Veterinary Diagnostics Market Growth & Trends

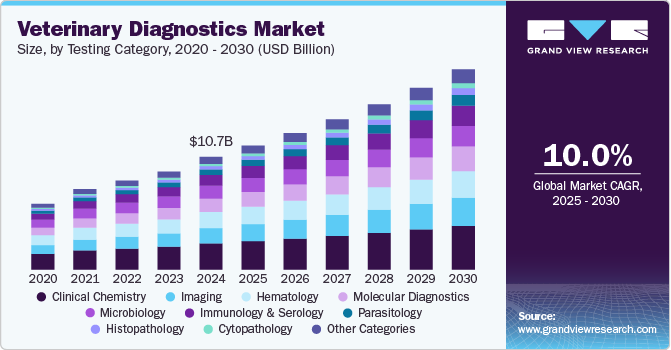

The global veterinary diagnostics market size is expected to reach USD 19.00 billion by 2030, registering a CAGR of 10.04% from 2025 to 2030, as per the new report by Grand View Research, Inc. The market growth is driven by increasing initiatives by key companies, veterinary visits, expenditure on animal health, the prevalence of diseases, and demand for safe food sources. BioChek, for instance, is a part of Hygiena Company and offers a range of products including ELISAs for poultry and swine as well as high-quality PCR kits. The presence of key companies in the market is marked by their global reach, comprehensive product portfolios, and initiatives aimed at driving the market growth.

IDEXX Laboratories, for instance, has a significant global presence and is known for its in-clinic diagnostic instruments, reference laboratory services, and rapid tests. The company provides its product lineup to a range of customers that include government and private laboratories, veterinarians, livestock producers, etc. Zoetis offers a diverse range of veterinary diagnostic products and services, including instruments and reagents, point-of-care testing devices, reference lab kits, rapid immunoassay tests, and blood glucose monitors. The company reported animal health diagnostics segment revenue of USD 353 million in 2022.

Gather more insights about the market drivers, restrains and growth of the Veterinary Diagnostics Market

Routine diagnostic testing is a standard practice in veterinary medicine, especially for companion animals and livestock. The regular monitoring of animal health through tests, such as blood counts, chemistry panels, and urinalysis, requires a consistent supply of consumables and reagents. As a result, there is a continuous and high demand for these products in veterinary practices. The trend toward point-of-care testing (POCT) in veterinary diagnostics has contributed to the increased demand for consumables and kits. POCT devices often rely on ready-to-use kits and reagents that enable rapid on-site testing, aligning with the need for quick results in veterinary clinics, animal hospitals, and field settings.

Veterinary Diagnostics Market Report Highlights

- The clinical chemistry segment dominated the market with a share of 23.44% in 2024. The cytopathology segment is anticipated to grow at the fastest CAGR of 13.95% from 2025 to 2030.

- The companion animals segment held the highest market share in 2024. The production animals segment is expected to register the second-fastest CAGR from 2025 to 2030.

- The consumables, reagents & kits segment accounted for the highest share in 2024. The equipment & instruments segment is projected to register a considerable CAGR from 2025 to 2030.

- The veterinarians segment held the highest share of the market in 2024. The animal owners/producers segment is estimated to grow at the fastest CAGR in the coming years.

- North America held the largest revenue share of 38.6% in 2024. Asia Pacific is projected to grow at the fastest CAGR of 12.0% from 2025 to 2030.

- To facilitate regional expansion, companies form strategic alliances or partnerships with local distributors, veterinary clinics, or healthcare organizations. These collaborations help establish a stronger foothold in new markets and leverage the expertise of local partners.

Browse more reports published by Grand View Research.

- Pet Insurance Market Size, Share & Trends Analysis Report By Coverage Type (Accident-only, Accident & Illness), By Animal Type (Dogs, Cats), By Sales Channel, By Region, And Segment Forecasts, 2025 - 2030

- Veterinary Hospital Market Size, Share & Trends Analysis Report By Animal (Companion, Farm), By Type (Surgery, Medicine, Consultation), By Sector (Public, Private), By Region, And Segment Forecasts, 2025 - 2030

Veterinary Diagnostics Market Segmentation

Grand View Research has segmented the global veterinary diagnostics market report based on product, animal type, testing category, end-use, and region:

Veterinary Diagnostics Product Outlook (Revenue, USD Million, 2018 - 2030)

- Consumables, Reagents & Kits

- Equipment & Instruments

Veterinary Diagnostics Testing Category Outlook (Revenue, USD Million, 2018 - 2030)

- Clinical Chemistry

- Microbiology

- Parasitology

- Histopathology

- Cytopathology

- Hematology

- Immunology & Serology

- Imaging

- Molecular Diagnostics

- Other Categories

Veterinary Diagnostics Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

- Production Animals

- Companion Animals

Veterinary Diagnostics End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Reference Laboratories

- Veterinarians

- Animal Owners/ Producers

Veterinary Diagnostics Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Denmark

- Netherlands

- Sweden

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- Kuwait

- UAE

Order a free sample PDF of the Veterinary Diagnostics Market Intelligence Study, published by Grand View Research.