Bermuda's insurance market is internationally recognized for its dominance in the reinsurance sector. The island has become one of the largest reinsurance hubs globally, thanks to its strong regulatory framework, robust financial infrastructure, and access to both North American and European markets.

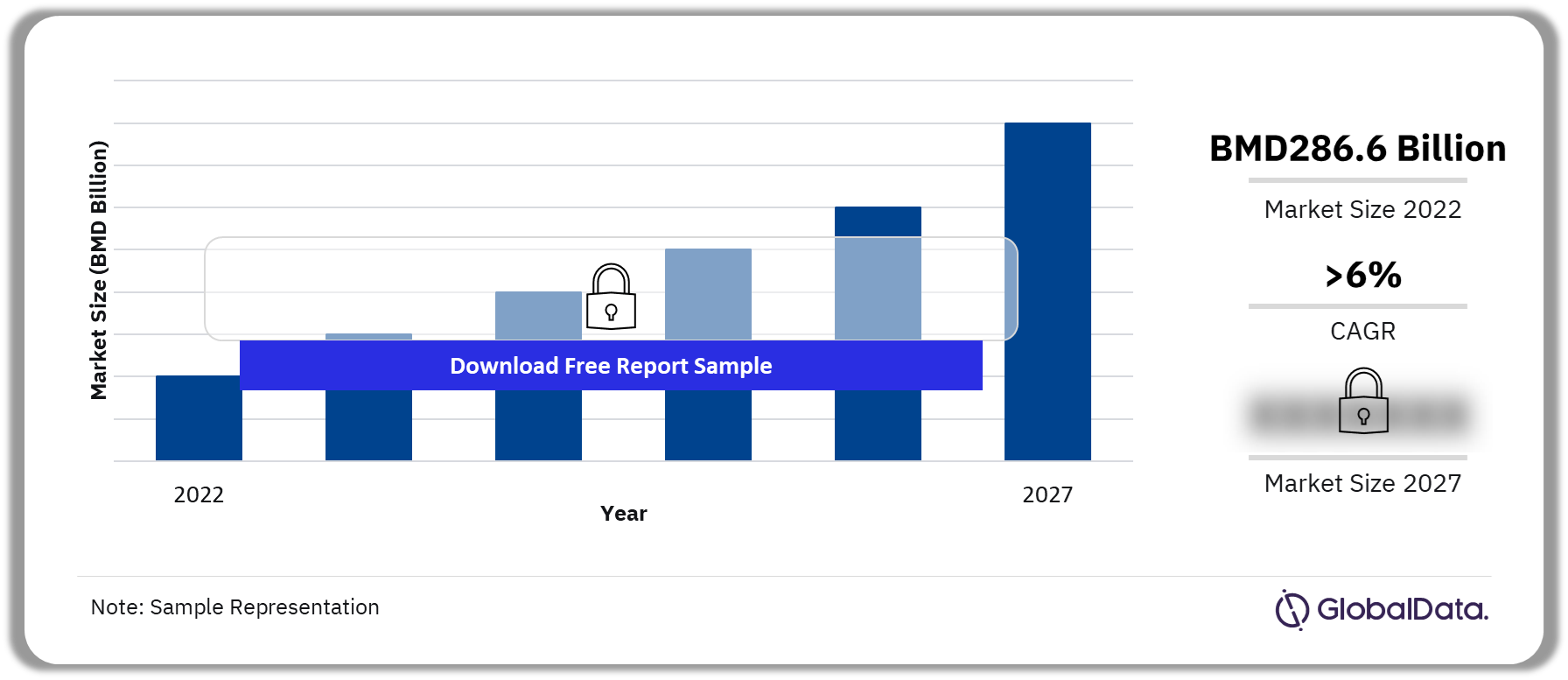

Buy the Full Report or Download a Free Sample Report for Bermuda’s Insurance Industry Forecasts

Growth Drivers in Bermuda's Insurance Market

Several factors contribute to the growth of Bermuda’s insurance market, with the following playing a significant role:

Reinsurance Leadership: Bermuda is one of the world’s leading hubs for reinsurance, with numerous global reinsurers choosing to domicile on the island. The reinsurance market in Bermuda provides solutions to cover large-scale risks, including natural disasters, large corporate losses, and emerging risks like cyber threats.

Insurance-Linked Securities (ILS): Bermuda is a significant player in the insurance-linked securities market, which involves the use of financial instruments such as catastrophe bonds to transfer risk. The growth of the ILS market is attracting institutional investors and providing innovative ways to manage risk, especially for large-scale events like hurricanes and earthquakes.

Regulatory Advantages: Bermuda’s regulatory environment, overseen by the Bermuda Monetary Authority (BMA), is highly regarded for its transparency, flexibility, and alignment with international standards. The island has been proactive in adapting its regulations to accommodate new technologies, digital platforms, and evolving insurance products.

Tax Incentives and Competitive Pricing: Bermuda offers favorable tax policies that allow insurers and reinsurers to reduce operational costs. These tax incentives have been a major factor in attracting international insurers to set up operations in Bermuda. Additionally, competitive pricing in the market provides value to businesses seeking affordable and reliable insurance solutions.

Key Trends in the Bermuda Insurance Market

Growth in Alternative Risk Financing: One of the defining trends in Bermuda's insurance market is the growth of alternative risk financing mechanisms such as catastrophe bonds, ILS, and collateralized reinsurance. These instruments allow insurers to access additional capital from institutional investors, providing a more diversified approach to risk management.

Expansion of Insurtech: The rise of insurtech is making a significant impact on Bermuda’s insurance market, as technology transforms underwriting, claims management, and customer experience. Bermuda has positioned itself as an attractive location for insurtech companies seeking to scale and innovate in the insurance sector, offering the infrastructure and regulatory framework needed for these firms to thrive.

Climate Change and Catastrophe Risk Solutions: Bermuda's insurance market is increasingly focused on providing solutions to manage climate-related risks. With the rise in natural disasters and extreme weather events, Bermuda-based reinsurers and insurers are leading the charge in offering coverage for catastrophe risks. The use of data analytics and advanced modeling techniques to assess these risks is becoming more widespread, enhancing the island’s reputation as a leader in catastrophe risk solutions.

Cyber Insurance: The growing threat of cyberattacks has led to an increased demand for cyber insurance solutions. Bermuda’s insurance market is well-positioned to offer tailored cyber risk products, leveraging its global network of insurers and reinsurers to provide coverage for businesses facing potential cybersecurity threats.

Challenges Facing the Bermuda Insurance Market

While the Bermuda insurance market remains strong, it is not without its challenges:

Increased Competition: As more markets around the world establish themselves as attractive locations for the insurance and reinsurance industries, Bermuda faces growing competition. Other jurisdictions, such as London, the Cayman Islands, and Luxembourg, are also seeking to capture a larger share of the global insurance market.

Climate and Environmental Risks: Although Bermuda has a strong track record in managing catastrophe risks, the growing frequency and severity of climate-related events pose significant challenges. Insurers and reinsurers will need to adapt to changing environmental conditions by improving risk assessment models, expanding coverage options, and managing claims more effectively.

Regulatory Changes and Global Standards: As global insurance regulations continue to evolve, Bermuda must remain adaptable to ensure compliance with international standards. Changes in tax laws, reporting requirements, or capital adequacy rules could have implications for Bermuda’s competitiveness in the global market.

Technological Disruption: The rapid growth of insurtech presents both an opportunity and a challenge for Bermuda’s traditional insurance players. While insurtech can enhance operational efficiency and customer experience, it also requires insurers to invest in new technologies and adopt more agile business models to stay competitive.