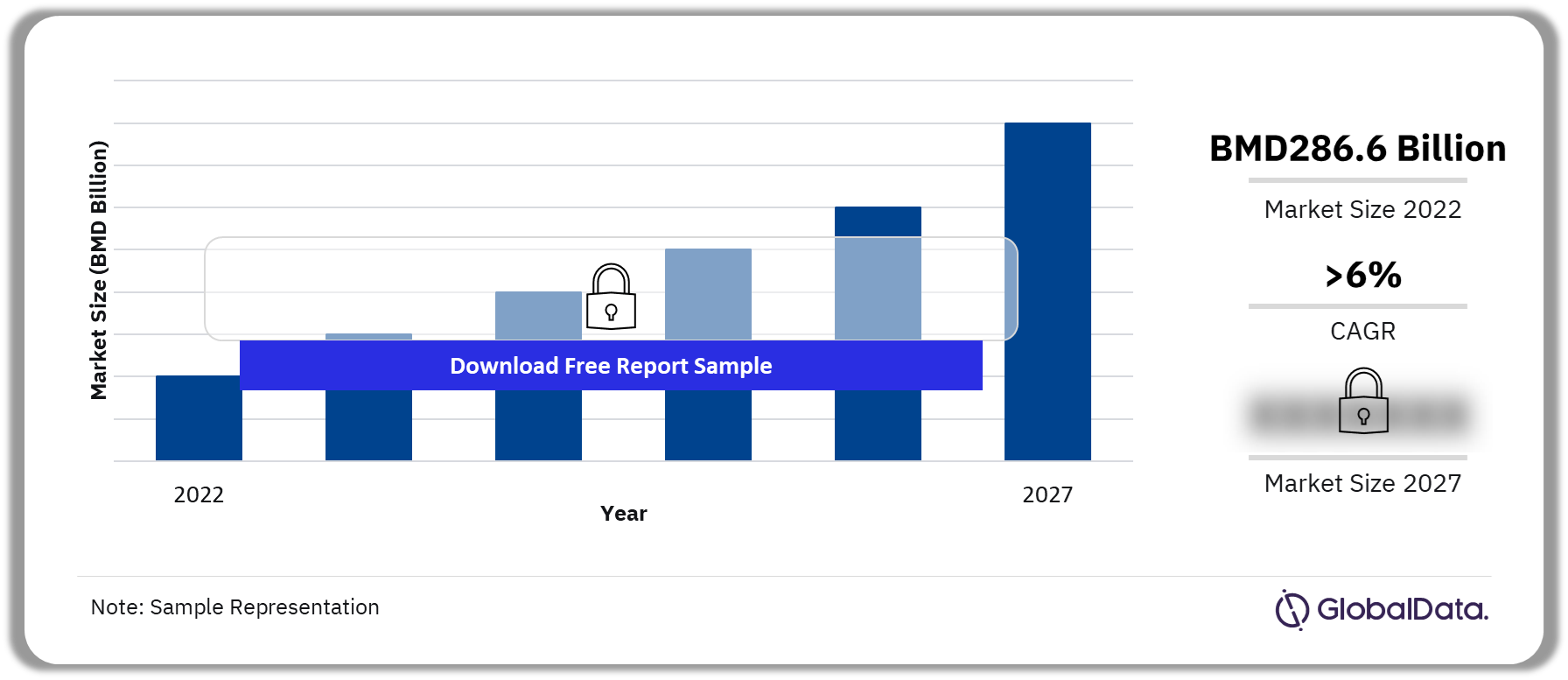

Bermuda Insurance Market has long been recognized as a global leader in the insurance and reinsurance sectors, offering a robust regulatory environment, favorable tax policies, and access to capital markets. With a history rooted in innovation, Bermuda’s insurance market has evolved to become a hub for both traditional and alternative risk transfer solutions.

Buy the Full Report or Download a Free Sample Report for Bermuda’s Insurance Industry Forecasts

Overview of the Bermuda Insurance Market

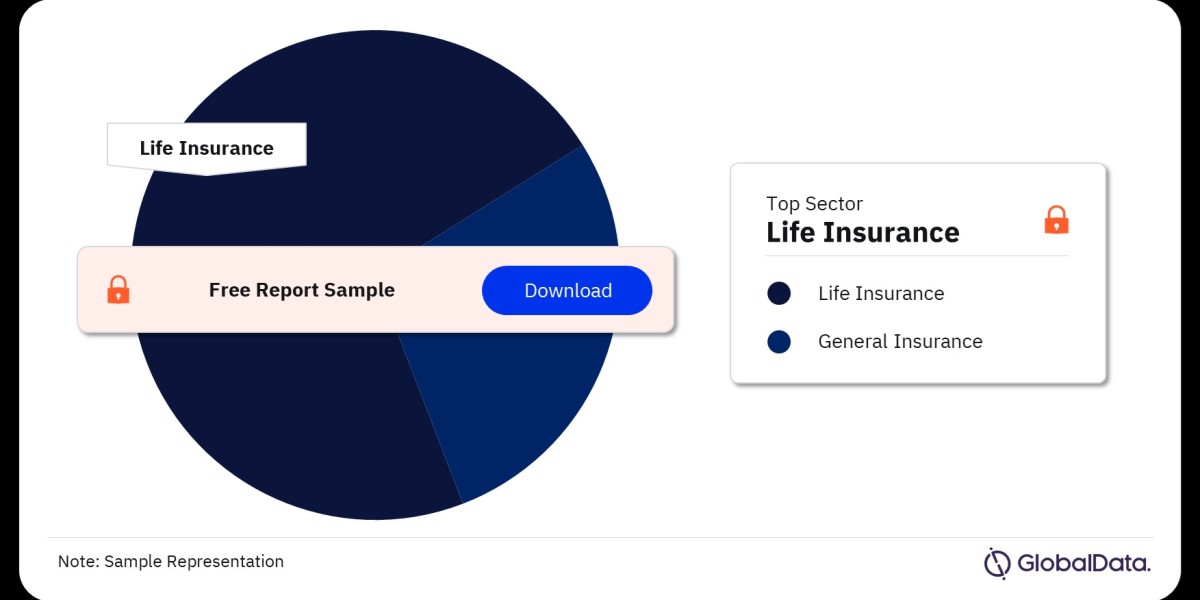

Bermuda is home to a highly developed and diversified insurance market, with a particular focus on international insurance and reinsurance. The island’s strong regulatory infrastructure and business-friendly environment have made it a preferred jurisdiction for insurers, reinsurers, and alternative risk carriers. Key sectors within Bermuda’s insurance market include:

Property and Casualty Insurance: Bermuda is a leading provider of property and casualty (P&C) insurance, particularly for large-scale commercial risks. The island's reinsurers play a significant role in covering global catastrophic risks such as hurricanes, earthquakes, and wildfires.

Reinsurance: Bermuda’s reinsurance market is one of the largest in the world, offering capacity to cover major risks faced by global insurers. The island’s reinsurers provide protection to primary insurers, ensuring that catastrophic losses do not cripple the wider industry.

Captive Insurance: Bermuda has established itself as a leading domicile for captive insurance companies. Captives allow companies to self-insure risks by creating an insurance subsidiary. The captive insurance market in Bermuda continues to grow, with corporations from a wide range of industries utilizing captives to manage and mitigate risks.

Insurance-Linked Securities (ILS): Bermuda is the world’s leading center for insurance-linked securities, a rapidly growing market segment that connects insurance risk to capital markets. ILS products such as catastrophe bonds (CAT bonds) provide investors with opportunities to assume risk in exchange for potentially high returns, while also offering insurers additional capacity.

Key Drivers of Growth in Bermuda’s Insurance Market

Several factors contribute to Bermuda’s continued success as a global insurance hub, positioning it for further growth:

Regulatory Excellence: The Bermuda Monetary Authority (BMA) is known for its effective and risk-based regulatory framework, which balances flexibility with financial stability. The BMA’s proactive approach to regulation has helped Bermuda maintain its reputation as a well-regulated and transparent jurisdiction, particularly following its designation as a Solvency II-equivalent market by the European Union. This equivalence grants Bermuda insurers access to European markets under similar regulatory standards.

Favorable Tax Environment: Bermuda’s tax-neutral status is another major draw for insurers and reinsurers. The island imposes no corporate income taxes, capital gains taxes, or withholding taxes, making it an attractive jurisdiction for global companies seeking tax efficiency.

Proximity to Major Markets: Bermuda’s location offers a strategic advantage, providing easy access to both North American and European markets. Many of the world’s largest insurers, reinsurers, and financial institutions operate from Bermuda due to its advantageous time zone and proximity to key financial centers.

Innovation in Risk Transfer Solutions: Bermuda’s insurance market has been at the forefront of developing innovative risk transfer solutions, including the use of insurance-linked securities, parametric insurance products, and catastrophe bonds. These innovations have enabled the market to remain competitive and responsive to global demand for new ways to manage and transfer risk.

Growing Demand for Catastrophe Coverage: As climate change continues to exacerbate the frequency and severity of natural disasters, there is increasing demand for catastrophe insurance and reinsurance. Bermuda-based reinsurers are well-positioned to meet this demand, with the expertise and capacity to underwrite complex risks related to natural disasters and extreme weather events.