The Ghanaian insurance market is one of the most promising in West Africa, showing significant growth and innovation over the last few years. The expansion of the middle class, improving financial literacy, and a rising focus on risk management have led to a steady increase in demand for insurance services. This article will explore the key trends, challenges, and opportunities within Ghana's insurance sector, providing insights into its future potential.

Overview of Ghana's Insurance Market

As of 2024, Ghana's insurance sector is becoming more dynamic, driven by economic growth and regulatory reforms. The insurance penetration rate in Ghana, although still low compared to global standards, has been increasing steadily. With a population of over 30 million people, the untapped market offers immense growth potential for both life and non-life insurance products.

The industry is regulated by the National Insurance Commission (NIC), which plays a critical role in enhancing consumer confidence and ensuring fair practices within the market. NIC's efforts to enforce the Insurance Act 2021 have encouraged more transparency and accountability, fostering a healthier competitive environment among insurers.

Key Segments of the Ghanaian Insurance Market

The insurance market in Ghana can be broadly categorized into life and non-life segments.

Life Insurance: Life insurance products in Ghana are gaining popularity as more people seek financial security for their families. The rise of microinsurance, which caters to low-income households, has been a game changer. Companies are offering flexible, affordable premiums, making life insurance more accessible to the wider population.

Non-Life Insurance: The non-life insurance sector is driven by property, motor, health, and agricultural insurance. Motor insurance, in particular, is mandatory, which makes it one of the most significant contributors to non-life insurance premiums. The expansion of urban areas and growing investments in infrastructure have also led to increased demand for property insurance.

Another rising star is agricultural insurance, which is vital in a country where farming employs a large portion of the population. Insuring against unpredictable weather patterns and crop failures has become increasingly important for food security and farmer welfare.

Major Players in Ghana's Insurance Industry

Ghana's insurance market is dominated by several key players, both local and international. Some of the notable insurance companies include:

SIC Insurance Company

One of the oldest and largest insurance providers in Ghana, specializing in both life and non-life insurance products.Enterprise Insurance

Known for its innovative products and strong customer service, Enterprise Insurance continues to be a leader in both corporate and individual insurance.Glico Insurance

Glico Insurance is one of the fastest-growing insurers in the market, with a focus on providing life insurance solutions, especially to the middle-income segment.Hollard Ghana

Hollard has been expanding rapidly and is known for its partnerships and introduction of digital insurance products tailored to younger consumers.

Challenges Facing the Ghanaian Insurance Market

Despite the growth, the insurance industry in Ghana faces several challenges:

Low Insurance Penetration Rate: Even with the increase in insurance awareness, the overall insurance penetration rate in Ghana is still below 2%. Many Ghanaians are either unaware of insurance products or do not fully understand their benefits, limiting market expansion.

Economic Instability: Ghana’s economic fluctuations, including high inflation and currency depreciation, affect the ability of insurers to maintain profitability. Economic challenges can also result in lower disposable incomes, reducing the ability of individuals to afford insurance.

Regulatory Compliance: While the NIC has introduced several regulatory reforms, complying with these regulations can be a burden for some insurance companies, especially smaller firms that lack the necessary infrastructure to meet regulatory requirements.

Digitalization and Innovation: The shift toward digital platforms and innovation in the insurance sector has been slow. While mobile insurance and digital platforms are beginning to gain traction, the market still lags in adopting the latest technologies that could streamline operations and improve customer experiences.

Opportunities in Ghana’s Insurance Market

The Ghanaian insurance market presents a range of opportunities for insurers and investors:

Microinsurance Expansion: With the majority of Ghanaians in the informal sector, microinsurance has significant growth potential. Insurers that create products tailored to the needs and financial capabilities of low-income individuals could capture a large portion of the untapped market.

Digital Insurance Platforms: The rise of mobile technology in Ghana opens the door for digital insurance products. Companies that invest in mobile platforms and fintech partnerships can offer more efficient, affordable, and accessible insurance solutions, especially to younger consumers.

Agricultural Insurance Growth: Given the importance of agriculture to Ghana’s economy, the expansion of crop and livestock insurance can be an essential tool for managing risk and ensuring food security. The government’s commitment to supporting agricultural insurance schemes offers a robust opportunity for insurers in this segment.

Public-Private Partnerships: Collaborations between the government and private insurers to expand access to insurance for all citizens could lead to a more robust insurance sector. Public-private partnerships, particularly in health and agricultural insurance, will be crucial in reaching underserved populations.

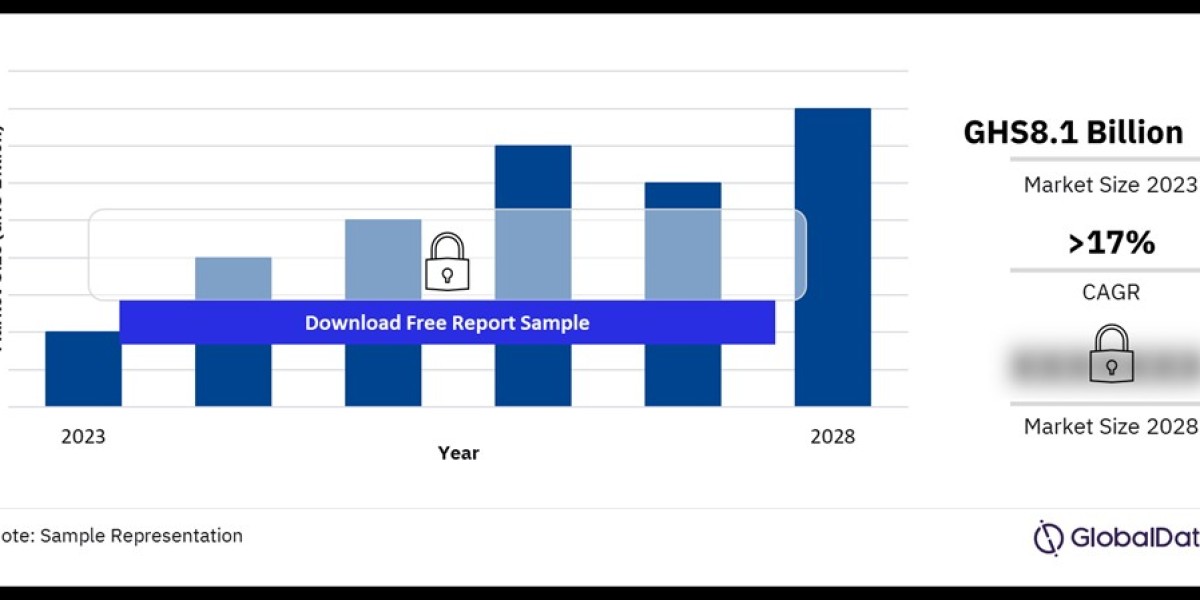

Buy the Full Report for More Insights into the Ghana Insurance Market Forecast

Download a Free Report Sample