Automotive Wiring Harness Industry Overview

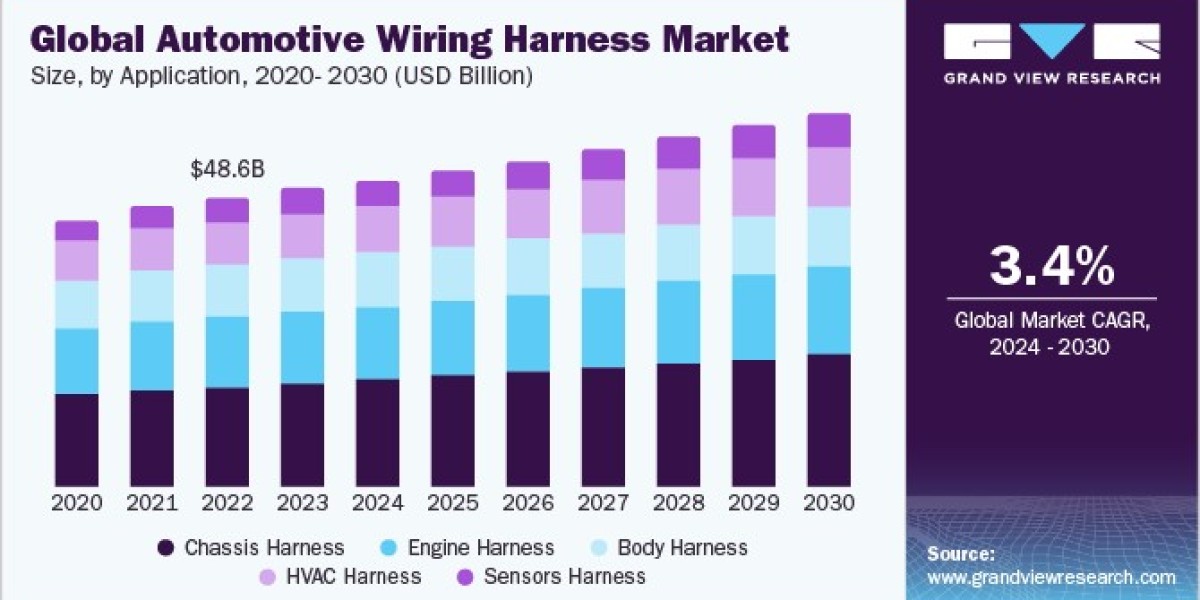

The global automotive wiring harness market size was estimated at USD 50.09 billion in 2023 and is projected to grow at a CAGR of 3.4% from 2024 to 2030. The surge in electric vehicle (EV) adoption, bolstered by consistent government incentives for both manufacturers and consumers, is a key driver propelling demand for the EV segment. This, in turn, is fueling market growth.

Gather more insights about the market drivers, restrains and growth of the Automotive Wiring Harness Market

Rising integration of advanced technologies such as vehicle-to-vehicle communication, self-healing for electric vehicles, smart battery systems, and smart braking & safety systems, among others, is attributed to drive the market growth. In line with these advancements, the introduction of autonomous and semi-autonomous vehicles, which have a high dependency on components such as low-latency communication devices, sensors, cameras, and radar, will increase the demand for automotive wiring harnesses within the automotive manufacturing industry, thereby offering numerous growth opportunities to the global market. Moreover, the increasing use of optical fiber for producing wiring harnesses is expected to create new opportunities for market players.

The rising consensus pertaining to security and safety while driving is fueling the demand for driver-assisting technologies such as adaptive cruise control, blind spot detection, adaptive front light, and lane departure warning systems. In addition, vehicle manufacturers are obliged to comply with stringent safety norms introduced by authorities worldwide and are expected to support the market growth. For instance, in July 2022, the European Union introduced new safety measures to reduce commute-related injuries and fatalities by applying general safety regulations. The regulation sets the legal framework for the EU's approval of fully driverless and automated vehicles and introduces advanced driver assistance technologies for passenger and commercial vehicles.

The deployment of cables or wire harnesses is anticipated to gain traction owing to its incorporation into multimedia and security systems. To enhance the driving experience, features including ambient lighting systems, cooled cup holders, voice recognition systems, heated steering wheels and seats, infotainment, and power steering functions have gained prominence. A wiring harness is necessary for the data, signal, and power transfer in electronic equipment which enables these functions. Wiring harness bundles are put in automobiles with these circuits to ensure that various features operate without interruption. Thus, the market growth is due to its application in automotive industry.

The demand for automotive wiring harnesses is increasing owing to the connected car ecosystem, new laws, electrification, growing preference for 48V high voltage capacity, and an increase in comfort and safety features in automobiles. Throttle control, steering, and braking are essential vehicle activities that the electronic control unit (ECU) aids. Throughout the sensors, actuators, and ECU, the wiring harness facilitates the transmission of signals, power, and data. The development of electronic and electrical features in vehicles further exacerbates the need for wiring harnesses. Governments in North America, Europe, and Asia-Pacific are advocating for an increase in the integration of ADAS systems, telematics, and low-emission engines such as China VI, Euro VI, and BSIII to BSIV electronics engines. These engines increase the application of sensors. radar, telematics, and communication devices. Thus, the growing need for connectivity and data transmission in automobiles is anticipated to propel market growth within the forecast period.

The strong emphasis market players are putting on ensuring sustainable manufacturing operations is emerging as a notable trend. Market players are delving into the realm of eco-friendly materials and sustainable manufacturing processes as part of the efforts to mitigate the environmental impact of their operations. As such, market players are increasingly seeking sustainable alternatives to conventional materials and methods. Eco-friendly practices, such as using recycled plastics, biodegradable polymers, and eco-friendly metals, and advancements in manufacturing processes, such as energy-efficient production techniques and waste mitigation strategies, are also being pursued to reduce the carbon footprint of the automotive wiring harness manufacturing processes.

Browse through Grand View Research's Automotive & Transportation Industry Research Reports.

• The global warehouse simulation market was valued at USD 552.4 million in 2023 and is projected to grow at a CAGR of 14.6% from 2024 to 2030. Warehouse simulation refers to the use of computer models to replicate and analyze the operations within a warehouse environment.

• The global apparel logistics market size was estimated at USD 54.96 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The increasing complexity of supply chains in the fashion industry drives market growth.

Automotive Wiring Harness Market Segmentation

Grand View Research has segmented the global automotive wiring harness market report based on component, application, electric vehicle, vehicle, and region:

Automotive Wiring Harness Component Outlook (Revenue, USD Million, 2018 - 2030)

• Electric Wires

• Connectors

• Terminals

• Others

Automotive Wiring Harness Application Outlook (Revenue, USD Million, 2018 - 2030)

• Body Harness

• Chassis Harness

• Engine Harness

• HVAC Harness

• Sensors Harness

Automotive Wiring Harness Electric Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

• Battery Electric Vehicle (BEV)

• Plug-in Hybrid Electric Vehicle (PHEV)

Automotive Wiring Harness Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

• Light Vehicles

• Heavy Vehicles

Automotive Wiring Harness Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o France

• Asia Pacific

o China

o India

o Japan

o Australia

o South Korea

• Latin America

o Brazil

• Middle East & Africa

o UAE

o Saudi Arabia

o South Africa

Order a free sample PDF of the Automotive Wiring Harness Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• China Auto Electronics Group Limited (THB Group)

• Delphi Technologies PLC (Aptiv PLC)

• Furukawa Electric Co., Ltd.

• Kromberg & Schubert GmbH Cable & Wire

• Lear Corporation

• LEONI AG

• PKC Group

• Spark Minda, Ashok Minda Group

• Sumitomo Electric Industries, Ltd.

• Yazaki Corporation

Key Automotive Wiring Harness Company Insights

• Sumitomo Electric Industries, Ltd. prioritizes research and development, offering cutting-edge solutions like lightweight aluminum harnesses and high voltage wiring for electric vehicles. Additionally, the company has a global presence with a wide network of manufacturing facilities, allowing them to efficiently serve the needs of automotive manufactures globally

• Furukawa Electric Co., Ltd. has comprehensive range of wiring harness, including those for conventional vehicles, electric vehicles, and hybrid vehicles, caters to the diverse needs of automotive manufacturers

• Lear Corporation engaged provides automotive technology to enhance in-vehicle experiences for consumers worldwide. The company supplies key seat components; complete seat systems; complete electrical connection and distribution systems; and high-voltage power distribution products, including electronic controllers, low-voltage power distribution products, battery disconnect units, and other electronic products, to all the major automotive manufacturers

• Tianhai Auto Electronics Group Co., Ltd. designs and manufactures connection systems, electronic transmission systems, low-carbon intellectual solutions, and intelligent control systems. The company is committed to designing and manufacturing high-speed and low- and high-voltage wire harnesses for intelligent connected vehicles

Recent Developments

• In April 2024, AVR Global Technologies, Inc., a manufacturer of wire harnesses, custom molded cables, and electronics assemblies, announced its merger with Conner Industrial, a Surface Mount Technology (SMT) PCB and cable manufacturer. The companies would be named AVR Conner Industrial Ltda. The combined proficiency of these companies in SMT, electronics box assembly, and custom wire harness OEM/CM/ODM manufacturing is likely to help manufacturers improve their product efficiency

• In May 2023, Sumitomo Electric Industries, Ltd. accelerated the development of an automotive optical harness, with commercial samples slated for release in 2026. Leveraging its extensive experience in wire harness technology and optical communication, the company has been looking forward to facilitating the evolution of Connected, Autonomous, Shared & Services, and Electric (CASE) technologies by enabling high-speed, large-capacity communication

• In April 2023, Sumitomo Corporation, headquartered in Tokyo, secured a license to establish a factory dedicated to manufacturing wiring harnesses for EVs in Egypt, backed by an investment of approximately USD 100 million. Spanning an area of 150,000 square meters within a free zone, the facility is poised to create around 10,000 employment opportunities. Its production capacity is strategically aligned to serve the needs of prominent car manufacturers in Europe and the Middle East, reinforcing the company’s commitment to global market expansion

• In February 2023, Hero Electric joined forces with Dhoot Transmission, a wiring harness manufacturer based in Aurangabad, Maharashtra, India to source wiring harnesses for its electric two-wheelers. The wiring harnesses provided by Dhoot Transmission would ensure efficient power transmission with minimal losses from the battery to the wheel while guaranteeing that the materials remain durable over years of operation

• In May 2022, Yazaki North America (YNA) and Aptera Motors announced a collaborative partnership and supply agreement, designating the two companies as an engineering service supplier and a supplier for line prototype and production parts. The agreement envisaged YNA providing specific production parts for Aptera Motors’ HV & LV EE electrical harnesses, including charge ports, connectivity, wiring, and other utilities