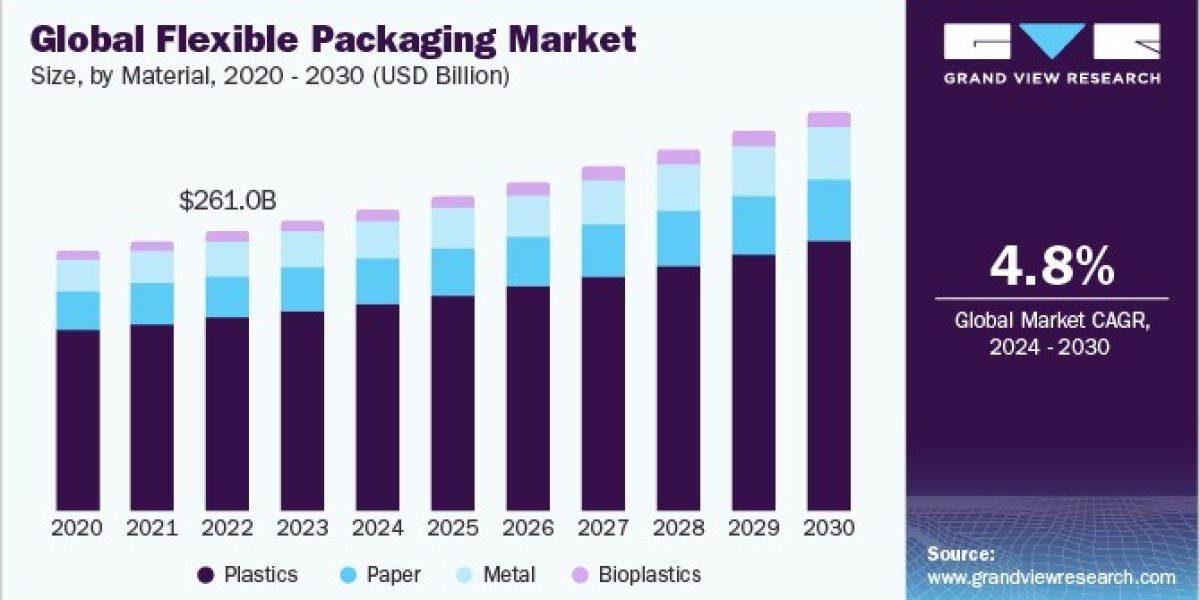

The global flexible packaging market size was estimated at USD 270.96 billion in 2023 and is expected to expand at a CAGR of 4.8% from 2024 to 2030. Increasing consumption of flexible packaging products in medical and pharmaceutical sectors is driving their demand. These products offer various advantages, such as container variety, need for less raw materials, ease of disposal, and lightweight nature, which are expected to fuel their demand over the forecast period.

According to the Flexible Packaging Association, nearly 34.7 million tons of all produced food is sent to landfills annually. Food waste generates 27.0 million tons of carbon dioxide. In addition, there are other indirect effects of food production on the environment, which include the greenhouse gases generated from cattle breeding, farm machinery, vehicles that transport food, and nutrient runoff from fertilizers that often lead to water pollution.

Gather more insights about the market drivers, restrains and growth of the Flexible Packaging Market

Detailed Segmentation:

Material Insights

Based on material, plastics dominated the market with the largest revenue share of 69.08% in 2023. The demand for plastic in flexible packaging industry is expected to increase over the next seven years. Plastic is widely used in the food & beverage industry as they can take various forms and shapes which is a crucial advantage in this industry.

Product Insights

Based on product, the pouches segment dominated the market with the largest revenue share in 2023. Pouches are small-sized single-use bags commonly made of plastic, aluminum foil, and occasionally of paper. They consist of two or more plastic films that are laminated together using heat and pressure or adhesives. Pouches are resealable and are considered a cost-effective alternative to metal, cardboard, and glass containers. Most pouches available in the market are multilayered.

Application Insights

Key applications for flexible packaging products include food, beverages, pharmaceutical & healthcare, and personal care & cosmetics among others. The food segment dominated the market with the largest revenue share in 2023. Growing demand for packaged foods, including ready-to-eat meals, frozen meals, snack foods, and cake mixes, is expected to force flexible packaging manufacturers to increase production capacity, thus augmenting flexible packaging market demand over the forecast period.

Regional Insights

North America has several flexible packaging manufacturers such as Amcor plc, ProAmpac, Mondi, American Packaging Corporation, Cheer Pack North America, and Eagle Flexible Packaging. These players are constantly engaged in developing sustainable flexible packaging options for various end-use industries to strengthen their market presence which can increase the penetration of flexible packaging solutions in North America. The government programs focused on increasing the labeling and traceability of the packaging circulating in the region are driving end-use industry companies to adopt flexible packaging solutions. In April 2023, Cheer Pack North America developed a new flexible packaging solution for packaging ScottsMiracle-Gro’s weed and grass killer concentrate. The company developed 5-ounce flexible spouted pouches that are the first of their kind in the lawn care market.

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports.

• The global molded pulp packaging market size was estimated at USD 5.45 billion in 2023 and is expected to grow at a CAGR of 7.4% from 2024 to 2030.

• The global plastic market size was estimated at USD 624.8 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030.

Key Companies profiled:

• Amcor plc

• Mondi Group

• Huhtamaki Flexible Packaging

• Sonoco Products Company

• Sealed Air

• DS Smith

• Berry Global

• Constantia Flexibles

• Bemis Manufacturing Company

• UkrMetal

• ProAmpac

• Wipak Group

• FlexPak Services

• Transcontinental Inc.

• Coveris Holdings

• American Packaging Corporation

• InterFlex Group

• FLEX-PACK ENGINEERING, INC.

• Innovia Films

• Cosmo Films

• Novolex

• Sigma Plastics Group

• Graphic Packaging International, LLC

• Bischof+Klein SE & Co. KG

• Südpack

Flexible Packaging Market Segmentation

Grand View Research has segmented the global flexible packaging market report based on material, product, application, and region

Flexible Packaging Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Plastics

o Polyethylene (PE)

o Polypropylene (PP)

o Polyamide (PA)

o Polyvinyl Chloride (PVC)

o Polystyrene (PS)

o Others

• Paper

• Metal

• Bioplastics

Flexible Packaging Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Bags

• Pouches

o Retort Pouches

o Refill Pouches

• Rollstock

• Films & Wraps

• Others

Flexible Packaging Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Food

• Beverages

• Pharmaceutical & Healthcare

• Personal Care & Cosmetics

• Others

Flexible Packaging Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Italy

o Spain

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

o Indonesia

o Malaysia

o Philippines

o Thailand

o Vietnam

o Myanmar

• Central & South America

o Brazil

o Argentina

• Middle East & Africa

o Saudi Arabia

o UAE

o South Africa

Order a free sample PDF of the Flexible Packaging Market Intelligence Study, published by Grand View Research.

Recent Developments

• In May 2024, Amcor and AVON both combinedly launch the AmPrima Plus refill pouch for the AVON Little Black Dress classic shower gels in China. The recycle-ready packaging will result in an 83% reduction in carbon footprint, and 88% and 79% reduction in water consumption and renewable energy respectively when it's recycled.

• In August 2023, Amcor acquired Phoenix Flexibles, expanding its capacity in Indian market. Phoenix Flexibles is situated in Gujarat, India, and generates revenue of approximately USD 20 Mn per year from the sale of flexible packaging for food, home care and personal care applications. The acquisition also adds advanced film technology, enabling local production of a broader range of more sustainable packaging solutions, and brings capabilities allowing Amcor to expand its product offering in attractive high-value segments.

• In February 2023, Sealed Air acquired Liquibox for a purchase price of USD 1.15 Bn on a cash and debt-free basis. Liquibox is a pioneer, innovator and manufacturer of Bag-in-Box sustainable fluids & liquids packaging and dispensing solutions for fresh food, beverage, consumer goods and industrial end-markets.