The general insurance market in Norway is a significant and well-regulated sector that plays a vital role in the country’s economy. With a population of approximately 5.4 million people and a high standard of living, Norway's insurance market is characterized by its maturity, stability, and the presence of both domestic and international insurers. This article provides an overview of the market dynamics, regulatory environment, key players, and future outlook of the general insurance market in Norway.

Market Dynamics

Norway's general insurance market encompasses a wide range of products, including motor insurance, property insurance, liability insurance, marine insurance, and health insurance. The market is primarily driven by the country’s robust economic environment, high per capita income, and a strong focus on risk management and safety.

Motor Insurance: This is one of the largest segments in the general insurance market, driven by the mandatory nature of third-party liability insurance for all vehicle owners. In addition, the increasing number of electric vehicles in Norway, due to government incentives and growing environmental awareness, has created a demand for specialized insurance products.

Property Insurance: Norway's harsh weather conditions, including heavy snow, rain, and floods, make property insurance a critical product for both individuals and businesses. Homeowners insurance, in particular, is highly sought after, providing coverage against natural calamities, theft, and other unforeseen events.

Marine Insurance: Given Norway's extensive coastline and its prominence in global shipping and oil exploration, marine insurance is another key segment. The marine insurance sector covers a wide array of risks associated with shipping, cargo, and offshore installations.

Health Insurance: While Norway has a strong public healthcare system, the demand for private health insurance has been growing, driven by the desire for faster access to healthcare services and broader coverage options.

Regulatory Environment

The Norwegian insurance industry is tightly regulated to ensure the protection of policyholders and the stability of the financial system. The Financial Supervisory Authority of Norway (Finanstilsynet) is the main regulatory body overseeing the insurance market. Key regulations affecting the market include:

- Solvency II Directive: This EU directive, which Norway adheres to despite not being a member of the European Union, sets stringent capital requirements for insurers to ensure they can meet their long-term obligations.

- Consumer Protection: Norwegian laws emphasize strong consumer protection, requiring transparency in insurance product offerings and fair treatment of customers.

- Data Protection and Privacy: Compliance with the General Data Protection Regulation (GDPR) is mandatory, impacting how insurance companies handle personal data and customer information.

Key Players in the Market

The Norwegian general insurance market is dominated by a mix of domestic and international companies. Some of the key players include:

Gjensidige Forsikring ASA: One of the largest and oldest insurance companies in Norway, offering a wide range of general insurance products including motor, property, and health insurance.

If Insurance (If Skadeforsikring): A leading property and casualty insurance provider in the Nordic region, If Insurance offers various insurance products tailored to both individual and business clients.

SpareBank 1 Forsikring: Part of the SpareBank 1 Group, this company provides a broad spectrum of insurance services, with a focus on motor and property insurance.

Tryg Forsikring: Another major player in the Nordic insurance market, Tryg offers general insurance products in Norway, Denmark, and Sweden, with a strong emphasis on customer service and digital innovation.

Storebrand ASA: Primarily known for its life insurance and pension products, Storebrand also has a significant presence in the general insurance market, offering home, motor, and travel insurance.

Technological Advancements and Digital Transformation

The general insurance market in Norway has been undergoing significant digital transformation, driven by technological advancements and changing customer expectations. Key trends include:

- Telematics: The use of telematics in motor insurance has been growing, allowing insurers to offer usage-based insurance (UBI) products that reward safe driving behavior with lower premiums.

- Digital Platforms: Many insurers are investing in digital platforms and mobile apps to streamline the customer experience, from policy purchase to claims processing.

- Artificial Intelligence (AI): AI is increasingly used for risk assessment, fraud detection, and personalized product offerings. This technology helps insurers optimize their operations and improve customer service.

- Blockchain: Although still in the early stages, blockchain technology has the potential to enhance transparency and efficiency in claims processing and policy management.

Future Outlook

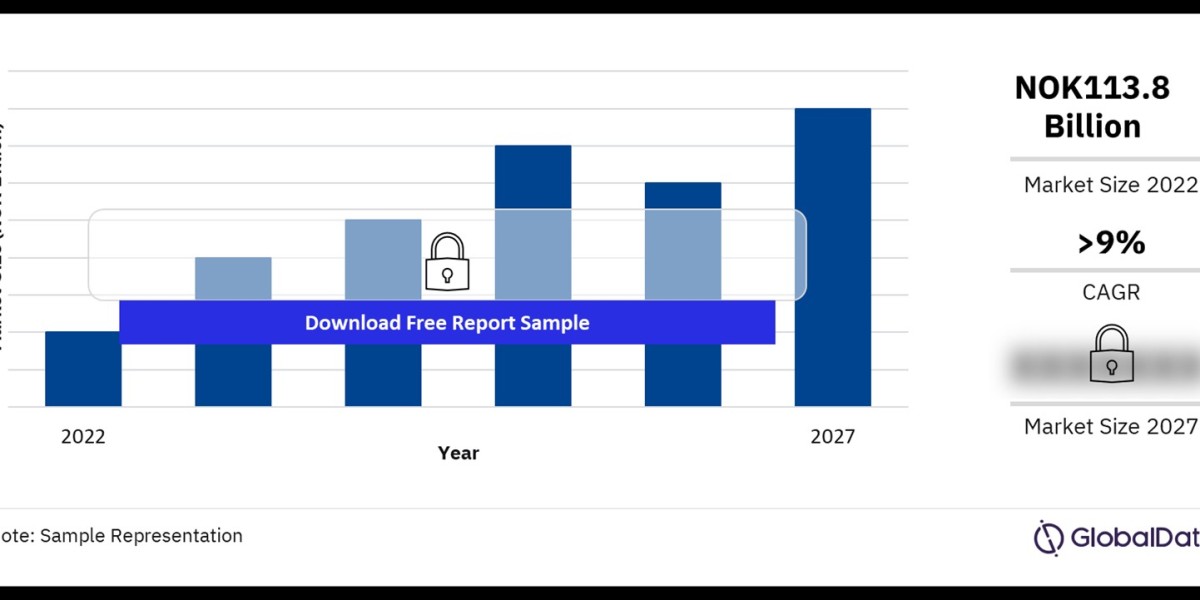

The future of the general insurance market in Norway looks promising, with several factors expected to drive growth:

Economic Stability: Norway's strong economic fundamentals, supported by its oil wealth, provide a stable environment for the insurance industry to thrive.

Increasing Awareness: As awareness of various risks, including cyber threats and climate change-related disasters, grows, the demand for specialized insurance products is expected to rise.

Aging Population: Norway's aging population may lead to increased demand for health and long-term care insurance products.

Sustainability Initiatives: Insurers are likely to play a crucial role in promoting sustainability by offering green insurance products and investing in environmentally friendly projects.

Challenges

Despite the positive outlook, the market faces challenges such as:

- Competition: The presence of numerous players in the market leads to intense competition, which can put pressure on profit margins.

- Regulatory Compliance: Adapting to evolving regulations, particularly in areas such as data protection and cybersecurity, requires continuous investment and adaptation.

- Climate Risks: Increasing frequency and severity of natural disasters pose significant risks to insurers, necessitating more accurate risk assessment models and sustainable underwriting practices.

Buy Full Report to Gain More Information about the Norway General Insurance Market Forecast