Microfluidics Industry Overview

The global microfluidics market size was estimated at USD 32.15 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.22% from 2024 to 2030. The increasing penetration of microfluidics devices in various fields of research and diagnosis is expected to drive market growth. For instance, there has been an improvement in the number of microfluidic devices applicable to ophthalmological conditions over the past decade. Microfluidic approaches have been effectively used to determine glucose levels, detect infection, diagnose dry eye disease, and assess levels of vascular endothelium growth factor. Such applications are expected to positively affect the market growth in the coming years.

Gather more insights about the market drivers, restrains and growth of the Microfluidics Market

An exponential rise in COVID-19 cases globally boosted the demand for microfluidics tools. Many approved tests are based on PCR, making it a preferred technique for COVID-19 diagnosis. To combat the rising cases of COVID-19 globally, several manufacturers have introduced products and ramped up their production to address the growing demand for IVD tests. When coupled with microfluidics, the PCR technique can be accelerated, which, in turn, provides faster test results (from approximately 1 hour to less than 10 minutes) with high accuracy.

For instance, BeforCure, a spin-off company from Elvesys, developed an ultra-fast PCR-on-chip system for the detection of the virus. This product is based on Fastgen technology and leverages the advantages of microfluidics to deliver test results in less than 30 minutes. Furthermore, various studies are being conducted to evaluate the use of microfluidics in COVID-19 detection by PCR technique. A study was published in June 2021 by researchers in China that demonstrated the use of the latest rapid microfluidic PCR. It concluded that rapid PCR can be achieved with the use of emerging state-of-the-art microfluidics for SARS-CoV-2 detection.

The major advantage of microfluidics devices is their ability to analyze small volumes of samples. This reduces the amount of reagent waste and helps preserve samples that are difficult to produce. The introduction of microfluidics devices has driven the demand for low-volume sample devices. A surge in research activities undertaken by analytical and clinical researchers has also driven the demand for microfluidics devices. The conventional method of genome analysis requires decoding the entire DNA, thus adding to the cost of analysis and time. Microfluidics devices need a very small volume of samples for data interpretation. The application of microfluidics has allowed conventional laboratory procedures to be miniaturized onto a lab-on-a-chip.

The point-of-care diagnostics introduced by numerous market players led to early disease diagnosis and reduced hospital visits. With improved technologies, market players now distinguish their products using minimally invasive features along with accuracy and speed. Microfluidics has thus made its mark in the IVD market. Moreover, market players, such as Abbott, Roche, and Danaher, have already incorporated microfluidics technology in their existing diagnostic devices. With advancements in technology, digital microfluidics is being explored by several key players. In August 2022, HORIBA announced a collaboration with SigTuple to speed up the deployment of its AI100, an AI-assisted digital pathology solution, in the Indian subcontinent. SigTuple combined AI, robotics, microfluidics, and cloud computing to develop smart diagnostic solutions to make quality healthcare delivery accessible and affordable.

With the increasing penetration of microfluidics devices in various fields of research and diagnosis, advanced technologies are introduced by industry players to grab a potential market share. Many companies have their devices under trial and are anticipated for commercialization. For instance, in January 2022, BIOLASE, Inc., and EdgeEndo received FDA 510(k) clearance for the EdgePRO system, intended for effective disinfection and cleaning alternatives within root canal processes. The laser-aided microfluidic irrigation tool offers an enhanced solution to existing disinfection and cleaning techniques, without interrupting process workflow or adding significant cost on a per-procedure basis.

In March 2021, the Loschmidt laboratories team, together with partners from ETH Zurich, developed a microfluidic platform for an effective and rapid investigation of enzymes and their properties. The novel platform was already being used for developing new thrombolytics to treat stroke and study bioluminescent enzyme evolution. Besides, in November 2019, Panasonic Corporation and IMT jointly created a technology for the mass production of microfluidic devices utilizing glass molding. Compared to the conventional glass etching technique, this technology uses low-cost and highly accurate mass production. These devices can be used for analysis and sensing in biological, environmental, and medical applications, thus likely to drive the growth of the market in the forecast period.

Browse through Grand View Research's Biotechnology Industry Research Reports.

• The global immunoprecipitation market size was valued at USD 750.0 million in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The increasing treatment of immunoprecipitation testing in central nervous disorders, cancer, and cardiovascular diseases has a positive influence on the immunoprecipitation testing market.

• The global separation systems for commercial biotechnology market size was valued at USD 25.6 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. Separation systems are crucial for purifying valuable biomolecules from complex mixtures in biopharma production.

Microfluidics Market Segmentation

Grand View Research has segmented the global microfluidics market based on, technology, material, application, and region:

Microfluidics Application Outlook (Revenue, USD Million, 2018 - 2030)

• Medical/Healthcare

o PCR & RT-PCR

o Gel Electrophoresis

o Microarrays

o ELISA

o Others

• Non-medical

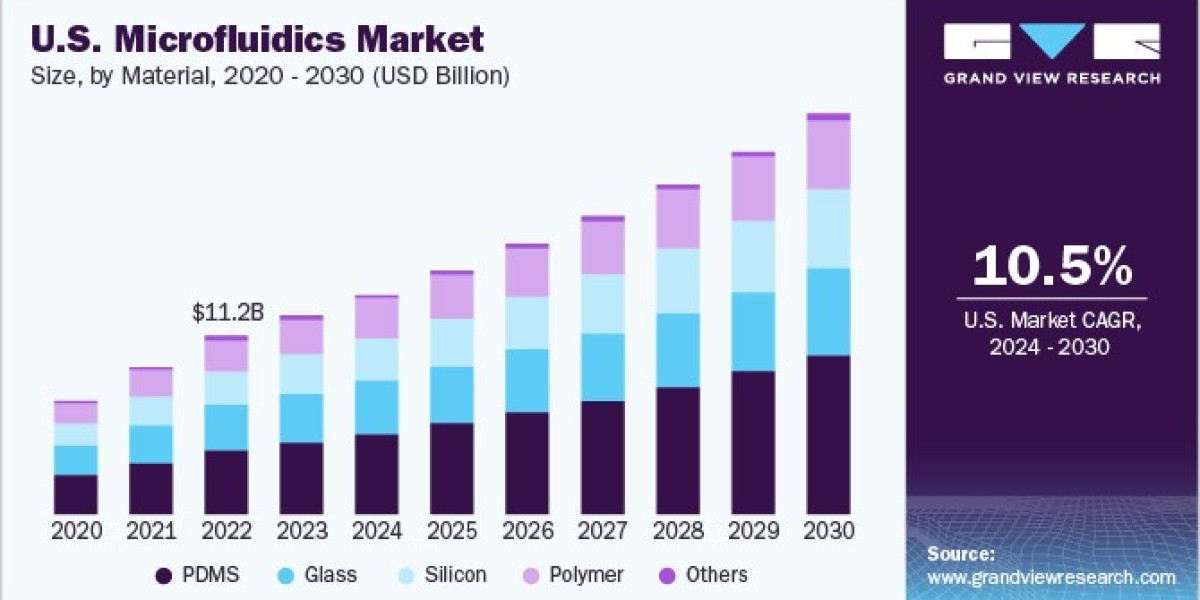

Microfluidics Material Outlook (Revenue, USD Million, 2018 - 2030)

• Silicon

• Glass

• Polymer

• PDMS

• Others

Microfluidics Technology Outlook (Revenue, USD Million, 2018 - 2030)

• Lab-on-a-chip

o Medical

o Non-Medical

• Organs-on-chips

o Medical

o Non-Medical

• Continuous Flow Microfluidics

o Medical

o Non-Medical

• Optofluidics And Microfluidics

o Medical

o Non-Medical

• Acoustofluidics And Microfluidics

o Medical

o Non-Medical

• Electrophoresis And Microfluidics

o Medical

o Non-Medical

Microfluidics Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o Germany

o France

o UK

o Italy

o Spain

o Denmark

o Sweden

o Norway

• Asia Pacific

o Japan

o China

o India

o Australia

o Thailand

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East and Africa

o South Africa

o Saudi Arabia

o UAE

o Kuwait

Order a free sample PDF of the Microfluidics Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• Illumina, Inc.

• F. Hoffmann-La Roche Ltd

• PerkinElmer, Inc.

• Agilent Technologies, Inc.

• Bio-Rad Laboratories, Inc.

• Danaher Corporation

• Abbott

• Thermo Fisher Scientific

• Standard BioTools