The global simulation software market size was valued at USD 20.96 billion in 2023 and is expected to register a CAGR of 13.8% from 2024 to 2030. Simulation software is a tool used to virtually create a real-time environment to test the applicability and efficiency of different products and processes. Benefits, such as a reduction in production expenditure and reduced costs of training, are expected to drive the market. Furthermore, simulation tools play a major role in determining the effects of military weapons. They also help automotive companies determine the ideal vehicle prototypes for reducing CO2 emissions.

Simulation software is widely adopted by different companies as it helps reduce production costs. The software helps develop several prototypes and test them virtually. Moreover, it helps realize error-free output in a production process, thereby avoiding the production of faulty products and the respective costs involved. It also helps save time spent on R&D activities. All these factors are expected to fuel the market growth. Conventionally, manufacturers incurred huge costs while prototyping products, which involved complex mechanisms. Despite the availability of prototypes, the chances of failure were high, which incurred additional R&D expenses to reduce such product failures.

Gather more insights about the market drivers, restrains and growth of the Simulation Software Market

Detailed Segmenattion:

Component Insights

The software segment dominated the market and accounted for the largest revenue share of over 69.5% in 2023. The segment is expected to remain dominant throughout the forecast period. The growth of this segment can be attributed to the benefits of software, such as data safety, reliability, and uninterrupted testing. Furthermore, under the software segment, finite element analysis is expected to largely contribute to the growth of the segment. FEA is widely used in industries, such as automotive, aerospace, defense, and electronics, to test product quality, performance, and design.

Deployment Insights

On the basis of modes of deployment, the global market has been further segmented into on-premises and cloud. The on-premise deployment segment dominated the market in 2023 and accounted for the largest share of more than 71.4% of the global revenue. The high share of this segment was attributed to the early adoption of the software. On-premise deployment is a traditional method of deployment that involves the installation of the software on-site. This method is beneficial for companies that wish to maintain the confidentiality of their data and secure the data from hackers.

Application Insights

TThe engineering, research, modeling & simulated testing dominated the market accounted for the largest revenue share of 37.3% in 2023. The high segment share is attributed to the robust adoption of simulation software by prominent end-use companies like Airbus, Boeing, Volkswagen Group, and others for product engineering, modeling, research, and testing purposes. In addition, the segment growth is driven by the client’s requirements for quick and quality improvement in a cost-effective manner, allowing companies to foray into the market with new products fast and lower warranty costs.

End-use Insights

The automotive segment dominated the market and accounted for the largest revenue share in 2023, owing to the early adoption of virtual tools for product development.The growth was credited to the early adoption of virtual tools for product development. Furthermore, the automotive industry is witnessing a shift toward the use of electric and autonomous vehicles. The use of simulation to enhance production processes in this industry is primarily driving the growth of this segment.

Regional Insights

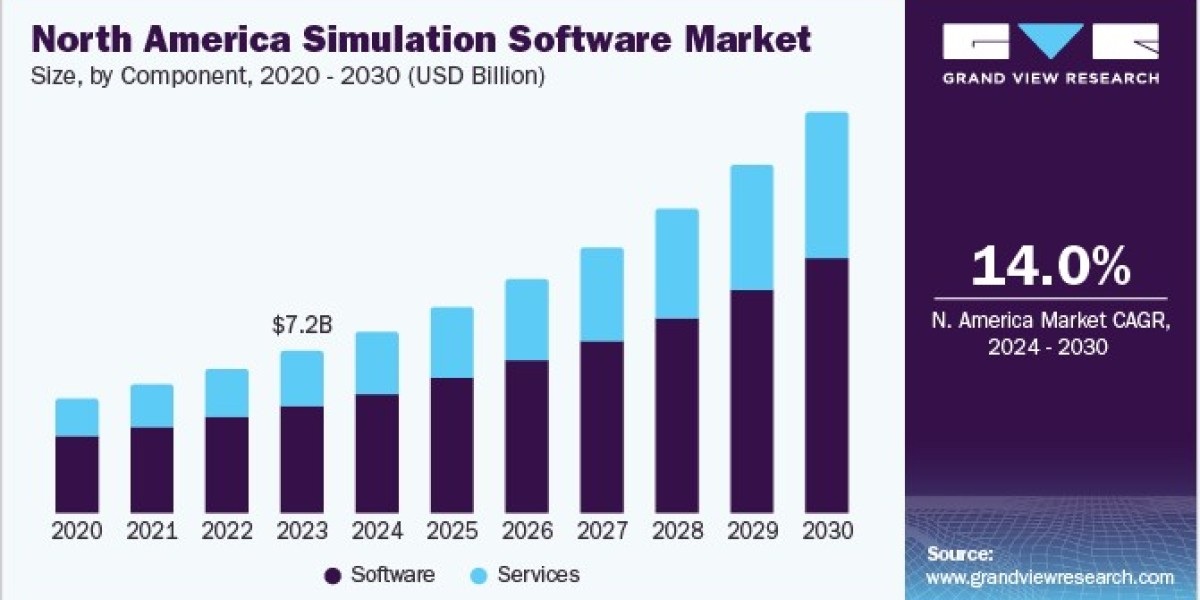

In 2023, North America dominated the target market and accounted for the largest revenue share of 34.2%. The region is expected to continue its dominance over the forecast period on account of the presence of major players in the U.S. and Canada. The companies in these countries have been observed to be investing in research and development activities to introduce technologically advanced products in the market. Moreover, the region is well-known as an early adopter of advanced technologies. In the Asia Pacific, the market is anticipated to witness the fastest CAGR over the forecast period.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global enterprise content management market size was valued at USD 39.46 billion in 2023 and is projected to grow at a CAGR of 15.1% from 2024 to 2030. The increasing volume of digital content organizations generate propels the demand for enterprise content management (ECM) solutions.

• The global application integration market size was valued at USD 15.90 billion in 2023 and is projected to grow at a CAGR of 19.8% from 2024 to 2030. Organizations invest in application integration to streamline business processes, enhance operational efficiency, and support digital transformation initiatives.

Key Simulation Software Company Insights

• Dassault Systemes develops 3D designs, product lifecycle management software, and 3D digital mock-up. The company offers various products and services. The company has around 12 brands. The product portfolio including ENOVIA, CATIA, 3DEXCITE, SOLIDWORKS, DELMIA, GEOVIA, BIOVIA, SIMULIA, 3DVIA, EXALEAD, and NETVIBES.

• ANSYS, Inc. specializes in the development and promotion of engineering simulation software. Utilizing Workbench as a platform for constructing its simulation technologies, the company offers a range of product functionalities. These include 3D design software, electromagnetic field simulation, computational fluid dynamics, optical simulation, semiconductors and structural analysis, as well as systems modeling, simulation, and validation.

• Bentley Systems, Inc. and The MathWorks, Inc. are some of the emerging market participants in the target market.

• Bentley Systems, Inc. develops, licenses, and sells computer software and offers services for infrastructure construction, design, and operations. The company’s primary software product line includes ProjectWise, MicroStation, and AssetWise. The company’s products and services include asset lifecycle information management, bridge analysis, asset reliability, building design, hydraulics & hydrology, modeling & visualization, mine design, operational analytics, plant design, reality modeling, and project delivery, among others.

• The MathWorks, Inc. develops mathematical computing software. The company’s products cater to a variety of applications, including design, simulation, technical computation, visualization, and implementation. The company’s product offerings, such as MATLAB and Simulink, are used across various industries and industry verticals for research & development purposes and modeling and simulation.

Key Companies profiled:

• Altair Engineering, Inc.

• Autodesk Inc.

• Ansys, Inc.

• Bentley Systems, Inc.

• Dassault Systèmes

• MathWorks, Inc.

• Rockwell Automation, Inc.

• Simulations Plus

• ESI Group

• GSE Systems

Simulation Software Market Segmentation

Grand View Research has segmented the global simulation software market on the basis of component, deployment, application, end-use, and region:

Simulation Software Component Outlook (Revenue, USD Million, 2017 - 2030)

• Software

• Services

o Simulation Development Services

o Training and Support & Maintenance

Simulation Software Deployment Outlook (Revenue, USD Million, 2017 - 2030)

• On-Premise

• Cloud

Simulation Software Application Outlook (Revenue, USD Million, 2017 - 2030)

• Engineering, Research, Modeling & Simulated Testing

• High Fidelity Experiential 3D Training

• Gaming & Immersive Experiences

• Manufacturing Process Optimization

• AI Training & Autonomous Systems

• Planning And Logistics Management & Transportation

• Cyber Simulation

Simulation Software End-use Outlook (Revenue, USD Million, 2017 - 2030)

• Conventional Automotive

• Electric Automotive and Autonomous Vehicles

• Aerospace & Defense

• Electrical, Electronics and Semiconductor

• Healthcare

• Robotics

• Entertainment

• Architectural Engineering and Construction

• Others

Simulation Software Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

• Europe

o U.K.

o Germany

o France

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

• Latin America

o Brazil

o Mexico

• Middle East & Africa (MEA)

o KSA

o UAE

o South Africa

Order a free sample PDF of the Simulation Software Market Intelligence Study, published by Grand View Research.

Recent Developments

• In May 2022, Dassault Systemes announced that it has collaborated with the BMW Group to establish the vehicle development programs with increased efficiency. The two businesses worked together to develop an industry-ready, process-oriented solution for stamping die design and stamped sheet metal component definition that will boost the effectiveness of the parts production and design process with the invaluable assistance of BMW Group's in-depth process and specialist know-how.

• In June 2022, ANSYS, Inc announced that the company has joined the Intel Foundry Services Cloud Alliance. Intel Foundry Services is a completely vertical, independent foundry company by Intel. This interoperable, semiconductor design workflow enabled with cloud technology is made possible by Ansys products, such as Ansys HFSS, Ansys Totem, Ansys RedHawk-SC, Ansys VeloceRF, Ansys PathFinder, and Ansys RaptorX, and will assist present and prospective Intel customers increase their productivity.