The Ethiopian construction market has been experiencing rapid growth in recent years, driven by the country's ambitious infrastructure projects and a growing demand for residential, commercial, and industrial developments. With a population exceeding 120 million and one of the fastest-growing economies in Africa, Ethiopia presents a wealth of opportunities for local and international construction companies. In this article, we provide an in-depth look at the current state of the Ethiopian construction market, the key factors driving its growth, major challenges, and future prospects.

Key Drivers of Growth in Ethiopia's Construction Market

1. Government Infrastructure Initiatives

One of the primary drivers of the construction boom in Ethiopia is the government's commitment to large-scale infrastructure projects. The Ethiopian government has prioritized infrastructure development as part of its Growth and Transformation Plan (GTP), with a focus on expanding transport networks, energy generation, and industrial zones.

Some of the major projects include:

- Addis AbabaDjibouti Railway: A key transportation link connecting Ethiopia's capital with Djibouti's port, facilitating trade and logistics.

- Grand Ethiopian Renaissance Dam (GERD): One of Africas largest hydroelectric dams, aimed at boosting the countrys power generation capacity and supporting industrial growth.

- Road and Highway Projects: Expansion of road networks across the country, improving connectivity between urban and rural areas.

2. Urbanization and Housing Demand

Ethiopia's urban population is growing rapidly, with increasing demand for residential housing in major cities like Addis Ababa, Dire Dawa, and Mekele. Urbanization has led to a surge in housing projects, including affordable housing schemes, mixed-use developments, and luxury apartments. Real estate developers are capitalizing on this trend by constructing modern apartment complexes, commercial buildings, and shopping malls to accommodate the growing middle class.

3. Foreign Direct Investment (FDI)

The Ethiopian government has created a favorable environment for foreign direct investment (FDI) in the construction sector by offering incentives such as tax breaks, duty-free imports of construction equipment, and land leasing. As a result, several international construction companies from China, Turkey, and the Middle East have entered the Ethiopian market, bringing with them new technologies and expertise.

4. Industrial Parks Development

The Ethiopian government has made significant investments in developing industrial parks to attract investors and promote manufacturing. These industrial zones are designed to support the country's goal of becoming a major manufacturing hub in Africa, particularly in textile and garment production, leather products, and agro-processing industries.

Challenges Facing the Ethiopian Construction Market

1. Shortage of Skilled Labor

A major challenge facing the Ethiopian construction sector is the shortage of skilled labor. While there is a large pool of general labor available, there is a scarcity of professionals such as engineers, architects, and project managers with the necessary skills to handle large-scale and complex construction projects. This has led to delays in project execution and increased reliance on foreign expertise.

2. High Construction Costs

Rising construction material costs have been a persistent challenge for developers in Ethiopia. The cost of materials such as cement, steel, and aggregates has increased significantly due to limited local production and reliance on imports. Fluctuations in global commodity prices and transportation costs further exacerbate this issue, affecting project budgets and timelines.

3. Bureaucratic Hurdles and Regulatory Framework

The bureaucratic red tape involved in acquiring permits, licenses, and land for construction projects in Ethiopia can cause significant delays. Although the government has made efforts to streamline processes, many developers still face challenges with lengthy approval procedures and complex land acquisition policies.

Future Prospects and Opportunities

1. Green Building and Sustainable Construction

With growing awareness of environmental issues, there is increasing demand for green building practices and sustainable construction in Ethiopia. Developers and construction companies are beginning to adopt eco-friendly materials, energy-efficient designs, and water-saving technologies. As environmental regulations become stricter, the demand for green construction is expected to rise, creating new opportunities for innovation in the sector.

2. Expansion of Transport and Energy Infrastructure

The Ethiopian government plans to continue its focus on expanding transportation networks and energy infrastructure. Projects such as the Lamu Port-South Sudan-Ethiopia Transport (LAPSSET) Corridor and further expansions of the Addis Ababa Light Rail are expected to enhance connectivity and support trade within the region. Additionally, investments in renewable energy projects, including wind and solar power, will provide the necessary energy capacity for future industrial growth.

3. Real Estate Development

The demand for modern housing, commercial properties, and office spaces is expected to remain high as Ethiopia's urban population continues to grow. Real estate developers have opportunities to capitalize on this trend by delivering quality, affordable housing solutions and upscale properties catering to the country's expanding middle class and expatriate community.

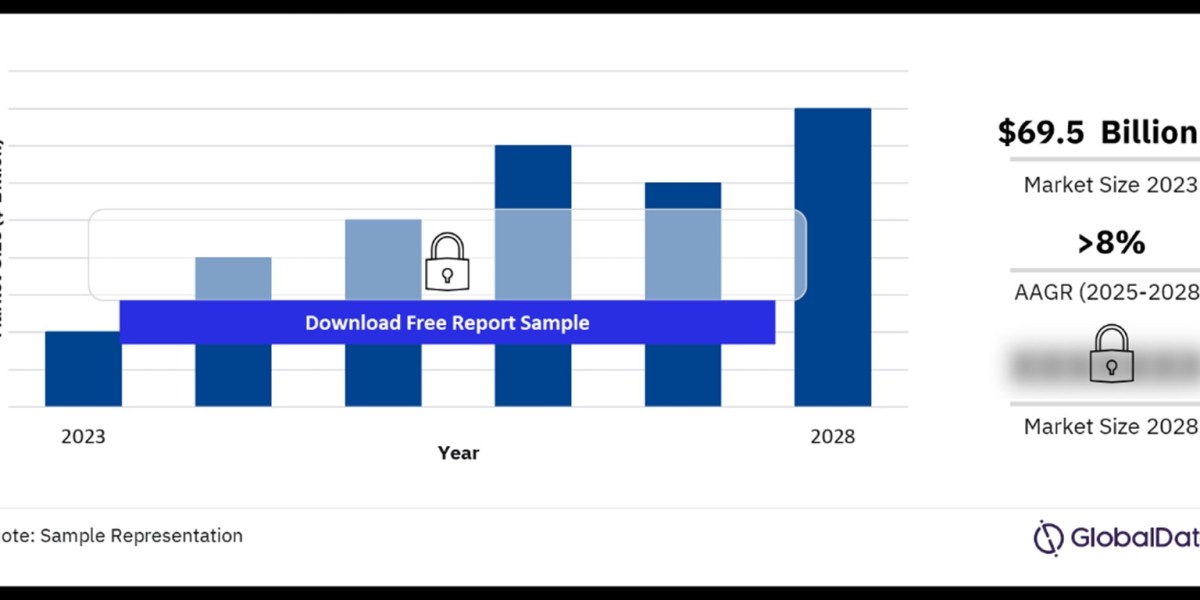

Buy the Full Report to Learn More about the Ethiopia Construction Market Forecast