The Indian Semiconductor Market is expected to grow according to the regional dynamics that can capitalize on local enablers. Karnataka heads as the design state, Tamil Nadu is the manufacturing state; and Andhra Pradesh and Telangana work on establishing semiconductor parks and nurturing innovation through Startups. Maharashtra has a widespread industrial structure while Gujarat has been getting investments in electronic and renewable energy sectors. These regional projects backed by government standards and a highly trained talent pool working in tandem to collectively advance the semiconductor industry in India are positioning the country for further elevated involvement in the semiconductor ecosystem.

1. Karnataka

· Bengaluru as a Technology Hub: Famously referred to as the Silicon Valley of South India Bengaluru is also famous for semiconductor design and engineering. However, the city is also the epicenter of various emerging organizations involved in chip design, embedded systems, and numerous IoT projects.

· R&D and Collaboration: This is backed by the robust technology industry and university partnerships that continue to fuel the creation of such developments in Bengaluru. Measures by IISc and various engineering colleges give back skilled people and innovations to the sector.

· Investment Surge: The state government has policies that in a way will provide incentives to investors; this has been able to attract the most prominent semiconductor companies and the state is pro-entrepreneurial for start-ups.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=66556

2. Tamil Nadu

· Manufacturing Leadership: As a consequence, Tamil Nadu has become a center of the electronics and semiconductor industry with many assembly and manufacturing units located in Chennai and Coimbatore.

· Government Initiatives: Proactive policies that are approved by the state government include tax incentives, and infrastructure development to accommodate the operations of local and international companies, which improves semiconductor manufacturing.

· Sectoral Diversification: Semiconductors are used in the automotive industry, consumer electronics, and telecom industries which is why the players in the industry have invested in manufacturing facilities to meet the expanding market demand.

3. Andhra Pradesh

· Emerging Semiconductor Parks: The state is in the process of creating semiconductor parks in a bid to improve production systems and lure companies involved in the manufacture of semiconductors from across the globe.

· Investment and Infrastructure: Accordingly, the state government, more specifically targeted towards infrastructure, is providing a load of support by creating a favorable environment for the establishment of semiconductor manufacturing and different forms of incentives.

· Collaboration with Academia: Cohesion with universities and research institutions helps in the funding of innovation as well as supporting professionals in the area of specialization whereby semiconductor belongs to this category as well as supplying innovation talents to this sector.

4. Telangana

· Hyderabad's Role: At the same time, Hyderabad is still in the process of becoming one of the important IT cities, and semiconductor companies and research institutes have been attracted. The presence of the city and the development of transport facilities are important factors.

· Startup Ecosystem: There are also a lot of startups related to IoT, AI, and semiconductors and these are driving a healthy environment further supported by government policies in favor of startups and innovation.

· Government Support: The Government of the state is also involved in the technology industry growth and supports and helps semiconductor firms and research programs.

5. Maharashtra

· Established Industry Base: Leading semiconductor companies and their research centers are located in Maharashtra; the widely known regions are Mumbai and Pune; they have a strong influence on the market.

· Diverse Industrial Landscape: Long-term growth across segments such as automotive, aerospace and telecommunication enhance the implementation of semiconductors and, therefore, support the parts market.

· Investment in Infrastructure: Strengthening investment in the technology parks and incubation centers has been proposed to expand semiconductors, sustaining the competitiveness of the state.

For more information about this report visit- https://univdatos.com/report/india-semiconductor-market/

6. Gujarat

· Investment Opportunities: Gujarat is experiencing an increased influx of Investment towards Electronics Manufacturing, with Gujarat State policies for Semiconductor Companies.

· Policy Support and Incentives: Favourable policies and government measures to boost manufacturing and exports are trying to lure semiconductor firms to build their base in the state.

· Focus on Renewable Energy: Semiconductor components integrated into renewable energy, particularly solar, show increasing demand; thus making Gujarat a market in the rising field.

Recent Developments in these states are:

In September 2024, the Indian government approved the establishment of a new semiconductor manufacturing unit by Kaynes Semicon Pvt Ltd in Sanand, Gujarat.

In September 2024, Maharashtra Chief Minister Eknath Shinde inaugurated the state’s first semiconductor manufacturing OSAT (Outsourced Semiconductor Assembly and Test plants) plant in Navi Mumbai which will reduce the country’s reliance on imported semiconductor chips.

In August 2024, Gujarat-based semiconductor company Suchi Semicon announced to inaugurate the state’s first Outsourced Semiconductor Assembly and Test (OSAT) facility in Surat this November, marking a critical advancement for India’s semiconductor ecosystem. The plant is expected to create about 1,200 jobs, focusing on advanced semiconductor assembly and testing.

Related Reports-

India Heat Transfer Fluids Market: Current Analysis and Forecast (2024-2032)

India Gas Insulated Switchgear Market: Current Analysis and Forecast (2024-2032)

Conclusion

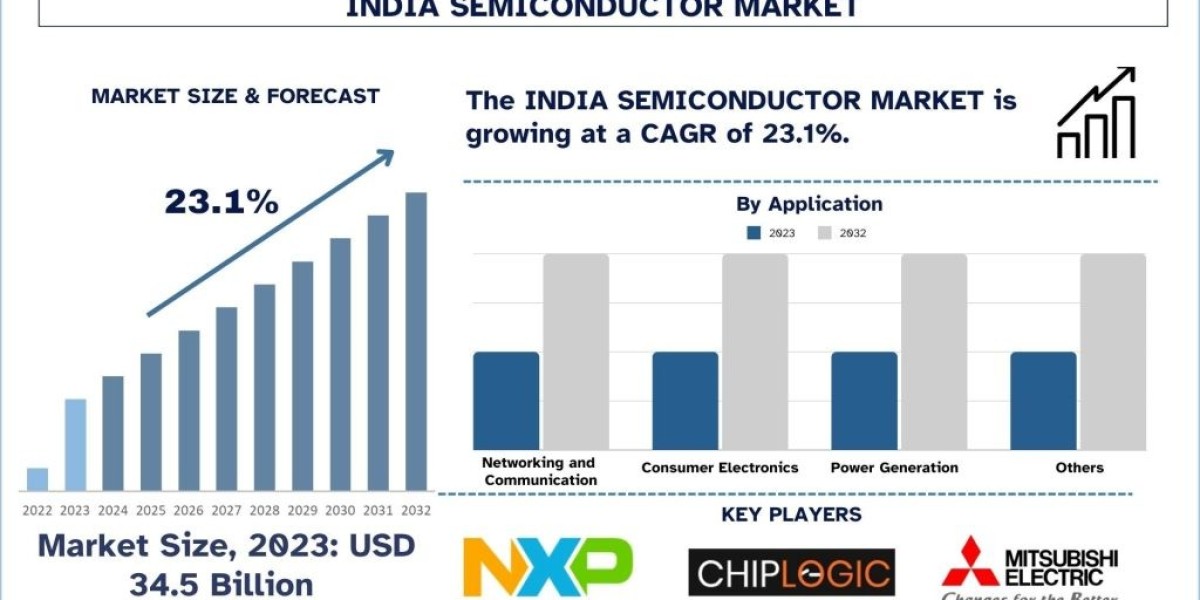

The current market of semiconductors in India is segmented by regions and each of the states plays a role in the development of this marker differently. Karnataka dominates the design and innovation followed by the manufacturing sector led by Tamil Nadu, and the emerging parks and startups by Andhra Pradesh and Telangana. Maharashtra is endowed with a robust industry structure, While Gujarat is still in the process of building a semiconductor ecosystem. These states in their endeavour to align with the national policies and the global market signal an expansion in the Indian semiconductor market to make a strong growth in the global semiconductor supply chain. According to the Univdatos market insights analysis, rising demand for electronics, growing government initiatives, and rapid digital transformation across the globe will drive the scenario of the Indian semiconductor market. As per their “India Semiconductor Market” report, the global market was valued at ~USD 34.5 billion in 2023, growing at a CAGR of about 23.1% during the forecast period from 2024-2032.