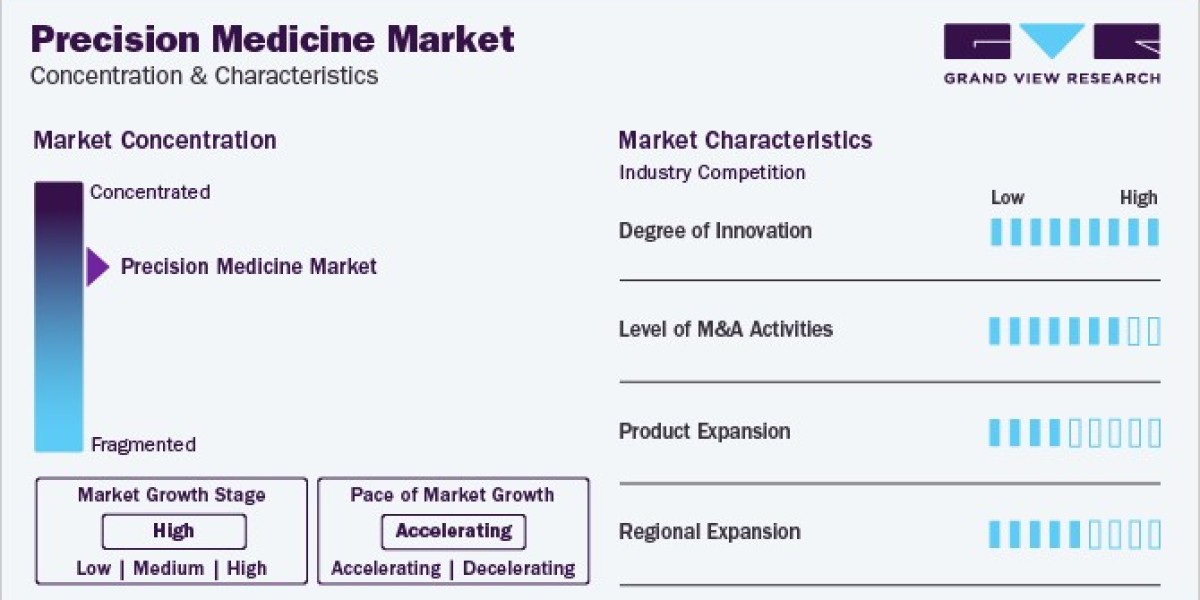

Precision Medicine Industry Overview

The global precision medicine market size was estimated at USD 87.50 billion in 2023 and is projected to grow at a CAGR of 16.3% from 2024 to 2030. The market is expected to grow further due to advancements in genomics, increased demand for personalized treatments, and technological innovations in diagnostics. The rising prevalence of chronic diseases, favorable government initiatives, and increased investment in research are likely to drive the market, aiming to improve patient outcomes through tailored therapeutic approaches.

Gather more insights about the market drivers, restrains and growth of the Precision Medicine Market

Next-generation Sequencing (NGS) has transformed genomics and is instantly reshaping clinical diagnosis & personalized medicine. These technological advancements allow for rapid and cost-effective analysis of extensive genomic data, enabling thorough exploration of disease genetics. In clinical settings, NGS is an effective tool for identifying disease-causing variations and facilitating precise & early detection of genetic disorders. In addition, NGS helps diagnose novel disease-related genes & variations, supporting the development of targeted therapies and personalized treatment approaches. These advantages associated with the technology, which include a better understanding of disease mechanisms and identification of specific molecular markers for disease subtypes, significantly enhance precision medicine, enabling tailored medical interventions based on individual characteristics.

Several oncologists expect that NGS combined with companion diagnostics can play a major role in precision diagnostics & therapeutics, significantly increasing the demand for NGS applications. The NGS companion diagnostics space has been continuously evolving and is highly dynamic. Developments in the regulatory framework for the safety & efficacy of NGS-based laboratory tests and increasing clinical investigation data on disease heterogeneity are expected to propel the demand for personalized medicine over the forecast period. For instance, in February 2021, QIAGEN extended its partnership agreement with Inovio Pharmaceuticals, Inc. to develop companion diagnostics for INOVIO’s VGX-3100. VGX-3100 is a phase III DNA immunotherapy candidate for cervical dysplasia.

In addition, due to the successful launch of companion diagnostics, usage & penetration rates of precision diagnostics and drugs greatly depend upon the level of adoption of their respective companion diagnostic tests. Over 150 companion diagnostic on-label combinations and a wide array of precision medicines are expected to be under clinical trials in the coming seven years. Moreover, the adoption of companion diagnostics is expected to increase post-FDA approval of novel tests. The expected increase in accuracy of testing & development of their analysis systems is likely to positively impact the market for companion diagnostics and precision therapeutics & diagnostics over the forecast period.

The utilization of biomarkers for personalized medicine in cancer therapy is also a key factor driving market growth. Biomarkers are crucial in diagnosing cancer and characterizing its specific subtype. This precision allows healthcare professionals to tailor treatment strategies to the unique genetic and molecular profile of each patient’s cancer, improving diagnostic accuracy.

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

• The global pancreatic cancer treatment market was valued at USD 2.87 billion in 2023 and is projected to grow at a CAGR of 13.9% from 2024 to 2030. Factors such as unhealthy lifestyles, alcohol consumption, and obesity have been the primary cause of pancreatic cancer in patients.

• The global smoking cessation and nicotine de-addiction market size was valued at USD 25.46 billion in 2023 and is projected to grow at a CAGR of 10.4% from 2024 to 2030. The factors responsible for the market growth are the increasing prevalence of diseases caused due to smoking products.

Precision Medicine Market Segmentation

Grand View Research has segmented the global precision Medicine market on the basis of application, end-use, and region:

Precision Medicine Application Outlook (Revenue, USD Million; 2018 - 2030)

• Diagnostics

o Genetic Tests

o Direct to Consumer Tests

o Esoteric Tests

o Others

• Therapeutics

o Pharmaceuticals

o Oncology

o Respiratory Diseases

o Skin Diseases

o CNS Disorders

o Immunology

o Genetic Diseases

o Others

o Medical Devices

o Others

Precision Medicine End-use Outlook (Revenue, USD Million; 2018 - 2030)

• Home Care

• Hospitals

• Clinical Laboratories

• Others

Precision Medicine Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Italy

o Spain

o Denmark

o Sweden

o Norway

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

o Thailand

• Latin America

o Brazil

o Argentina

• Middle East and Africa (MEA)

o South Africa

o Saudi Arabia

o Kuwait

o UAE

Order a free sample PDF of the Precision Medicine Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• F. Hoffmann-La Roche Ltd.-(Foundation Medicine)

• Siemens

• Janssen Global Services, LLC

• Illumina, Inc.

• Quest Diagnostics Incorporated

• 23andMe, Inc.

• NeoDiagnostix

• Myriad Genetics

• Medtronic

• GE Healthcare

• Abbott

• QIAGEN

Recent Developments

• In May 2024, Atara filed a Biologics License Application (BLA) with the U.S. FDA for tabelecleucel (tab-cel). It is proposed as a standalone treatment for Epstein-Barr Virus-Positive Post-Transplant Lymphoproliferative Disease (EBV+ PTLD) in adults and children aged 2 years and above who have undergone at least one prior therapy. In the case of solid organ transplant recipients, prior therapy typically involves chemotherapy if suitable. Notably, there are currently no FDA-approved treatments available for this specific condition

• In May 2024, Dragonfly Therapeutics, Inc., a biotechnology company dedicated to pioneering new immunotherapies, announced a clinical collaboration with Merck (known as MSD outside the U.S. and Canada). This collaboration aims to assess DF9001, Dragonfly's Epidermal Growth Factor Receptor (EGFR) immune engager, alongside Merck's anti-PD-1 therapy, KEYTRUDA (pembrolizumab), in patients with advanced solid tumors expressing EGFR