Hong Kong, as one of the worlds leading financial hubs, has a robust and highly competitive general insurance market. In recent years, this sector has experienced significant growth, driven by economic stability, increasing awareness of insurance benefits, and evolving consumer demands. This article delves into the key trends, opportunities, and challenges shaping Hong Kong's general insurance market.

Overview of the General Insurance Market in Hong Kong

General insurance, also known as non-life insurance, includes various products such as motor insurance, property insurance, liability insurance, health insurance, and travel insurance. Unlike life insurance, general insurance policies provide coverage for specific risks over a shorter time frame.

Hong Kong's general insurance market is regulated by the Insurance Authority (IA), which ensures a stable and transparent environment for insurers and policyholders. The market is highly competitive, with both local and international insurers offering a wide range of products to cater to individual and corporate clients.

Key Trends in Hong Kongs General Insurance Market

1. Growth in Health and Medical Insurance

Health and medical insurance have seen a significant rise in demand, driven by Hong Kong's aging population and the rising cost of healthcare services. The COVID-19 pandemic also heightened awareness about the importance of medical coverage, leading to increased uptake of individual and corporate health insurance policies.

Insurers are offering more customized plans with additional benefits such as coverage for critical illnesses, wellness programs, and telemedicine services to meet the changing needs of consumers.

2. Technology and Digital Transformation

The rise of digital platforms and the adoption of technology in insurance processes have revolutionized the way insurance is sold and managed in Hong Kong. Insurtech (insurance technology) is playing a pivotal role in simplifying policy purchases, claims processing, and customer support.

Mobile applications and online portals are becoming essential tools for insurers to enhance customer experience. Many insurers now offer seamless digital policy renewals, real-time claims tracking, and AI-powered chatbots to answer customer queries.

3. Increase in Regulatory Oversight

In recent years, the Hong Kong government has strengthened its regulatory framework for the insurance sector. The Insurance Ordinance introduced by the Insurance Authority ensures the financial soundness of insurance companies and promotes good corporate governance. These regulations protect policyholders and maintain the overall stability of the market.

The Risk-Based Capital (RBC) regime is another regulatory reform aimed at enhancing the solvency and resilience of insurers, ensuring they hold enough capital to cover potential risks.

4. Growing Demand for Environmental and Liability Insurance

With increased awareness of environmental sustainability, companies are more concerned about protecting themselves from potential environmental risks. This has led to a rise in demand for environmental liability insurance in Hong Kong, which provides coverage for damages caused by pollution or other environmental hazards.

Additionally, the surge in corporate activities and global trade has amplified the need for liability insurance. This includes directors' and officers' (DO) liability insurance, professional indemnity insurance, and cyber liability insurance, which protect businesses from lawsuits, professional errors, and data breaches.

5. Expansion of Travel Insurance Post-Pandemic

The reopening of borders after the COVID-19 pandemic has reignited the demand for travel insurance in Hong Kong. Insurers are now offering more comprehensive travel policies that cover not only medical emergencies but also trip cancellations, COVID-related disruptions, and quarantine requirements.

Challenges in the General Insurance Market

Despite its growth, the general insurance market in Hong Kong faces several challenges:

- Intense Competition: The market is highly saturated with a large number of local and international players, leading to stiff competition and downward pressure on premium rates.

- Increasing Claims Costs: Rising medical expenses, property repairs, and legal fees have increased the cost of claims for insurers. This, coupled with the low-interest-rate environment, puts pressure on the profitability of insurance companies.

- Cybersecurity Risks: As more insurers digitize their operations, they face the growing threat of cyberattacks. Ensuring data privacy and securing customer information is now a critical concern for the industry.

Opportunities for Growth

Despite these challenges, there are several opportunities for growth in Hong Kongs general insurance market:

- Expansion into Mainland China: With the integration of Hong Kong into the Greater Bay Area (GBA), insurers have an opportunity to tap into the vast market potential of mainland China. Cross-border insurance products, such as motor insurance and medical insurance for individuals living or working in the GBA, offer significant growth potential.

- Insurtech Innovations: By leveraging advanced technologies such as artificial intelligence, machine learning, and blockchain, insurers can enhance customer experiences, streamline processes, and reduce operational costs. Insurtech startups in Hong Kong are thriving, and partnerships between traditional insurers and tech firms are likely to accelerate.

- Sustainable Insurance Solutions: As environmental and social governance (ESG) practices become more important, insurers can introduce more sustainable insurance solutions. Products that promote green living, cover climate-related risks, or encourage responsible corporate behavior will be in demand.

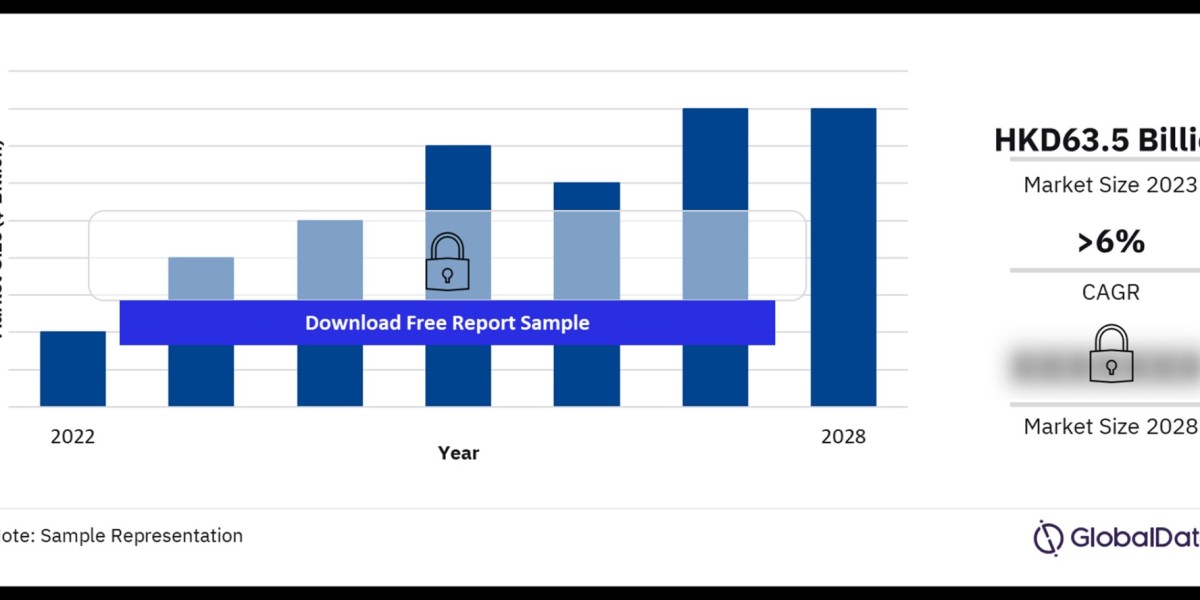

Buy the Full Report to Gain More Information about Hong Kong General Insurance Market Forecast