Oncology

o Solid tumors

o Liquid tumors

• Non-oncology oncology

o Inflammatory diseases

o Metabolic diseases

o Infectious diseases

o Cardiovascular diseases

o Others

Epigenetics End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Academic Research

• Clinical Research

• Hospitals & Clinics

• Pharmaceutical & Biotechnology Companies

• Other Users

Epigenetics Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o Germany

o UK

o France

o Italy

o Spain

o Denmark

o Sweden

o Norway

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

o Thailand

• Latin America

o Brazil

o Mexico

o Argentina

• MEA

o South Africa

o Saudi Arabia

o UAE

o Kuwait

Order a free sample PDF of the Epigenetics Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• Roche Diagnostics

• Thermo Fisher Scientific, Inc.

• Eisai Co. Ltd.

• Novartis AG

• Element Biosciences, Inc.

• Dovetail Genomics LLC.

• Illumina, Inc.

• Promega Corporation.

• Abcam plc.

Recent Developments

• In December 2023, BioLabs and Promega expanded their joint effort to accelerate life sciences innovation globally by supporting early-stage startups. Promega GmbH in Walldorf, which is the German subsidiary of global life sciences manufacturer Promega, provides equipment, services, and training to BioLabs Heidelberg.

• In November 2023, QIAGEN and Element Biosciences, Inc. have partnered strategically to provide broad NGS workflows for the innovative Element AVITI System.

• In October 2023, Zenith Epigenetics Ltd. agreed with Cencora to commercialize the ZEN-3694 program, an epigenetic method to synergistically advance the effectiveness of cancer treatment of currently marketed drugs.

• In September 2023, NanoString Technologies, a leading provider of life science tools for discovery and translational research, launched its latest GeoMx Digital Spatial Profiler (DSP) assay.

• In July 2023, Chroma Medicine, Inc. formed a license agreement with Sangamo Therapeutics, Inc. to devise epigenetic medicines leveraging zinc finger proteins for sequence-specific DNA recognition.

• In April 2023, Eisai collaborated with the National Cancer Center to advance investigator-initiated clinical research for the anticancer agent tazemetostat. Tazemetostat is an anticancer agent that operates as an epigenetic therapy targeting enzymes involved in chromatin modification.

• In February 2023, Tecan and Element Biosciences collaborated to provide a benchtop NGS workflow with MagicPrep NGS. The product is AVITI System, an innovative DNA sequencing platform by Element Biosciences, Inc.