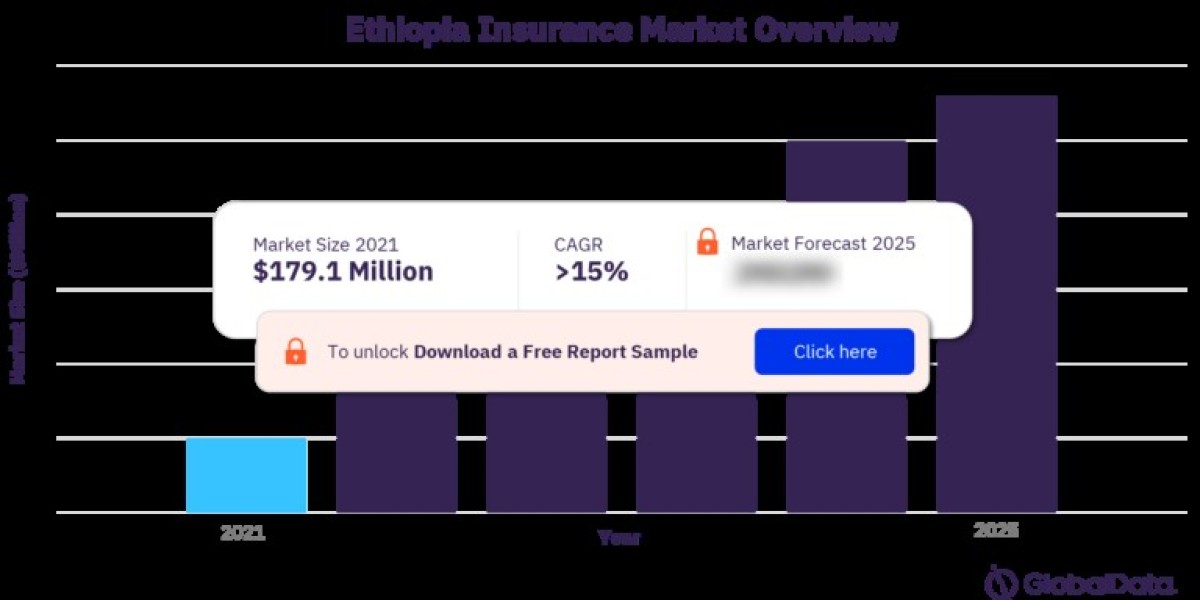

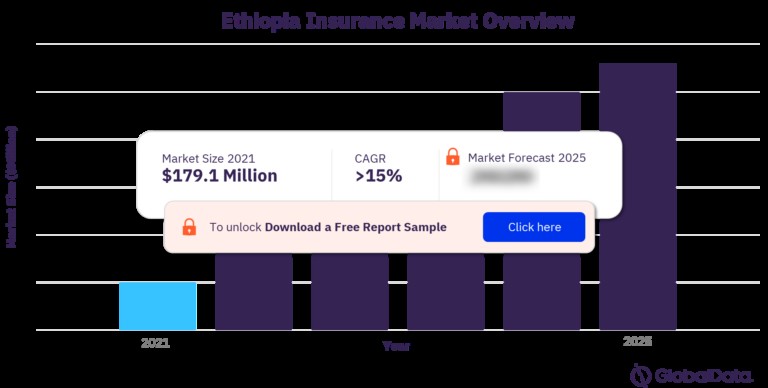

The Ethiopia insurance market has experienced significant growth in recent years, driven by factors such as economic development, increasing awareness of risk management, and government initiatives to promote insurance penetration.

This overview will delve into the key trends shaping the market and provide valuable insights into its future.

Key Trends in the Ethiopia Insurance Market

- Economic Growth: Ethiopia's robust economic growth has led to increased demand for insurance products, particularly among businesses and individuals seeking to protect their assets.

- Rising Awareness: Consumers are becoming more aware of the benefits of insurance and the importance of risk management. This has fueled demand for various insurance products.

- Regulatory Reforms: The Ethiopian government has implemented various regulatory reforms to modernize the insurance sector and promote competition.

- Technological Advancements: Insurance companies in Ethiopia are increasingly adopting technology to improve efficiency, enhance customer experience, and introduce innovative products.

- Expanding Product Offerings: Insurers are diversifying their product offerings to cater to the evolving needs of consumers, including products such as motor insurance, property insurance, and life insurance.

Challenges and Opportunities

The Ethiopia insurance market faces several challenges, including:

- Limited Infrastructure: The lack of adequate infrastructure, particularly in rural areas, can hinder the growth of the insurance industry.

- Low Insurance Penetration: Despite recent progress, insurance penetration in Ethiopia remains relatively low compared to other countries.

- Competition: The market is becoming increasingly competitive, with both domestic and international insurers vying for market share.

Despite these challenges, the Ethiopia insurance market presents numerous opportunities:

- Growing Population: Ethiopia's large and growing population offers significant potential for the insurance market.

- Urbanization: The increasing urbanization of the population is creating new demand for insurance products, such as home insurance and motor insurance.

- Economic Development: Ethiopia's economic development is driving demand for insurance products, particularly among businesses.

Conclusion

The Ethiopia insurance market is a dynamic and growing sector, driven by factors such as economic development, regulatory reforms, and technological advancements. By understanding the key trends, challenges, and opportunities, insurance companies can position themselves for success in this market.