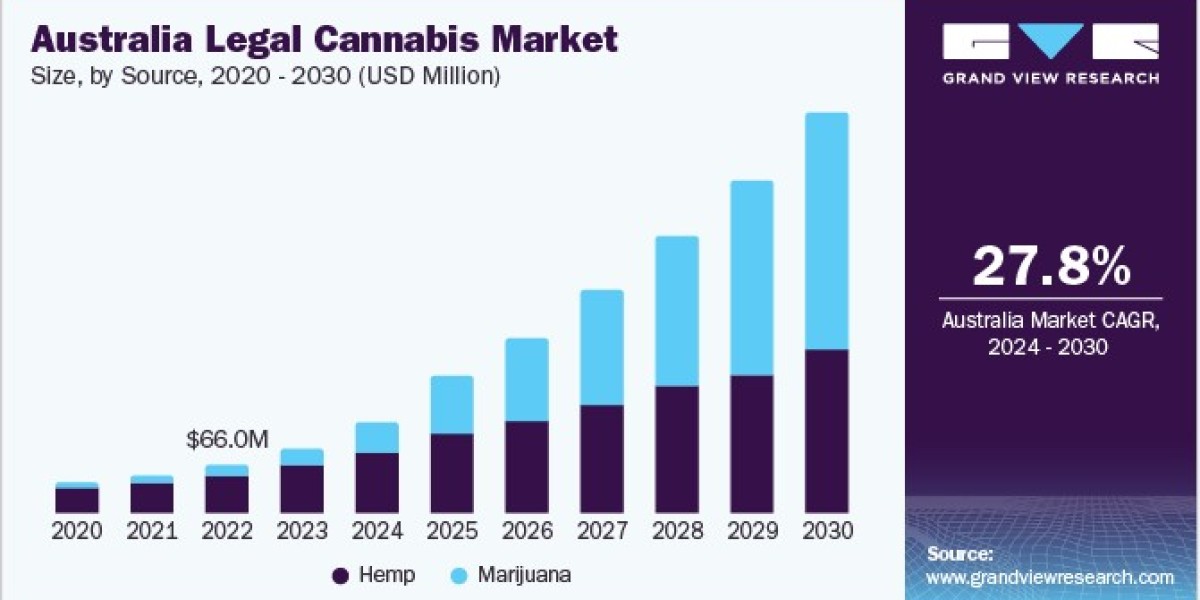

The Australia legal cannabis market size was estimated at USD 88.1 million in 2023 and is anticipated to grow at a CAGR of 27.8% from 2024 to 2030. The industry growth is propelled by the growing awareness of the health benefits of cannabis and the legalization of marijuana, mostly for medical purposes. Furthermore, the increase in medical marijuana output as a result of increasing demands in the pharmaceutical sector is boosting overall growth.

Gather more insights about the market drivers, restrains and growth of the Australia Legal Cannabis Market

In 2016, the Australian Government legalized cannabis for medicinal purposes in all six states and two territories. The Therapeutic Goods Administration (TGA) regulates the supply of medicinal cannabis in Australia. The legal framework regulating medicinal cannabis is constantly evolving and remains closely monitored. New cannabis legislation was enacted by the Australian government, allowing the Australian Capital Territory (ACT) to acquire and cultivate four plants of cannabis per household for personal use. In October 2023, the Australian Capital Territory (ACT) introduced certain regulations on the use of cannabis. It stated that individuals over 18 years old can own fresh cannabis up to 150 grams or dried cannabis up to 50 grams. This factor is expected to contribute to the cannabis usage in Australia.

The rising use of marijuana, mostly for medical purposes, and the availability of several medicinal cannabis products are boosting market growth as customers adopt cannabis-based treatment. For instance, as of 2023, more than 450 medicinal cannabis products are available in Australia. There are five different categories of cannabis products available such as,

• Category 1: CBD Medicinal Cannabis Product (CBD >98%)

• Category 2: CBD Dominant Medicinal Cannabis Product (CBD >60% and <98%)

• Category 3: Balanced Medicinal Cannabis Product (CBD <60% and >40%)

• Category 4: THC Dominant Medicinal Cannabis Product (THC 60-98%)

• Category 5: THC Medicinal Cannabis Product (THC >98%).

When contrasted with different nations in Asia Pacific, Australia has been a strong advocate of cannabis legalization. For instance, Australia is working on passing a bill to legalize the use of cannabis for recreational purposes. The Legalizing Cannabis Bill 2023 is expected to take place in May 2024. The Legalizing Cannabis Bill 2023, if approved, would modify the federal landscape. It aims to legalize the use of cannabis for recreational purposes in Australia. In addition, the Bill would develop the Cannabis Australia National Agency as a statutory body responsible for the registration of cannabis strains and oversight of cannabis-related activities such as growing, possession, manufacturing, sale, operation of cannabis cafes, and import/export of cannabis products. Such initiatives are expected to boost the growth of the legal cannabis market in Australia.

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

• The global superdisintegrants market size was valued at USD 536.2 million in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. This growth is attributed to several factors, including the expansion of the generics market, which heavily utilizes orally disintegrating tablets (ODTs).

• The global acute lymphocytic leukemia therapeutics market size was valued at USD 3.12 billion in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. The acute lymphocytic leukemia therapeutics market is expected to grow due to the increasing rate of the condition in the young population.

Australia Legal Cannabis Market Segmentation

Grand View Research has segmented the Australia legal cannabis market based on source, derivative, and end-use:

Australia Legal Cannabis Source Outlook (Revenue, USD Million, 2018 - 2030)

• Marijuana

o Flower

o Oil And Tinctures

• Hemp

o Hemp CBD

o Supplements

o Industrial Hemp

Australia Legal Cannabis Derivative Outlook (Revenue, USD Million, 2018 - 2030)

• CBD

• THC

• Others

Australia Legal Cannabis End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Medical

o Cancer

o Chronic Pain

o Depression And Anxiety

o Arthritis

o Diabetes

o Glaucoma

o Migraine

o Epilepsy

o Multiple Sclerosis

o AIDS

o Amyotrophic Lateral Sclerosis

o Alzheimer’s Disease

o Post-traumatic Stress Disorder (PTSD)

o Parkinson's Disease

o Tourette Syndrome

o Others

• Recreational

• Industrial

Order a free sample PDF of the Australia Legal Cannabis Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• Cann Group Limited

• Zelira Therapeutics

• AusCann Group Holdings Ltd.

• Bod Australia

• Althea Group

• ECOFIBRE

• Botanix Pharmaceuticals

• EPSILON

• Little Green Pharma

• Incannex

Recent Developments

• In February 2024, Peak Processing Solutions, an Althea Group Holdings subsidiary, signed an agreement with Collective Project to produce 6 cannabis-based beverage products based on contract manufacturing.

• In January 2024, Althea Group Holdings Limited, a manufacturer and distributor of cannabis-based products, launched two new products, Althea THC10, and Althea CBD3:THC2, and expanded its softgel capsule product range.

• In June 2023, Cann Group Limited signed an agreement with Levin Health Pty Ltd., to supply cannabis flowers to Levin to meet the production of cannabis based products.