Key Highlights of the Report:

In 2023, ABB India launched eco-efficient switchgear PrimeGear™ ZX0, with SF6-free alternatives for applications up to 12 kV reducing the global warming potential by 100%

In 2023, Toshiba Transmission & Distribution Systems (India) Private Limited (TTDI received orders for 23 units of 400kV and 9 units of 220kV Gas Insulated Switchgear (GIS) for the development and enhancement of power transmission and distribution networks to the new 2X500MVA substation at Xeldem in Goa and pooling substations of solar and wind renewable project at Alamuru and Kodamuru at 400kV voltage levels

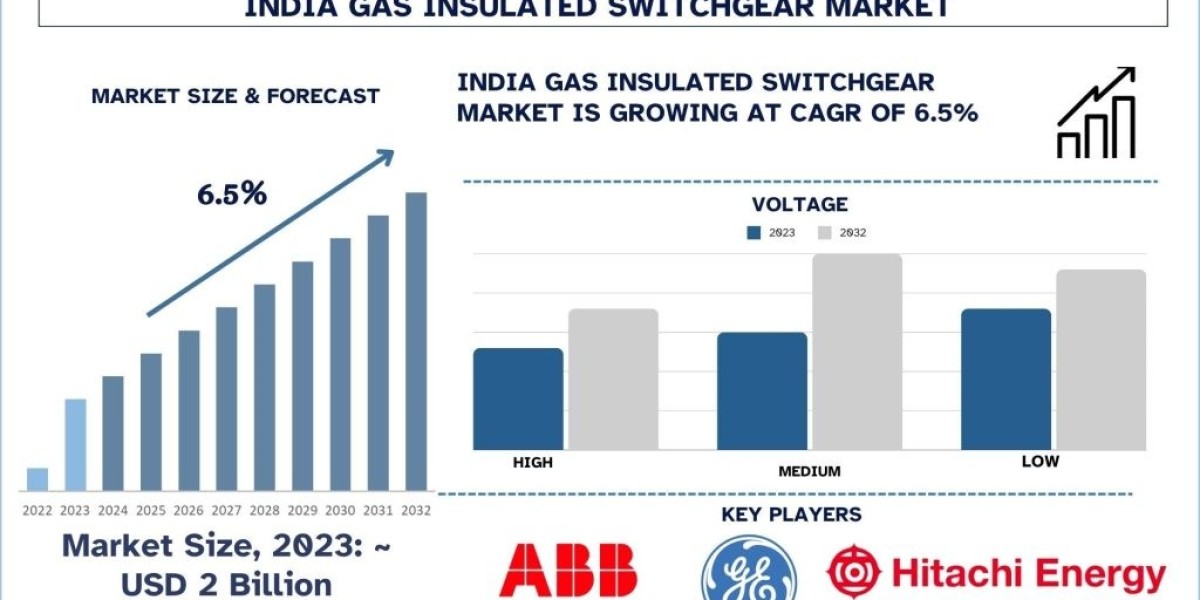

According to a new report by Univdatos Market Insights, India's gas-insulated switchgear Market was valued at USD 2 Billion in 2023 and growing at a CAGR of 6.5%. The Indian gas-insulated switchgear (GIS) market is in the progressive phase of its life cycle with more advanced technology, government-supporting policy, and growing requirements for effective power systems. Thus, the well-proven gas-insulated switchgear technology characterized by compactness, high reliability, and low demands on maintenance is gradually becoming one of the most popular options for modernizing and expanding the Indian power grid. This article focuses on market trends, major vendors, and government policies influencing the geographical information system market.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=64681

Recent Market Developments:

Major Stakeholders and Innovation Trends

Key Players in India are offering GIS services to the growing power sector is expected to change owing to the increasing power demand. Most leading and prestigious firms like Siemens Ltd., ABB India Ltd., General Electric (GE) India, Schneider Electric India Limited, and Hitachi Energy India are dominating the market with their sophisticated GIS solutions.

Siemens Ltd. has not been left behind in this area of GIS technology with the coming up of the 8DJH 12 a compact and highly reliable switchgear mostly used in urban areas. This GIS system has minimal effects on the natural environment and emphasizes secure performance, which is essential for developing contemporary infrastructures.

Similarly, ABB India Ltd. is updating its GIS with the help of the new introductions regarding its UniGear ZS1 system. This solution also involves adopting a smarter grid which in turn focuses on the deployment of a PRO, digital monitoring, and control to offer utilities valuable data that can include predictive maintenance prospects. The use of digital technologies in Smart grids is evident in ABB’s corporate strategy with the trends currently observed in the Indian power sector.

Further, Schneider Electric India has recently launched its SmarTAS GIS primarily based on energy efficiency, with flexibility of operations. This system’s primary purpose is to enhance the connection of renewable energy sources and stability in the supply of electric power.

Hitachi Energy India which was earlier known as ABB Power Grids has been about extending its GIS product offering for various requirements such as renewable energy and smart grid. Their GIS products are however made to work under the higher expectations of the growing urban markets as well as the more untouched rural markets.

These companies are not only pushing the envelope of GIS advancement, but they are also partnering with utilities and infrastructural development firms to record solutions that are custom-built for their respective localities.

Government Initiatives Driving Demand

Power Sector Reforms: The Indian government has lately initiated the following reforms aimed at restructuring the power sector in the country; The Pradhan Mantri Sahaj Bijli Har Ghar Yojana also known as Saubhagya is one of the flagship schemes of the government of India aimed at providing electricity to all households of the country by the end of the year 2018. They concern themselves with such areas as electrification and distribution which are areas that can facilitate the use of GIS.

Renewable Energy Integration: Therefore, India’s plan to achieve 500 GW of renewable power by 2030 requires sophisticated GIS solutions in power distribution and renewables integration for solar and wind power generation projects.

National Infrastructure Pipeline (NIP): It seeks to improve the overall capacity, especially in areas that concern power and transportation. Current development in the power industry is revealing the need to enhance GIS technology, and this is well captured by the NIP which is already tightening up the power infrastructure.

The GIS market in India is experiencing several notable trends in 2023, driven by technological advancements, market dynamics, and evolving customer needs.

Integration of Digital Technologies: Advancements in the GIS industry are characterized by the increased use of digital solutions in GIS systems. Modern GIS solutions offered by reputed firms like Siemens and ABB will upgrade products with digital supervisory and management features in 2023. For instance, Siemens’ 8DJH 12 GIS system utilizes Sensors with communication technology that enables utilities to detect the performance of the system and or any developing problems in the course of operating the system.

For more information about this report visit- https://univdatos.com/report/india-gas-insulated-switchgear-market/

Increased Focus on Sustainability: This paper notes that the current trends of thinking in terms of sustainability and greenhouse gas emissions are impacting GIS technology innovation. The SmarTAS GIS system of Schneider Electric for example is crafted with the efficiency of operations in mind, cutting costs with emphasis on environmental factors. These findings are in line with the Indian government’s other longer-term objectives of sustainable growth and combating climate change.

Rural Electrification Projects: The government has made rural electrification a point of emphasis as a result of which GIS solutions are being demanded more in the rural and semi-urban regions. During 2023, several projects launched under Saubhagya have installed GIS technology to enhance the reliability of the distribution network of such areas.

Urban Infrastructure Development: The rapid urbanization taking place in Indian cities mandates compact and efficient power solutions. Prominent new urban development projects in cities such as Mumbai and Bengaluru are incorporating efficient GIS solutions to deal with limited space and guarantee power availability.

Related Reports-

India LPG Market: Current Analysis and Forecast (2024-2032)

India Special Vehicle Market: Current Analysis and Forecast (2024-2032)

Conclusion

The Indian gas-insulated switchgear market is expected to grow at a good pace in coming years with growing technology innovation, government support, and because of growing demand for reliable and effective power systems. Some of the major industry players include Siemens, ABB, Schneider Electric, and Hitachi Energy among others, which are continuously coming up with attractive GIS solutions that suit the various segments of the power industry. It further added that government programs like Smart Cities Mission, integration of renewable energy, and rural electrification also help in boosting GIS technology. Ever-emerging pressures like Digitization, Globalization, and Urbanization would define the GIS market in India.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2024−2032F.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by voltage, application, and Regions

Competitive Landscape – Top Key Vendors and Other Prominent Vendors