Veterinary Imaging Industry Overview

The global veterinary imaging market size was estimated at USD 1.8 billion in 2023 and is expected to grow at a CAGR of 7.01% from 2024 to 2030. The market is primarily being driven by increasing prevalence of zoonotic diseases, rising number of pet owners, growing adoption of pet insurance, and rapid technological advancements in veterinary imaging.

Gather more insights about the market drivers, restrains and growth of the Veterinary Imaging Market

One such rapidly advancing technology is Artificial Intelligence (AI), especially incorporated into veterinary radiology and its respective software. It enables automated evaluation of various veterinary radiological parameters and directly uploads x-rays to servers securely. Implementing such AI-based strategies is a progressive step in veterinary practices. For instance, In April 2024, MiReye Imaging launched its unique product line of veterinary X-ray machines that use AI for the diagnosis of diseases in animals.

Furthermore, the rising incidence of zoonotic diseases has increased the demand for effective diagnostic solutions, which is expected to drive market growth. According to 2024 data by WHO, out of the total infectious diseases that occur in the world, 60% are reported to be of zoonotic origin. Moreover, in a 2024 publication, WHO states that in the last 30 years, out of the 30 new pathogens detected among humans, 75% were of animal origin. This compels veterinary professionals to perform in-depth diagnostic evaluations of animals to curb the spread of these zoonotic diseases from animals to humans.

The emergence of COVID-19 had an impact on the entire healthcare sector, including veterinary medicine. The COVID-19 pandemic slightly halted the growth of the veterinary imaging industry since several non-essential surgeries were restricted across the globe during the pandemic. Furthermore, strict restrictions on the transportation of individuals and goods led to a restricted patient influx in veterinary centers. Similarly, the shortage of skilled veterinarians, combined with suspended/postponed elective surgeries, significantly disrupted the activities of veterinary facilities, having a slightly negative impact on market providers.

The growing trend of pet humanization and the rising adoption of pet insurance in various countries have increased pet insurance enrollment rates globally. For instance, in a 2023 report by the North American Pet Health Insurance Association (NAPHIA), there are over 5.36 million insured pets in North America, and this number is expected to grow exponentially at a CAGR of 2.17%. Out of these insured pets, dogs account for the highest share of 80.1%, followed by cats with 19.9%. The overall number of pets insured in the U.S. increased from 3.1 million in 2020 to 4.8 million in 2022.

Moreover, diagnostic imaging procedures can prove to be costly for pet owners. For example, an X-ray can approximately cost the pet owner from USD 75 to USD 500 for dogs and USD 100 to USD 500 for cats. A comprehensive pet insurance plan can cover every diagnostic imaging test, such as CT, MRI, ultrasound, and radiography. Due to the recently evolving AI technology in veterinary diagnostics, insurance companies are expanding their coverage. For instance, the Embrace pet insurance plan, a part of the NSM Insurance Group, covers AI-based diagnostic imaging procedures for animals in the U.S. Increasing pet insurance adoption, coupled with expanding coverage for AI-based diagnostic imaging procedures, is expected to drive market growth. Accessibility of imaging procedures is expected to improve because they are covered by insurance.

Browse through Grand View Research's Animal Health Industry Research Reports.

• The global animal vaccines market size was valued at USD 13.67 billion in 2023 and is projected to grow at a CAGR of 9.4% from 2024 to 2030. The increasing outbreaks of cattle disease and the ever-expanding livestock population are the key factors for the wide acceptance of ruminants, especially cattle vaccines, globally.

• The global pet dental health market size was estimated at USD 7.59 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030. The market is driven by increasing pet humanization, focus on preventive care, growing awareness about pet dental health, and adoption of pet insurance.

Veterinary Imaging Market Segmentation

Grand View Research has segmented the global veterinary imaging market based on product, solutions, animal type, application, end use, and region:

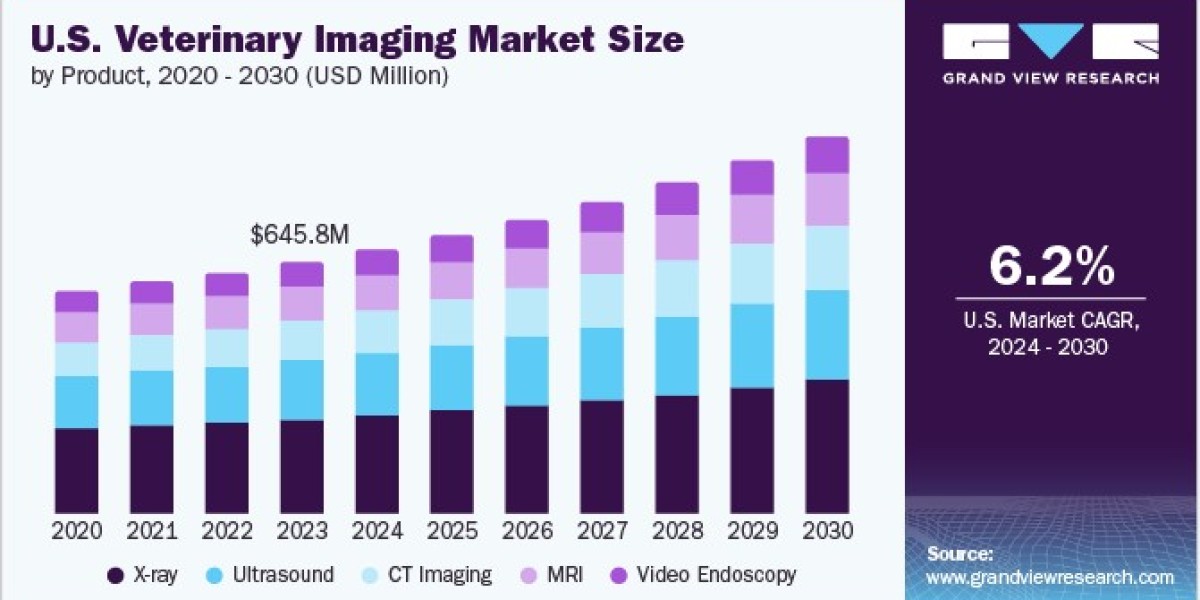

Veterinary Imaging Product Outlook (Revenue, USD Million; 2018 - 2030)

• X-ray

• Ultrasound

• MRI

• CT Imaging

• Video Endoscopy

Veterinary Imaging Solutions Outlook (Revenue, USD Million; 2018 - 2030)

• Equipment

• Accessories/ Consumables

• PACS

Veterinary Imaging Animal Type Outlook (Revenue, USD Million; 2018 - 2030)

• Small Animals

• Large Animals

Veterinary Imaging Application Outlook (Revenue, USD Million; 2018 - 2030)

• Orthopedics And Traumatology

• Oncology

• Cardiology

• Neurology

• Respiratory

• Dental Application

• Other

Veterinary Imaging End-use Outlook (Revenue, USD Million; 2018 - 2030)

• Veterinary Clinics & Hospitals

• Other End-use

Veterinary Imaging Market Regional Outlook (Revenue, USD Million; 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o Germany

o U.K.

o France

o Italy

o Spain

o Netherlands

o Sweden

o Denmark

o Norway

o Poland

o Rest of Europe

• Asia Pacific

o Japan

o China

o India

o South Korea

o Australia

o Thailand

o Rest of Asia Pacific

• Latin America

o Brazil

o Mexico

o Argentina

o Rest of Latin America

• Middle East & Africa

o South Africa

o Saudi Arabia

o UAE

o Rest of Middle East & Africa

Order a free sample PDF of the Veterinary Imaging Market Intelligence Study, published by Grand View Research.

Key Companies profiled:

• IDEXX Laboratories, Inc.

• ESAOTE SPA

• Mars, Inc.

• GE HealthCare

• Midmark Corporation

• FUJIFILM Holdings America Corporation

• Hallmarq Veterinary Imaging

• Canon Medical Systems Corporation

• Shenzhen Mindray Animal Medical Technology Co., Ltd.

• IMV Imaging

Recent Developments

• In April 2024, Asteris partnered with VetlinkPRO, intending to combine imaging technology with its practice management system

• In June 2023, ESAOTE SPA launched the MyLab X90VET ultrasound system with patented Augmented Insight technology for precise and accurate diagnostic imaging.