The global specialty food ingredients market size was estimated at USD 101.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. Rapid expansion of key application industries including food and beverages, pharmaceuticals, and personal care, and growing penetration of organized as well as e-retail across the world are primarily fueling growth in the industry. Specialty food ingredients typically preserve, texture, emulsify, color, and help to process and add an extra health dimension to produced food. They are all key to guaranteeing a wide range of processed foods offered today to consumers. They range from micro-ingredients such as vitamins, minerals, and enzymes to macro-ingredients such as specific proteins, fats, carbohydrates, fibers, and other substances. Moreover, the market is driven by the demand for products that are free from artificial ingredients and additives. This has led to the development of clean-label ingredients that use natural and simple ingredients.

With their technological, nutritional, and health-related functions, they make the food tasty, pleasant to eat, safe, sustainable, healthy, and affordable. Specialty foods are outpacing their non-specialty counterparts in almost all categories due to a rise in awareness regarding the overall food quality. Specific categories aligned with better-for-you options, health and wellness, and freshness are growing at the fastest rate.

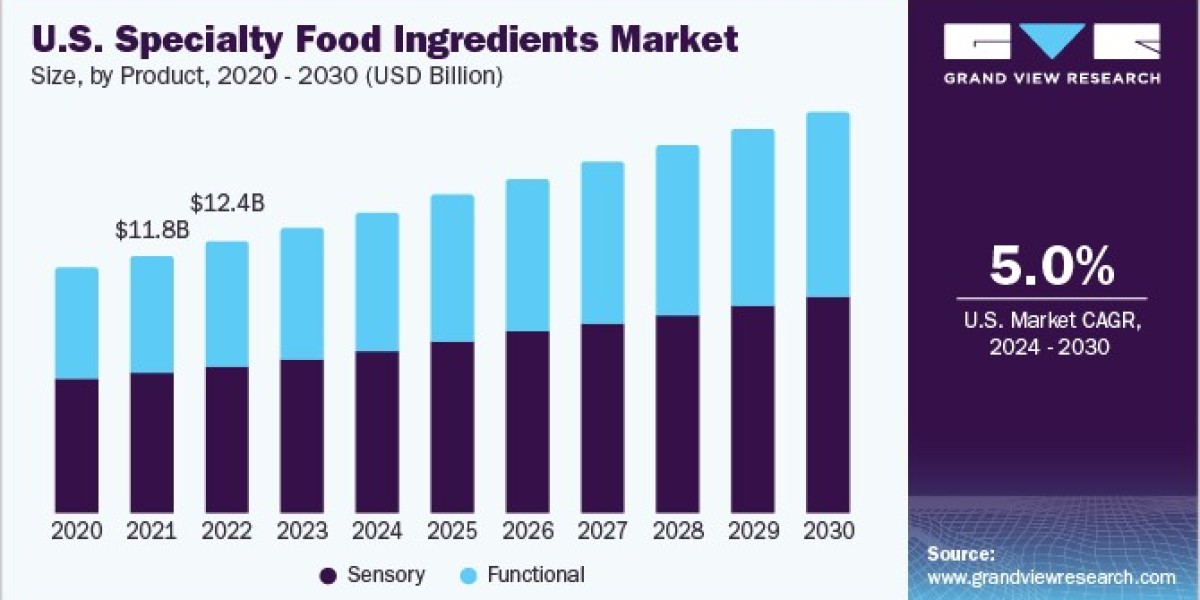

In the U.S. market, functional specialty food ingredients under the product segment are expected to witness robust growth from 2024 to 2030. The high penetration of organized retail across the country has also significantly contributed to a large share of specialty food ingredients in the country. The changing lifestyles, growing urban population, rising economic activities in emerging countries, and increasing penetration of e-retail worldwide are a few macro factors driving the global market.

The demand for food is poised to grow as the world population is expected to increase from 7.3 billion in 2015 to 9.7 billion in 2050, which, in turn, is anticipated to fuel demand for specialty food ingredients. Furthermore, as consumer shopping habits have drastically changed due to the COVID-19 outbreak, specialty ingredients companies that service center-of-the-store retail categories have observed an increase in sales over the past few weeks as consumers have drastically increased their purchases of center-of-store products.

Detailed Segmentation:

Material Insights

The aluminum segment accounted for the largest revenue share of 38.3% in 2022. The major portion of the demand in this segment is projected to come from emerging markets, especially from the automotive, construction, and oil & gas sectors. Finished casting products are likely to remain a key area for investors. As per the World Foundry Organization, the production volume of iron casting increased by 0.8% in 2017 compared to the previous year. It was 156.58 kilotons in 2017. The production of ductile iron and grey iron metal products observed a growth rate of 1.1% and 1.3%, respectively, in 2017 compared to 2016.

Application Insights

The automotive segment held the largest revenue share of 59.5% in 2022. The global automotive production has been observing gradual yet encouraging growth in global automotive production over recent years. The global automotive production rose by 2.3% in 2017, according to data from the International Organization of Motor Vehicle Manufacturers. The incorporation of aluminum in order to achieve weight reduction will continue to hold significant importance for both automakers and market vendors.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 55.4% in 2022. Asia Pacific is characterized by the presence of skilled labor at low cost, which makes it the most lucrative region for manufacturers to set up production facilities. A shift in the global production landscape toward emerging economies, especially China and India, is expected to positively influence market growth over the forecast period. The rapidly expanding automobile sector in the region is expected to further boost the market growth over the forecast period.

Browse through Grand View Research's Food Additives & Nutricosmetics Industry Research Reports.

• The global fumaric acid market size was valued at USD 561.5 million in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. This growth is attributed to the rising need for processed food and beverages, population growth, and dietary changes.

• The global nisin market size was estimated at USD 502.93 million in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. This growth is due to the increasing number of health-conscious consumers, who have become more aware of the importance of organic ingredients in food and beverages, leading to a higher demand for nisin.

Key Companies profiled:

• Naturex

• Givaudan

• Eli Fried Inc.

• KF Specialty Ingredients

• Ingredion

• Associated British Foods Plc

• Kerry Group

• Agropur Cooperative

• Ashland Inc

• Archer Daniels Midland Company

• Cargill Inc.

• Wild Flavors GmbH

• DSM

• Diana Group SA

• Tate & Lyle

• CHR. Hansen

Specialty Food Ingredients Market Segmentation

Grand View Research has segmented the global specialty food ingredients market report based on product, application, and region

Specialty Food Ingredients Product Outlook (Revenue, USD Million, 2018 - 2030)

• Sensory

o Enzymes

o Emulsifiers

o Flavors

o Colorants

o Others

• Functional

o Vitamins

o Minerals

o Antioxidants

o Preservatives

o Others

Specialty Food Ingredients Application Outlook (Revenue, USD Million, 2018 - 2030)

• Food & Beverage

o Snacks

o Bakery

o Confectionery

o Dairy Products

o Breakfast Cereals

o Frozen Foods

o Meat, Poultry & Seafood

o Baby Food

o Sauces, Dressings & Condiments

o Alcoholic

o Non-alcoholic

o Others

• Pharmaceutical

• Personal Care

Specialty Food Ingredients Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o U.K.

o France

• Asia Pacific

o China

o India

o Japan

• Central & South America

o Brazil

• Middle East & Africa

o Saudi Arabia

Order a free sample PDF of the Specialty Food Ingredients Market Intelligence Study, published by Grand View Research.